Prime Token

What is the Prime Token and what is its purpose? Let’s refer to the official documentation.

What is Prime?

Venus Protocol is excited to announce Venus Prime, a revolutionary incentive program aimed to bolster user engagement and growth within the protocol. An integral part of Venus Tokenomics v3.1, Venus Prime aims to enhance rewards and promote $XVS staking, focusing on markets including USDT, USDC, BTC and ETH.

What was expected from the introduction of the Prime token?

Venus Prime aims to incentivize larger stake sizes and diverse user participation. This is expected to significantly increase the staking of XVS, the Total Value Locked (TVL), and market growth.

Simply put, the Prime token is a financial instrument that allows XVS stakers to receive more favorable lending and borrowing conditions across supported markets.

As of this proposal, Prime impacts the following markets: USDT, USDC, BTC, and ETH.

More XVS staked == better APY == higher Total Supply / Total Borrow.

But is this actually happening?

Are Prime token holders really participating in the USDT, USDC, BTC, and ETH markets — or are these tokens being minted in vain? Let’s find out.

All data, calculations, and token prices are fixed at block 64714540 (Oct-15-2025 01:37:01 PM +UTC). Only BSC network is considered.

Prime Token Utilization

Let’s gather a dataset containing all (as of block 64714540) 500 Prime token holders, their minting timestamps, XVS staked amount, XVS’ value in USD and the total supplied and borrowed balances in USD equivalent for USDC, USDT, BTC, and ETH markets.

To collect this data, we need to:

- Scan the Prime contract history to track all mint/burn events.

- Gather information about deposits and borrows from addresses currently holding Prime tokens.

An example of a Prime holder record:

mint_time: 2025-02-28 15:43:09

address: 0x4905083abdd13bd95345a871701fd0b08abd46d1

xvs_staked: 1082.43

xvs_usd_balance: 5945.26

supply_usdc_usd_balance: 300668.57

borrow_usdc_usd_balance: 0

supply_usdt_usd_balance: 52065.38

borrow_usdt_usd_balance: 0

supply_btc_usd_balance: 467731.73

borrow_btc_usd_balance: 0

supply_eth_usd_balance: 0

borrow_eth_usd_balance: 232173.21

per: 3.16

After collecting the data, it is possible to determine which Prime holders actually use their Prime tokens as intended — i.e., those who periodically increase their Vault or Core Pool positions, thereby contributing to market growth and liquidity.

Part 1

Prime Efficiency Ratio (PER)

To determine how effectively each address utilizes their Prime token, let’s introduce a new metric: Prime Efficiency Ratio (PER).

Prime Efficiency Ratio (PER) — a metric that shows how effectively a user’s XVS stake translates into real protocol benefit through market activity.

In other words:

PER represents the efficiency of XVS staking utilization.

We’ll refer to the Prime documentation formula that determines a user’s qualified balances (deposits and borrows that count toward Prime rewards):

Prime Yield Documentation

Markdown formula

$$

σ_{i,m} = min(τ_i * supplyMultiplier_m, vSupplied_{i,m}) + min(τ_i * borrowMultiplier_m, vBorrowed_{i,m})

$$

Oh, md formulas does not work. Ok, I will screenshot it, lol

Where:

- τ_i — XVS staked by user i

- vSupplied_{i,m} — supplied balance by user i on market m

- vBorrowed_{i,m} — borrowed balance by user i on market m

- supplyMultiplier_m, borrowMultiplier_m — multipliers for each market m

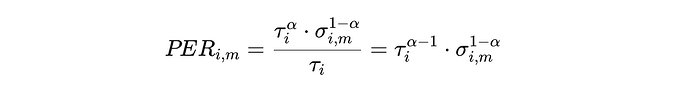

Define the efficiency coefficient for how effectively a user’s XVS stake contributes to activity:

Markdown formula

$$

PER_{i,m} = (τ_i^α * σ_{i,m}^{1 - α}) / τ_i = τ_i^{α - 1} * σ_{i,m}^{1 - α}

$$

where α ∈ (0,1) — a weighting coefficient for XVS staking strength.

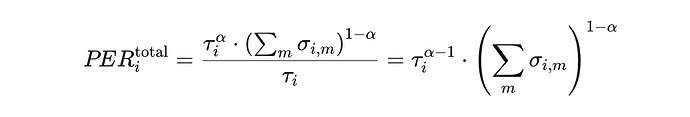

To compute the total efficiency across all markets:

Markdown formula

$$

PER_i^{total} = (τ_i^α * (Σ_m σ_{i,m})^{1 - α}) / τ_i = τ_i^{α - 1} * (Σ_m σ_{i,m})^{1 - α}

$$

- Sum all σ across markets to get the total activity of the user.

- Then apply the PER formula for the overall efficiency.

Interpretation:

- Local PER reflects user’s efficiency within a single market.

- Total PER reflects user’s efficiency across all supported markets.

Local PER values cannot be linearly summed due to the nonlinear exponent term (1−α).

PER > 1 → XVS is used super efficiently. The user could stake more XVS for even better market conditions since their deposits/borrows significantly outweigh their staked mass.

PER = 1 → optimal usage. All assets are efficiently utilized; APY terms fully reflect the Prime influence.

PER < 1 → XVS is underutilized. The user should increase their deposit/borrow volume to leverage Prime benefits effectively.

Example PER calculation:

alpha = 0.5 (source: Prime contract)

usdc supplierMultiplier = 2 (source: Prime contract)

usdc borrowMultiplier = 0 (source: Prime contract)

usdt supplierMultiplier = 2 (source: Prime contract)

usdt borrowMultiplier = 0 (source: Prime contract)

| User | τ_i (XVS staked) | USDC supplied | USDC borrowed | USDT supplied | USDT borrowed | Total PER_i |

|---|---|---|---|---|---|---|

| User 1 | 1000 | 500 | 0 | 300 | 0 | 1.049 |

| User 2 | 1000 | 400 | 100 | 500 | 0 | 1.000 |

| User 3 | 1000 | 300 | 200 | 200 | 100 | 0.894 |

Ideal PER

Some may have already noticed that PER equals 1 when the value of locked XVS (in USD equivalent) is equal to our sigma — the sum of qualified (eligible) supply and borrow balances for the user across markets.

Сonsider this an ideal balance to strive for, as when PER equals 1, users receive better market conditions while the protocol gains a more active participant. Win-Win.

PER < 1 (The XVS mass is significantly greater than the mass of market deposits/borrows)

A PER below 1 indicates that the Prime token is not being used efficiently by the address holding it.

The address keeps more XVS in the Vault (in USD equivalent) than the total amount of qualified (eligible) supplied and borrowed balances across markets.

How many such addresses?

SELECT count() FROM prime_addresses_utilization WHERE per < 1

RESULT: 252

How much additional liquidity can we attract to the supply and borrow markets if all addresses had PER equal to 1?

To find out, let’s calculate how much (in USD equivalent) the markets are lacking in qualified supply and borrow balances.

SELECT

SUM(

xvs_usd_balance

-

(

LEAST(xvs_usd_balance * 2, supply_usdc_usd_balance) +

LEAST(xvs_usd_balance * 0, borrow_usdc_usd_balance) +

LEAST(xvs_usd_balance * 2, supply_usdt_usd_balance) +

LEAST(xvs_usd_balance * 0, borrow_usdt_usd_balance) +

LEAST(xvs_usd_balance * 2, supply_btc_usd_balance) +

LEAST(xvs_usd_balance * 4, borrow_btc_usd_balance) +

LEAST(xvs_usd_balance * 2, supply_eth_usd_balance) +

LEAST(xvs_usd_balance * 4, borrow_eth_usd_balance)

)

) AS total_additional_sigma

FROM prime_addresses_utilization

WHERE per < 1;

RESULT: 9.60 million

9.6 million in qualified supply and borrow balances could be additionally attracted to the supply and borrow markets for the Prime token to be considered efficiently used.

PER > 1 (The XVS mass is significantly less than the mass of market deposits/borrows)

A PER above 1 indicates that the address holds less XVS in the Vault (in USD equivalent) than the total amount of qualified supplied and borrowed balances across markets.

PER above 1 indicates that the Prime token is used super efficiently by the address. This is good for the protocol, but the user may gain access to even better conditions.

(That is, the address keeps less XVS in the Vault, in USD equivalent, than the total amount of qualified balances it provides across markets.)

How many such addresses?

SELECT count() **FROM** prime_addresses_utilization WHERE per > 1

RESULT: 248

248 — not surprising, since 252 addresses have PER below 1.

How much additional liquidity can we attract into the Vault if all addresses had PER equal to 1?

We’ll do the same as before when calculating PER < 1, but in this case, we’ll be adding XVS into staking so that users get better APY conditions based on their existing market activity.

SELECT

SUM(

(

LEAST(xvs_usd_balance * 2, supply_usdc_usd_balance) +

LEAST(xvs_usd_balance * 0, borrow_usdc_usd_balance) +

LEAST(xvs_usd_balance * 2, supply_usdt_usd_balance) +

LEAST(xvs_usd_balance * 0, borrow_usdt_usd_balance) +

LEAST(xvs_usd_balance * 2, supply_btc_usd_balance) +

LEAST(xvs_usd_balance * 4, borrow_btc_usd_balance) +

LEAST(xvs_usd_balance * 2, supply_eth_usd_balance) +

LEAST(xvs_usd_balance * 4, borrow_eth_usd_balance)

)

-

xvs_usd_balance

) AS total_additional_sigma

FROM prime_addresses_utilization

WHERE per < 1;

RESULT: 14.71 million

14.71 million XVS (in USD equivalent) could be additionally attracted into the XVS Vault if users were incentivized with better APYs relative to their current market activity.

(In this case, it would be more profitable to stake additional XVS rather than supply or borrow assets on the markets.)

Part 2

Minimum required PER

In this proposal, I would like to introduce a mechanism to incentivize the efficient use of the Prime token — specifically when PER < 1.

I won’t consider the part that incentivizes users with higher PER to move toward 1.

Those addresses are already efficient enough, and encouraging them to stake even more XVS could be addressed in a separate proposal.

Although, truth be told, it’s already in users’ own interest to aim for PER = 1, as it improves their market conditions without additional actions.

How can we encourage users with low PER to maintain it at or above 1?

At the contract level, it’s proposed to introduce a min_per parameter (configured by governance), defining the minimum PER required for an account holding a Prime token.

An address acquiring a Prime token agrees to provide enough liquidity (by supplying or borrowing) to the markets.

If the address fails to meet this condition within N days (governance-defined), it loses the Prime token and gets a M-day freeze before it can mint another one — to avoid instant re-minting after burning.

The Prime token is not a badge of honor. It’s a financial instrument.

The Prime token unlocks new opportunities for both Prime holders (better APY) and the protocol itself (more supply/borrow → more fees).

Those who just want to stake XVS don’t need to acquire the Prime token.

Since such a change may seem drastic and not all addresses might want to adopt this new logic (even though it clearly benefits both sides), it’s proposed to start with min_per < 1 and gradually raise it over time (e.g., every 3 months).

Let’s assume the initial min_per equals 0.5 and reaches 1 in 6 months (increasing by 0.25 every 3 months).

Drawbacks of introducing min_per

I don’t see any ![]()

This parameter is designed to stimulate both new XVS staking and greater activity across markets.

But for curiosity’s sake, let’s imagine some Prime token holders don’t want to take advantage of the beneficial APY conditions on the markets.

-

Let’s answer this together:

Will a Prime holder who only stakes XVS without any market activity lose anything if their Prime token is revoked?- No. Their position remains the same. They continue earning from staking as before.

-

How many XVS “whales” (Prime token holders) have per < 0.5?

Let’s assume a whale is defined as an address with over 10,000 XVS staked.

SELECT sum(xvs_usd_balance) FROM

prime_addresses_utilization WHERE per < 0.5 AND

xvs_staked >= 10_000

RESULT: 31

How much XVS do they hold in USD equivalent?

SELECT sum(xvs_usd_balance) FROM prime_addresses_utilization WHERE per < 1 AND xvs_staked >= 10_000

RESULT: 6.76 million

Yes, some XVS might be sold, but the potential for attracting new market liquidity and XVS Vault deposits outweighs that risk.

p.s. The difference in sum(xvs_usd_balance) between per < 0.5 and per < 1 is only 3 million.

Benefits of introducing min_per

The most obvious one — increased Total Supply / Total Borrow, leading to higher protocol revenue.

A higher overall Total Supply / Total Borrow ratio might also allow the protocol to consider increasing the number of offered Prime tokens.

A higher Total Supply / Total Borrow ratio for an address will encourage it to stake more XVS to access better APY conditions on the markets.

Expected impact of implementation:

- +9.60 million additionally attracted to markets (sum of qualified supply and borrow balance)

- +14.71 million additionally attracted to XVS staking

Conclusion

Part 1 is the most critical part of this proposal, introducing a clear metric for assessing the efficiency of Prime token utilization. (Mandatory for implementation)

Part 2 is a logical next step following the introduction of the PER metric, allowing further incentivization of effective Prime token usage. (Recommended for implementation)

Introducing the PER metric will create a system that helps Prime token holders understand how efficiently they’re using their tokens — which in turn will attract more liquidity to markets and increase XVS staking in the Vault.

Even now, we could attract 9.60 million additionally to markets and 14.71 million to XVS staking.

PER is the opportunity to finally realize the true power and purpose of the Prime token.

Thank you for your attention — let’s make Venus great again!

p.s. Since the forum doesn’t allow sharing files other than images, anyone who wants to verify my calculations or build their own models can DM me, and I’ll provide the JSON file with all the data I have.