Summary:

Puffer Finance proposes the addition of pufETH to Venus’ Core Lending Markets on BSC and Ethereum. pufETH is a liquid restaking token that allows users to earn both Ethereum staking rewards and additional returns through restaking on the EigenLayer. With its significant adoption and security measures, pufETH presents an attractive option for enhancing Venus’ market offerings.

Governance Incentives for Compound Voters:

Voters who support the listing of pufETH on Venus will be rewarded with Puffer Points, which will be redeemable for Puffer’s PUFI governance token. This reward incentivizes voter participation and engagement with Puffer Finance’s governance, while also offering long-term benefits for those contributing to the ecosystem’s growth.

Background:

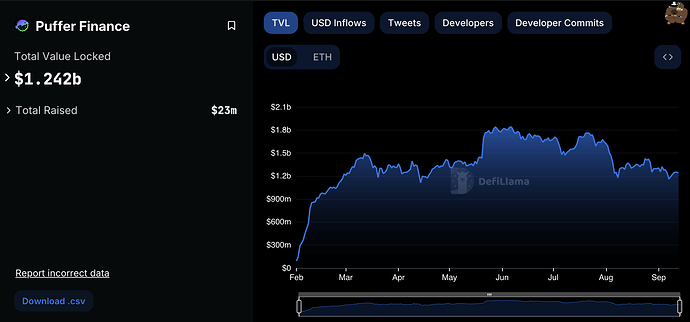

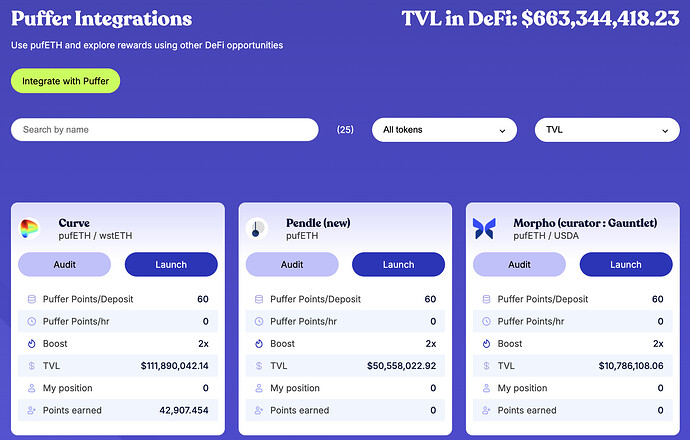

pufETH is the liquid staking token of Puffer Finance, a protocol built on Ethereum that supports restaking through the EigenLayer. By allowing users to participate in Ethereum’s Proof of Stake (PoS) with as little as 1 ETH, Puffer lowers the barrier to entry while also mitigating slashing risks with its Secure-Signer technology. The project has quickly gained traction, amassing over $1.39 billion in TVL within its ecosystem, with an additional $641 million integrated across DeFi platforms such as Pendle, Curve, and others.

Puffer Finance has also established a $120 million pufETH-wstETH pool on Curve, providing deep liquidity and expanding its DeFi presence. The project has been thoroughly audited by 10 different firms, ensuring strong security measures are in place, further boosting its credibility in the DeFi space.

Benefits for Venus:

Passive Income:

By listing pufETH, Venus users can earn yields from Ethereum staking and restaking rewards simultaneously. This allows for increased capital efficiency and higher returns for both borrowers and lenders on the platform.

Security and Transparency:

Puffer Finance employs robust security measures, including anti-slashing mechanisms and Secure-Signer technology, to protect its stakers and validators. The protocol’s operations are fully transparent, with real-time on-chain data on staking, restaking, and liquidity.

Diversification and Growth Opportunities:

Adding pufETH allows Venus to diversify beyond traditional assets like USDT and USDC, introducing a liquid asset that can be used in various DeFi applications. Puffer’s DeFi integrations are expanding rapidly, meaning more opportunities for Venus to grow its TVL and volume.

Incentives:

To support pufETH’s listing on Venus, the Puffer Finance Foundation will provide pufETH (ETH) & PUFI (puffer gov. token) over the first few months to incentivize user participation, helping to seed liquidity and borrowing activity.

Token Contracts:

Ethereum: 0xd9a442856c234a39a81a089c06451ebaa4306a72