Summary

This proposal aims to onboard WBTC (Wrapped Bitcoin) to Venus on Unichain. With WBTC now natively deployed on Unichain via LayerZero’s OFT (Omnichain Fungible Token) standard, Venus has an opportunity to integrate the leading tokenized Bitcoin asset into its latest network. This move will further increase the total value locked (TVL) in Venus and enhance asset diversity for users on Unichain.

Motivation

Market Acceptance

WBTC remains the largest Bitcoin-backed ERC-20 token, with a current market capitalization of approximately $13.4 billion (June 2025). It consistently ranks among the top 20 cryptocurrencies by market cap. Compared to other tokenized Bitcoin representations, WBTC leads in liquidity, trust, and DeFi integrations.

Money markets continue to attract the largest share of minted WBTC, as holders seek to borrow against their Bitcoin-backed collateral and access alternative yield opportunities. Venus Protocol, as the leading money market on Unichain, can capture a significant share of WBTC’s TVL as DeFi users bridge assets to Unichain for its low transaction costs and fast-growing ecosystem.

Asset Diversity

Currently, Venus on Unichain focuses on major stablecoins and ETH derivatives. Onboarding WBTC will give users a blue-chip, Bitcoin-backed collateral option for both borrowing and lending. This will diversify the pool’s risk profile and make Venus markets on Unichain more attractive to sophisticated users seeking to deploy BTC capital in DeFi.

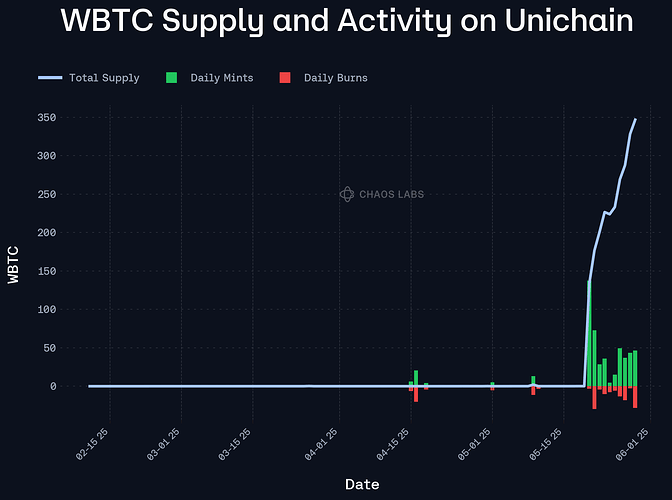

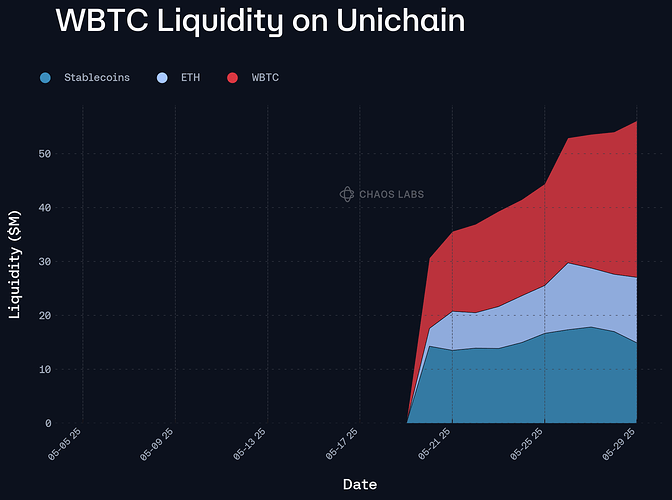

WBTC Liquidity on Unichain

WBTC liquidity on Unichain has seen notable growth. According to recent data:

-

Total WBTC TVL on Unichain: approximately $60 million (DefiLlama, June 2025).

-

Top liquidity pools:

-

WBTC/USDC: $18.2 million TVL.

-

WBTC/USD₮0: $16.5 million TVL.

-

ETH/WBTC: $21.9 million TVL.

-

These figures reflect robust and growing demand for WBTC on Unichain, supported by attractive liquidity and a solid DeFi infrastructure.

Background

About WBTC

Launched by BitGo in January 2019, WBTC brings Bitcoin’s liquidity and brand to EVM-compatible chains, maintaining a strict 1:1 backing with Bitcoin held by qualified custodians. The minting process includes AML/KYC by authorized merchants, transparent proof-of-reserves, and robust custody standards.

Omnichain Expansion

In 2024, WBTC adopted LayerZero’s OFT standard, enabling seamless, native transfers of WBTC across integrated blockchains. This allows WBTC to move between chains (Ethereum, BNB Chain, Base, Avalanche, and now Unichain) using a secure, decentralized burn-and-mint model, verified by a decentralized verifier network (DVN) operated by BitGo. Importantly, all token contracts and supply logic remain under BitGo’s direct control, reducing risks associated with third-party bridges.

With WBTC’s native OFT deployment now live on Unichain, Venus Protocol can safely support WBTC as a collateral asset, benefiting from native cross-chain liquidity without custodial fragmentation.

Conclusion

Bringing WBTC Venus Protocol on Unichain aligns with the protocol’s strategy of expanding blue-chip collateral offerings across all supported networks. This integration will attract new TVL, broaden the protocol’s user base, and further position Venus as the premier money market on Unichain.

We invite the Venus DAO community to review and discuss this integration to maximize the protocol’s growth and competitiveness on Unichain.