I am trying to understand how this works. Does that mean I will earn more XVS than I would have, and there would be no interest expense in-kind on the funds that I borrow?

No, it is the contrary. When APY is negative, it costs you to borrow. When APY is positive, you will earn more XVS in value than the interest of your loan. Note that you have to repay your loan with the token you have borrowed.

Oh. That is the opposite of what I thought. Very confusing. Thanks for your help, but how do you know this and where is it documented?

So, if you borrow XVS, then they will pay you 232% more XVS to borrow it and re-supply it. How does that make sense?

Borrowing XVS is currently not possible due to capping. There are some ongoing discussions in the forum around this special case still unresolved.

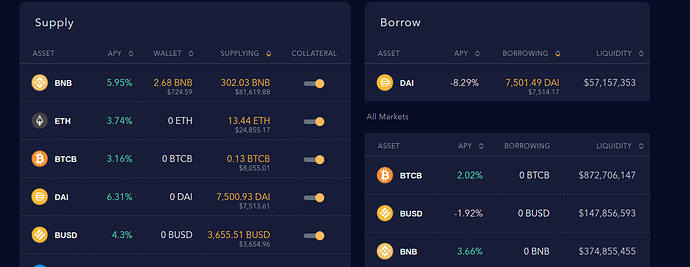

But take for instance DAI, you may see the details for borrowing when clicking on the token from the Borrow tab. Currently, interest rate is 9.31% (to be repayed in DAI) and reward is 0.93% (distributed in XVS token). So it costs 9.31 - 0.93 = 8.38% in term of USD value. APY for borrowing is -8.38% in this example.

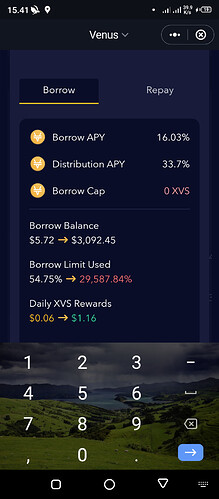

In the borrow details pop-up:

Borrow APY = APY you have to repay in the borrowed token

Distribution APY = APY you would earn in XVS (whatever the borrowed token)

OK, I see the breakdown. So, If I borrow BNB, and then supply it, I am paying .38 interest (6.24 -5.86), (rate keeps changing) but I am getting 9.78 APY in XVS, at the current prices, which more than compensates. Sounds like a pretty good deal if I understand correctly.

The alternative would be to get 5.86 APY for my BNB, then mint Vai at 0% interest, and also get 16.52% APR for staking the XVS in the vault. Sounds even better. Do you agree?

I agree. Enjoy because this is no for long time. When the time pass, Venus distribution will decrease… só, the APYs will bem more similar with Maker DAO, Compound, etcetera…