Summary

Chaos Labs offers a comprehensive risk management and optimization platform specifically tailored for DeFi protocols. Our strategies aim to secure protocol assets against market volatility, black swan events, liquidity attacks, and instances of market manipulation. Our methodology is rooted in an integrative approach, offering protocol robustness and protecting funds from market risks through dynamic and responsive risk parameter recommendations.

Chaos Labs proposed collaboration is directed towards mitigating risks in volatile markets, countering economic attacks on protocols, and ensuring the secure preservation of user funds.

As an integral part of this partnership, Chaos Labs will provide customized access to the following:

- Risk Management Portal: An extensive portal, including custom risk dashboards for monitoring and alerting on systemic risk and protocol and wallet health.

- Risk Parameter Recommendations: Agent-based simulations to optimize protocol risk parameters.

About Chaos Labs

The Chaos Labs team exhibits exceptional talent and represents diverse expertise, encompassing esteemed researchers, engineers, and security professionals. Chaos Labs has garnered its experience and skills from renowned organizations, including Google, Meta, Goldman Sachs, Instagram, Apple, Amazon, and Microsoft. Additionally, the team boasts members who have served in esteemed cyber-intelligence and security military units, further contributing to their unparalleled capabilities.

You can explore our past and ongoing projects for customers like Aave, GMX, Benqi, dYdX, Uniswap, Maker, and more in the Research and Blog sections of our website.

The Chaos Labs’ offering

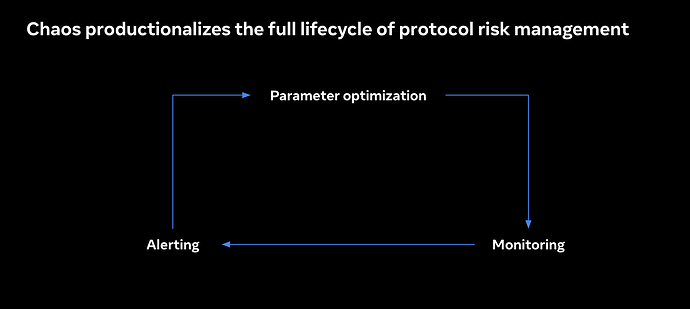

Chaos Labs offers a comprehensive risk management solution consisting of software and services that facilitate effective market risk management. This platform manages the entire lifecycle of protocol activity, including risk management, for contributors, users, and community members.

At a high level, an engagement with Chaos includes:

-

Parameter Optimization & Economic Modeling: Individual protocols rely on a range of market factors to achieve capital efficiency while mitigating the risk of unhealthy liquidations and bad debt. Through the use of our tools and services, Chaos Labs is committed to ensuring that the Venus protocol remains in a state of secure, optimal operation. This involves leveraging our state-of-the-art simulation platform to find the most effective parameter settings for each money market. By adopting this approach, Chaos Labs can provide clear, streamlined, and actionable recommendations to the community, fostering a more informed and engaged approach to risk management within the ecosystem.

-

Real-time Monitoring & Alerting: We offer real-time monitoring and alerting services through the Chaos Labs Risk Monitoring Platform. These services allow users to assess ecosystem risk and protocol health at granular levels using dashboards and data visualizations. Critical elements of our service include real-time data ingestion and risk assessment, identifying risks, and taking proactive measures to maintain system stability and growth.

-

Incident Response: Chaos Labs specializes in incident-response support and crisis management. We guide our clients in managing risks and making informed decisions during unpredictable market situations and times of high stress. Our team’s rich experience in risk management and rigorous data analysis enables us to provide critical insights and recommendations, working closely with our clients to mitigate potential impacts on their protocol and its users.

Engagement scope

As Chaos Labs spearheads risk management and optimization for Venus, all risk management activities are streamlined through cutting-edge simulation and monitoring technologies and backed by our team of researchers and data scientists to protect user funds and the protocol, even in the most volatile market situations. This engagement would cover two key aspects of risk management:

-

Custom-built Venus Risk Management Platform, including

- Continuous protocol & market monitoring

- Wallets activities and health

- Alerting and notifications

- Market manipulation exposure

- User scenario modeling

- Parameter recommendation analysis

- Isolated Markets coverage

-

Chaos team support when considering:

- New asset onboarding

- New market launches

- Understanding of parameter recommendations

- Implications of Abnormal and volatile market conditions

Chaos Labs will serve as a dedicated risk management partner to Venus, its contributors, and the broader community. Chaos will provide ongoing support and guidance, leveraging its expertise and sophisticated risk management tools to ensure the protocol remains secure and reliable.

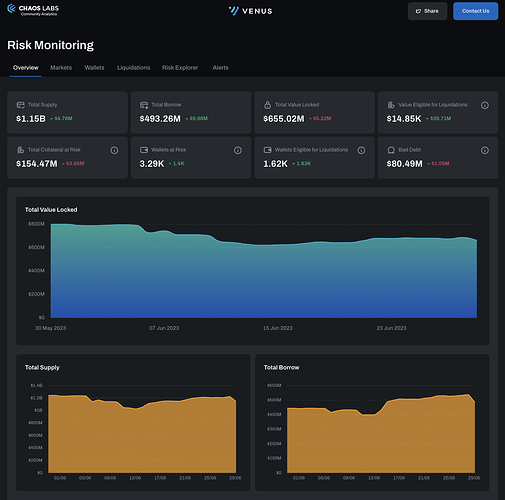

Risk Management Platform

Through this engagement, the Venus community will get access to a publicly accessible platform to monitor and analyze protocol health. Through this platform, users can delve into specific scenarios in which the protocol could be negatively impacted and receive alerts concerning significant changes to on-chain activities that could pose a risk or detriment to the protocol’s health.

The system is already live for existing customers such as Aave, Benqi, GMX, and Compound. A full run-through of the platform can be found here.

The Chaos Labs Risk Monitoring Platform is continuously updated with additional features and enhancements. As part of our commitment to delivering a world-class risk management solution for the DeFi ecosystem, we constantly iterate and improve on the platform. The Venus community will gain access to the newest feature additions and enhancements continuously, allowing users to stay ahead of the curve, making informed decisions while optimizing their overall portfolio performance.

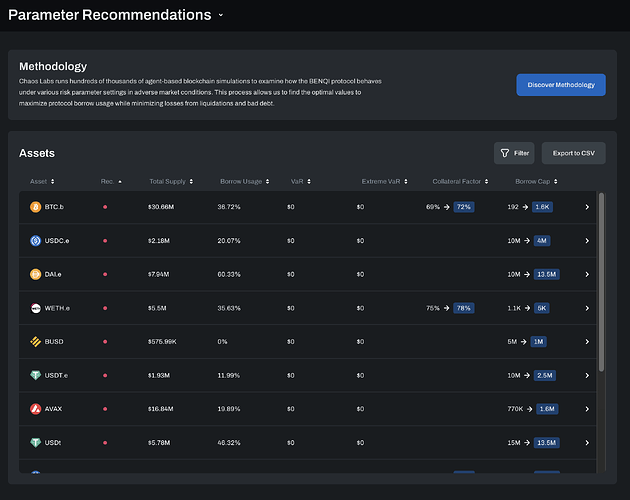

Parameter Optimization

As part of our ongoing commitment to optimizing risk management for the Venus protocol, Chaos Labs will thoroughly analyze the ecosystem and build custom agent-based simulations. These simulations will leverage protocol dynamics and on-chain behaviors to pressure test and optimize the protocol, identifying potential vulnerabilities and opportunities for improvement. Thorough system analysis will yield a comprehensive understanding of the factors that impact protocol health and stability, enabling us to make data-driven optimization and risk management recommendations. Recommendations will be provided through a bespoke platform (similar to the platforms built for Aave and Benqi) whereby the community can digest and analyze the tradeoffs of different parameter sets on protocol risk and capital efficiency.

Two key features make our parameter recommendation offering unique.

-

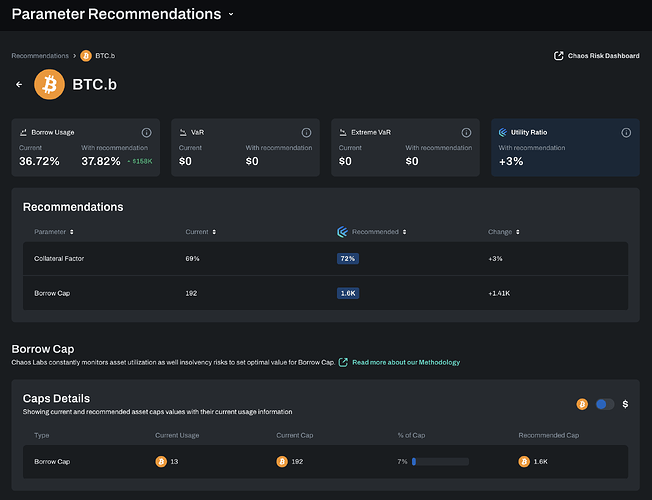

Chaos Labs conducts hundreds of thousands of simulations to measure key variables such as Value at Risk at statistically significant confidence levels. This approach gives us an unparalleled view of the various configurations of assets and chains, identifying the optimal parameters to protect the Venus protocol from potential bad debt, irrespective of market conditions.

-

We are committed to transparency, which is integral to our risk management solution. By transparently providing clear and concise information, we enable the Venus community to make data-driven decisions that optimize portfolio performance while minimizing the potential for loss.

Isolated Markets

Building on our frameworks to manage isolated markets on Aave, Chaos will publish a methodology, strategy, and tooling to inform the community of parameter changes pertaining to the launch of isolated markets on Venus.

For Venus, Chaos Labs will analyze and optimize a variety of relevant parameters, including:

- Collateral Factor

- Liquidation Threshold

- Liquidation Incentive

- Supply cap

- Borrow cap

Methodology

To ensure the protection of user funds in an ever-changing market, DeFi lending protocols must continuously iterate on their risk parameter settings. In order to evaluate the efficacy of different parameter settings, it is necessary to quantify the risk and return associated with each option.

Risk is quantified using Extreme Value at Risk (Extreme VaR), a metric measuring potential losses incurred from extreme market conditions. Return is defined as the total protocol borrows simulated using a given parameter set. We run hundreds of thousands of simulations using Monte Carlo simulations to calculate risk and return under different parameter settings and market conditions.

By conducting these simulations on an ongoing basis, we can continuously refine and optimize risk parameter settings, ensuring the protection of user funds in a rapidly changing market.

You can learn more about the Chaos Labs methodology here.

Parameter Recommendation Platform

The Chaos Labs Parameter Recommendation Portal is designed to provide the Venus community with a comprehensive understanding of the simulation outputs and underlying data to optimize risk parameter settings.

With this platform, the community will have access to ongoing and automated risk management that empowers the community to mitigate risk and optimize for capital efficiency, ultimately maximizing protocol revenue. By providing a clear and intuitive interface that highlights the impact of different parameter settings on risk and return, we can foster a more informed and engaged community, facilitating ongoing collaboration and knowledge sharing.

The platform homepage highlights the supported assets in the protocol and a high-level view of what changes the Chaos Simulation Engine recommends.

Each asset includes a detailed breakdown of the specific, respective parameter recommendations and the expected impact on relevant risk and usage metrics for community discussion.

Chaos Team Support

As part of our services, a Chaos protocol manager supported by a world-class team of researchers and data scientists will lead all risk-related communications and inquiries with the Venus community.

This includes providing detailed analyses of new asset onboarding, assessing the potential risks and benefits of launching in new markets, and providing a thorough understanding of parameter recommendations, including qualitative data and position analysis.

In addition, the Chaos Labs team will be available to support the community through significant events such as new market launches or turbulent market environments. Our team support typically covers two main areas: ongoing management and incident response. We will work closely with the Venus community to ensure that risk parameters are regularly reviewed and optimized, promoting the long-term health and sustainability of the protocol. Updates to risk parameters depend on fluctuations in the market and protocol usage and will be implemented as necessary. However, to keep the community well-informed, the Chaos team commits to providing an update to the community at least once every two weeks, at a minimum.

Incident Response

At Chaos Labs, we are committed to providing incident response support, helping our clients to manage risk and make informed decisions in volatile and unpredictable market events. This includes providing support for a wide range of events, including liquidity changes, asset depegs, price volatilities, and more.

Our team provides ongoing support in these events, including market monitoring and alerting, ad-hoc risk analysis, and recommendations on risk-mitigating actions. We work closely with our clients to provide timely and effective incident response, ensuring that any potential impacts on the protocol and its users are minimized.

Our team of experts brings a wealth of experience in risk management and data analysis, enabling us to provide the insights and recommendations necessary to navigate even the most challenging market conditions. By working closely with our clients, we can provide the support and guidance necessary to promote their protocols’ long-term success and sustainability.

Engagement Terms

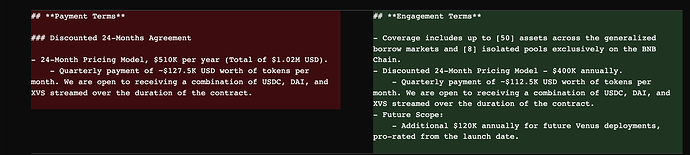

- Coverage includes up to [50] assets across the generalized borrow markets and [8] isolated pools exclusively on the BNB Chain.

- Discounted 24-Month Pricing Model - $400K annually.

- Quarterly payment of 100K USD worth of tokens per month. We are open to receiving a combination of USDC, DAI, and XVS streamed over the duration of the contract.

- Future Scope:

- Additional $120K annually for future Venus deployments, pro-rated from the launch date.

Next steps

We welcome the community’s feedback. We are excited to join the Venus community and contribute to its growth, security and continued success.