Summary

Chaos Labs supports the proposal to deprecate the Ethena Isolated Pool and list sUSDe and USDe in the Ethereum Core Pool. Below, we provide our analysis and recommendations.

Ethena Isolated Pool Deprecation

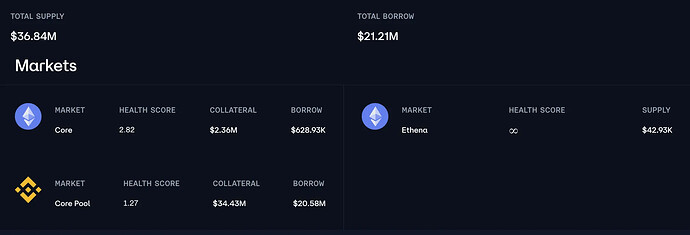

After reviewing the current state of the Ethena isolated pool on Ethereum, Chaos Labs concurs that the market can be safely deprecated. The review confirms there is only one active supplier, no borrowing activity, and the Pendle assets associated with the pool have already matured. Deprecating this inactive market aligns with protocol efficiency goals, reducing unnecessary complexity and freeing resources for more impactful allocations.

The user in question also maintains large positions on the BNB Core pool and Ethereum Core pool; as described in the proposal, they should be allowed to remove their supplied assets before the market is fully deprecated.

However, we propose the following steps to effectively deprecate the market while ensuring this user is not adversely affected:

- Set supply caps to 0

- Set borrow caps to 0

These two actions will, in essence, freeze the market by preventing any new supplying or borrowing activity.

Specification

| Market |

Asset |

Current Supply Cap |

Rec. Supply Cap |

Current Borrow Cap |

Rec. Borrow Cap |

| Ethereum Ethena |

sUSDe |

50,000,000 |

0 |

- |

- |

| Ethereum Ethena |

PT-USDe-27MAR2025 |

850,000 |

0 |

- |

- |

| Ethereum Ethena |

USDC |

50,000,000 |

0 |

46,000,000 |

0 |

| Ethereum Ethena |

PT-sUSDe-27MAR2025 |

12,000,000 |

0 |

- |

- |

List sUSDe and USDe in Ethereum Core

We agree with the proposal to list sUSDe and USDe in the Venus Ethereum Core to provide users a greater diversity of assets. Chaos Labs has previously reviewed these assets and found them acceptable for listing on Venus.

Pool Selection

However, it is important to acknowledge the inherent disadvantages Venus faces when integrating yield-bearing assets like sUSDe into its Core Pool. In isolated pools, yield-bearing assets can be assigned higher CFs due to their correlation with borrowable assets, allowing for greater leverage.

Conversely, in the Core Pool, the presence of uncorrelated borrowable assets necessitates more conservative CFs to mitigate liquidation risks, reducing leverage potential. While necessary from a risk perspective, this approach makes Venus less competitive compared to platforms that offer higher leverage through mechanisms like E-Mode on Aave.

Liquidity

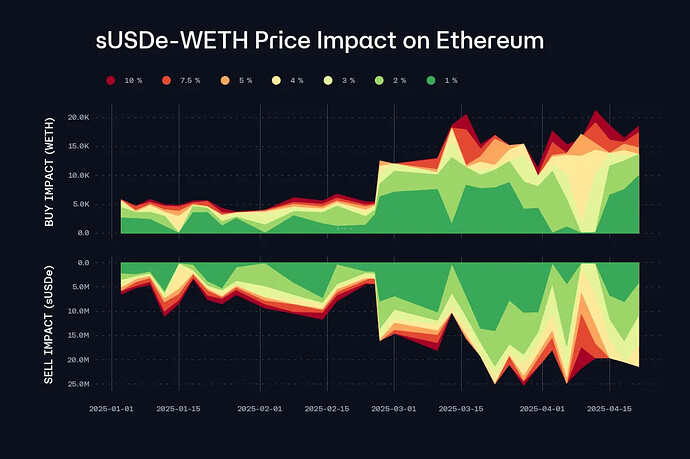

The liquidity for both sUSDe and USDe against the uncorrelated asset WETH has improved significantly in recent months. 15M sUSDe can be swapped for WETH at less than 5% price impact.

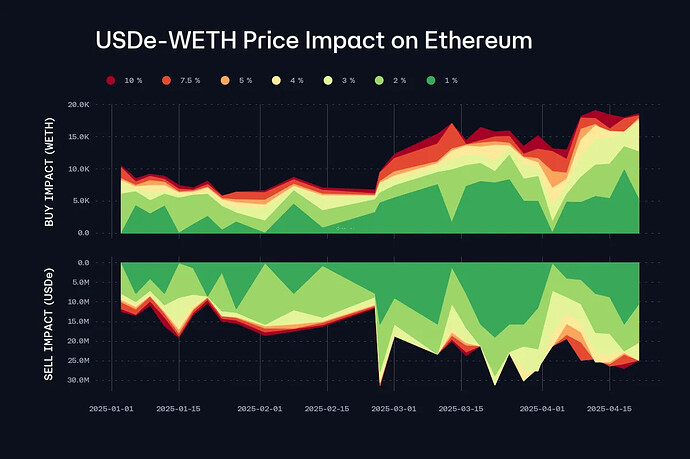

Meanwhile, 20M USDe can be swapped for WETH at the same price impact level, indicating robust liquidity on Ethereum.

Collateral Factor

As described above, the availability of uncorrelated borrowable assets in the Core Pool calls for a lower CF than in the Isolated Pool. However, their strong liquidity allows us to recommend somewhat permissive collateral parameters. Specifically, we recommend setting both USDe and sUSDe’s CFs to 72% and their LT to 75%.

IR Curve

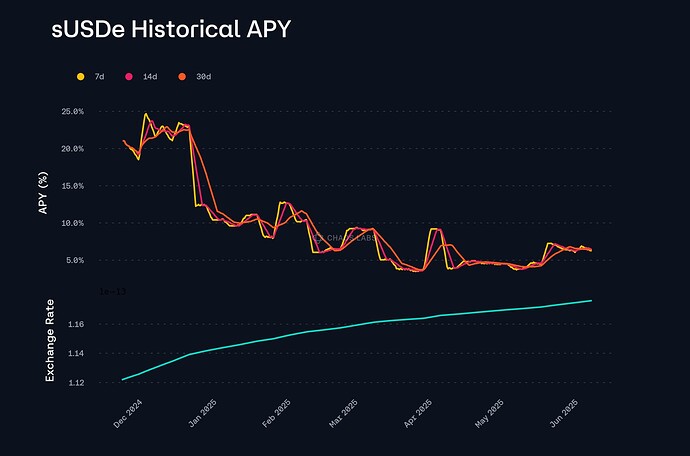

We recommend setting USDe’s IR curve equivalent to other stablecoins, while we recommend making sUSDe non-borrowable, given the lack of defined use cases for borrowing the asset. Given that USDe has sufficient history and has proved its resilience through multiple volatile periods, we recommend setting the RF to 10%, reflecting that it is less risky than other newly listed assets and thus does not need to build an insurance fund as quickly.

Supply and Borrow Caps

We recommend setting the caps according to our usual methodology, with the supply cap set to 2x the amount of liquidity available below the Liquidation Penalty; the borrow cap for USDe should be set slightly above the Kink. Thus, we recommend a starting supply cap of 20M sUSDe and 30M USDe, with a borrow cap of 25M USDe.

Pricing and Oracle

We recommend using the USDe/USD Chainlink price feed for USDe, while the sUSDe market should utilize the USDe/USD market rate multiplied by sUSDe/USDe exchange rate.

Specification

| Parameter |

Value |

Value |

| Asset |

sUSDe |

USDe |

| Chain |

Ethereum |

Ethereum |

| Pool |

Core |

Core |

| Collateral Factor |

72% |

72% |

| Liquidation Threshold |

75% |

75% |

| Liquidation Penalty |

10.00% |

10.00% |

| Supply Cap |

20,000,000 |

30,000,000 |

| Borrow Cap |

- |

25,000,000 |

| Kink |

- |

80% |

| Base |

- |

0.0 |

| Multiplier |

- |

0.10 |

| Jump Multiplier |

- |

2.5 |

| Reserve Factor |

- |

10% |

Disclaimer

Chaos Labs has not been compensated by any third party for publishing this recommendation.

![]()