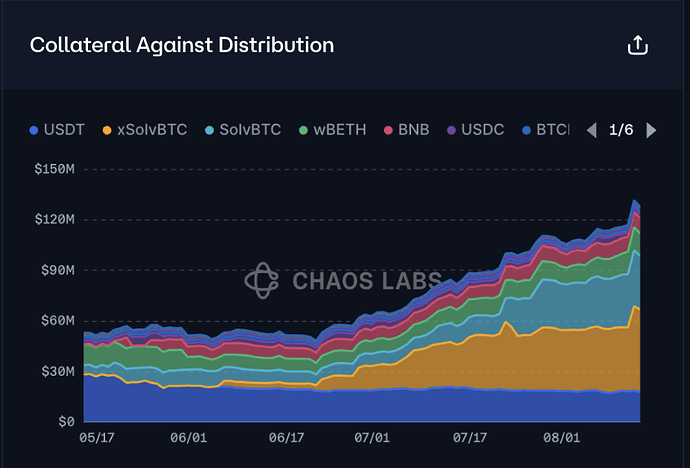

Summary

This proposal recommends updating the Interest Rate Curve for BTCB on Venus Protocol to better align with current market dynamics, promote healthy borrowing activity, and enable optimized looping strategies in preparation for the upcoming launch of E-Mode.

Background

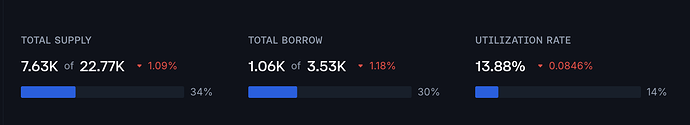

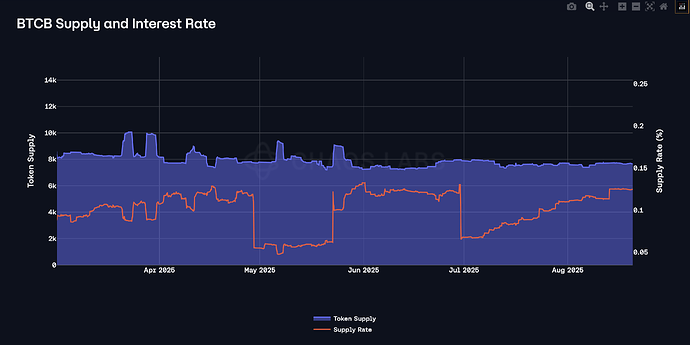

- BTCB Borrowing Demand: Growing steadily

- Current Utilization Rate: 13%

- BTCB Borrowing APY on Venus: 1.18%

- WBTC Borrowing APY on AAVE (Core Market): 0.65% for similar UR

Despite increased demand, BTCB utilization remains relatively low, partly due to the current shape of the interest rate curve, which may discourage more aggressive borrowing or looping strategies.

Motivation

With E-Mode support for BTCB and correlated assets coming soon, the current IRM curve may not be optimized for:

- Enabling capital efficiency via looping

- Attracting sophisticated users and institutional borrowers

- Competing with other protocols like AAVE that offer more favorable conditions for BTC/wrapped BTC borrowing and looping

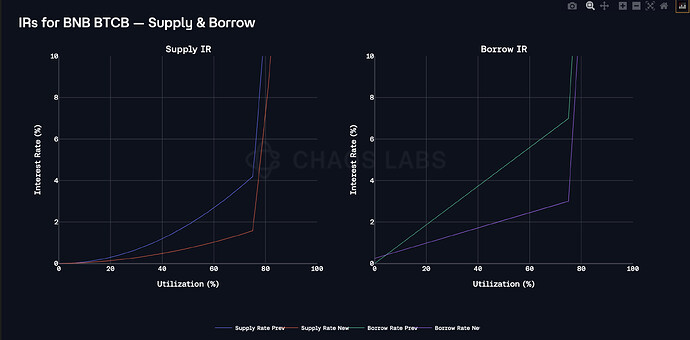

Benchmarking with AAVE

AAVE Core Markets (WETH, USDE, WBTC) have shown better optimization for looping strategies by adopting:

- Higher Kink Points

- WETH: 94%

- WBTC: ~80%

- (Venus BTCB: currently 75%)

- Lower Interest Rate at Kink

- WBTC on AAVE: ~4%

- BTCB on Venus: 6.99%

- Flatter pre-kink slope

- To encourage higher utilization before hitting aggressive rates

These optimizations make AAVE more competitive for recursive strategies while still maintaining protocol risk safeguards.

Proposed Adjustment

Adjust the BTCB Interest Rate Model (IRM) to reflect the following parameters:

| Parameter | Current | Suggested |

|---|---|---|

| Base Rate | 0% | 0.25% |

| Kink Utilization | 75% | 85–90% |

| Rate at Kink | 6.99% | ~4.00% |

| Max Borrow Rate (APR) | 56.7% | 50% |

| Pre-Kink Slope | Aggressive | Flatter growth |

| Post-Kink Slope | Sharp | Gradual, still protective |

Exact numerical rates can be discussed further with the Risk team for optimal calibration based on simulations and historical behavior.

Expected Outcomes

- Encourage higher BTCB utilization

- Promote looping and capital efficiency ahead of E-Mode

- Improve competitiveness vs. other lending markets (e.g., AAVE)

- Balance risk, protocol revenue, and user incentives

Risk Considerations

- Interest Rate adjustments should be continuously monitored and revised in response to utilization patterns, opportunities, volatility, and external market conditions.

- Any new IRM should be reviewed and stress-tested by Chaos Labs to ensure protocol solvency and liquidity safety.

Conclusion

Adjusting the BTCB interest rate curve will position Venus to attract more borrowing activity and increase capital efficiency, specially with the upcoming E-Mode. This proposal aims to balance borrower incentives, protocol income, and sustainable utilization.