Summary

Chaos Labs provides parameters for re-listing certain isolated pool assets in their respective Core pools.

Motivation

In the current strategy employed by Venus, LSTs and LRTs have been mostly listed in isolated pools. While this has limited their available borrowable liquidity, it has also allowed us to list the assets with significantly more aggressive parameters than they would otherwise be listed. This is because, using the example of the Liquid Staked ETH pools, ETH-correlated assets are only able to borrow other ETH-correlated assets; liquidations are thus far less likely, allowing for a lower Liquidation Incentive and higher Collateral Factor.

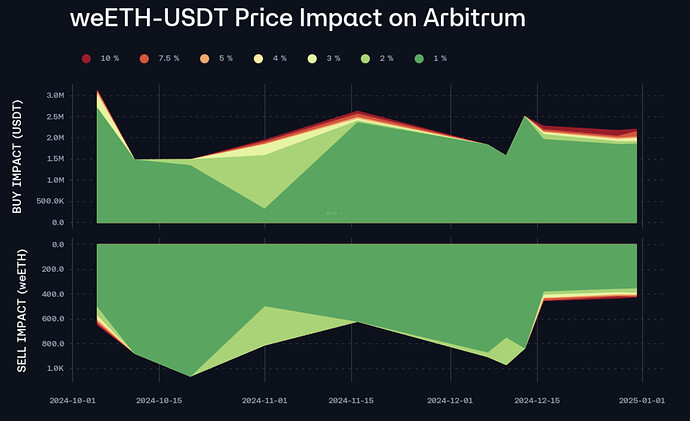

For example, on Ethereum weETH is listed in the Liquid Staked ETH pool with a CF of 93%, allowing for 14.29x leverage. In the Core pool — because of a higher Liquidation Incentive and uncorrelated borrowable assets — its CF will be set to 77.50%, allowing for 4.44x leverage.

Additionally, because liquidations are minimized, listings in correlated isolated pools allow us to recommend supply caps higher than what would otherwise be possible based on on-chain liquidity.

Thus, while many of these assets can be moved to the Core pool, it remains to be seen how much demand they will generate, given that their CFs will necessarily be lower than their Aave E-Mode counterparts. Should they grow rapidly, we may be limited in supply cap increases. However, from a risk perspective, we are amenable to this change and provide analysis and specifications below.

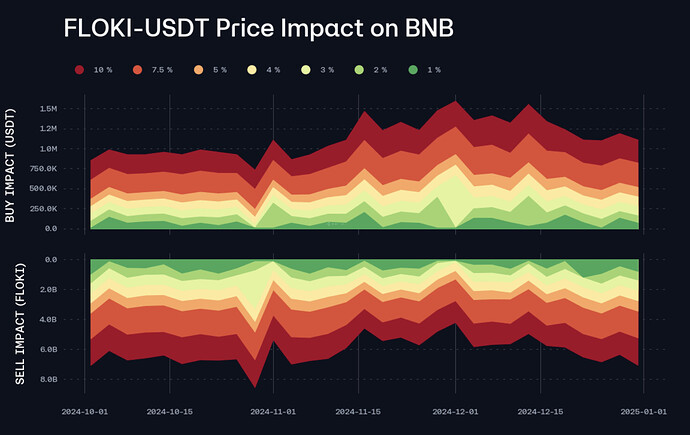

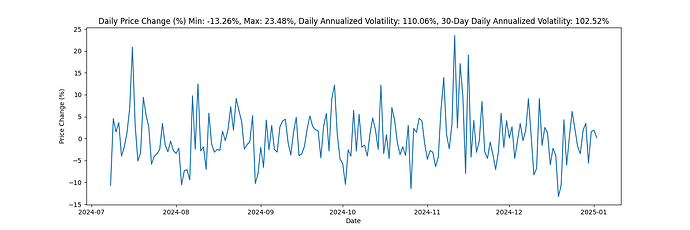

Regarding non-LST/LRT assets, while FLOKI has superior on-chain liquidity to LTC its volatility is significantly higher at 110% daily annualized over the last 180 days compared to LTC’s 77.5%. Additionally, while LTC’s on-chain liquidity is scarce, its price gets efficiently arbitraged to Centralized Exchanges, effectively providing additional liquidity depth. As these are important considerations, isolated pools allow the protocol more granular control over the assets that can be borrowed against a volatile token, as well as how much of each asset can be borrowed, functioning as a debt ceiling. Interest rates of borrowable assets, especially stablecoins, can be adjusted to provide greater incentives for suppliers.

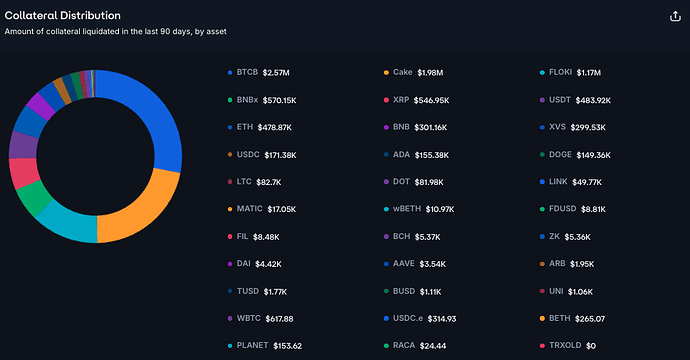

These controls have proved critical, as FLOKI is consistently one of the most liquidated assets on Venus, with over $1.17M in collateral liquidated in the past 90 days relative to a current total supply of just $5M.

When moving these assets to the Core pool, we will recommend more conservative collateral parameters to account for the lack of these additional tools.

Finally, it should be noted that Venus does not have a “migrate” function, and instead these assets must be listed a second time.

Given these factors, we do not recommend re-listing these assets (with the exception of wstETH). However, we have provided parameters for their re-listing should the community opt to do so. We recommend listing wstETH in the Core pool not because of the greater WETH borrowable liquidity available, but instead because we have observed demand to borrow uncorrelated assets against wstETH on other protocols.

wstETH and weETH

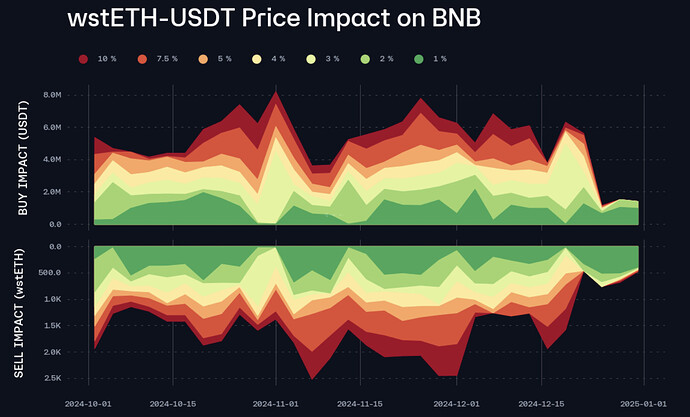

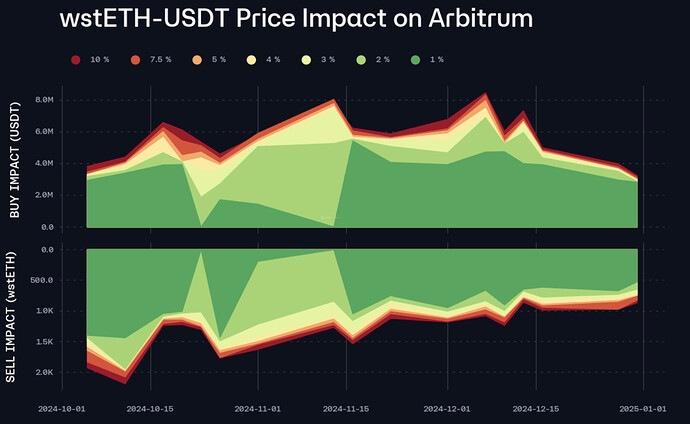

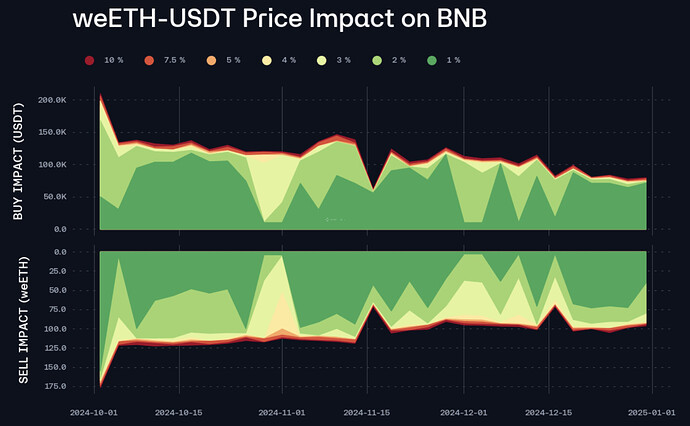

These assets are highly liquid, though somewhat less liquid on BNB Chain. We support listing them in their respective Core pools with reduced CFs.

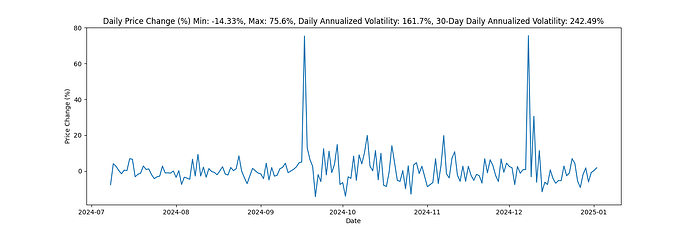

FLOKI

As described above, FLOKI has relatively strong on-chain liquidity but remains highly volatile.

Its current listing in the GameFi pool allows Venus to use the USDT borrow cap as an effective debt ceiling and mitigating VaR. Given that this guardrail will be removed when it is in the Core pool, we recommend setting its CF to 35%.

slisBNB

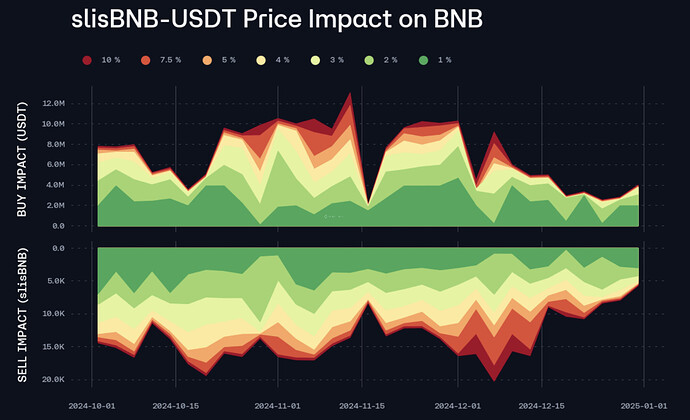

slisBNB’s on-chain liquidity has waned in recent weeks, though it is sufficient to list in the Core pool with a reduced CF, set to 72%.

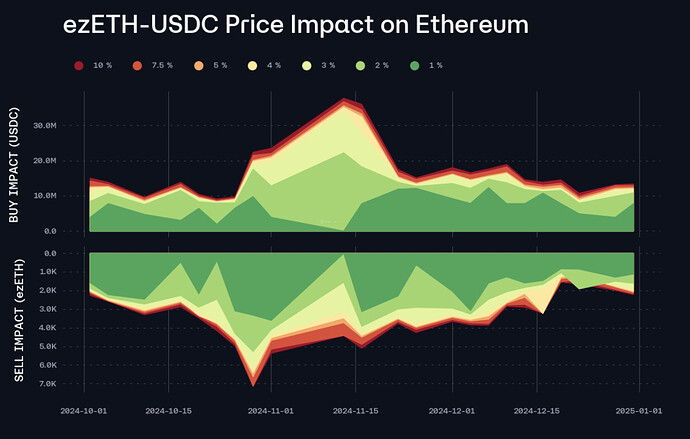

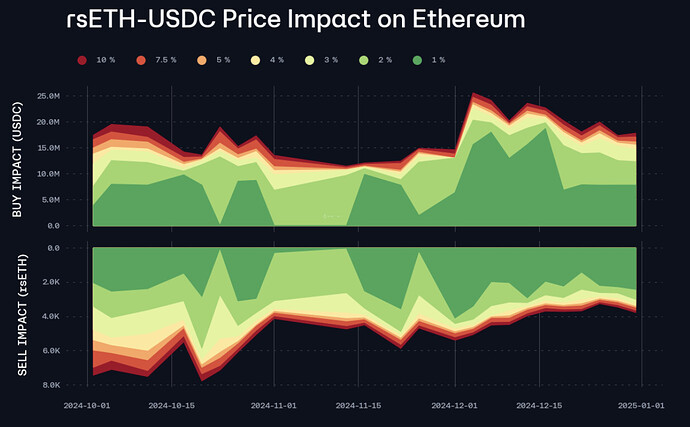

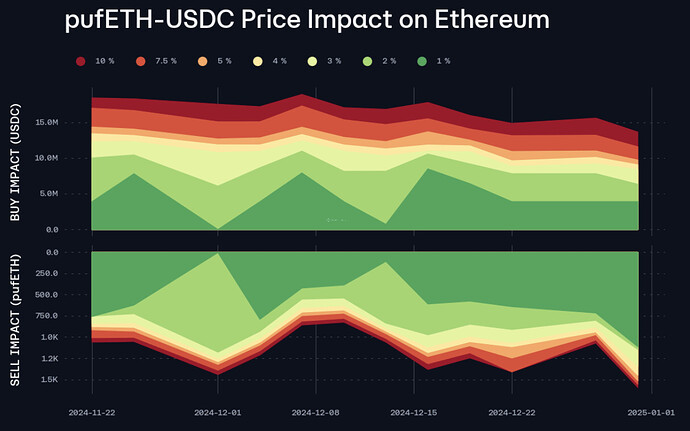

ezETH, rsETH, pufETH

All three assets have sufficient liquidity to list on the Ethereum Core pool.

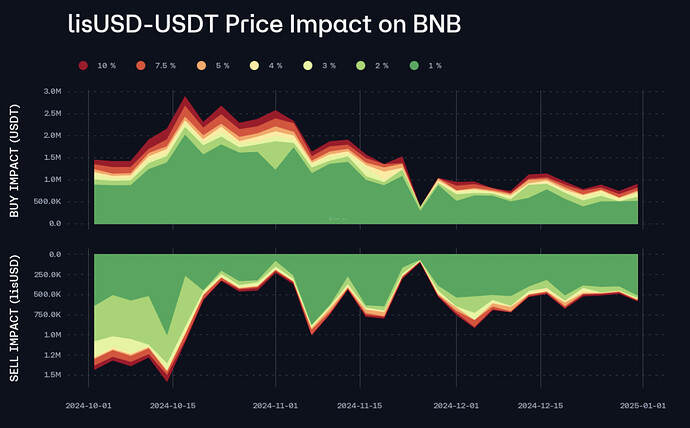

lisUSD

lisUSD’s on-chain liquidity has been relatively stable since the beginning of November, allowing us to recommend listing the asset in the Core pool, albeit with a reduced CF given its low market cap relative to other stablecoins listed with a 75% CF.

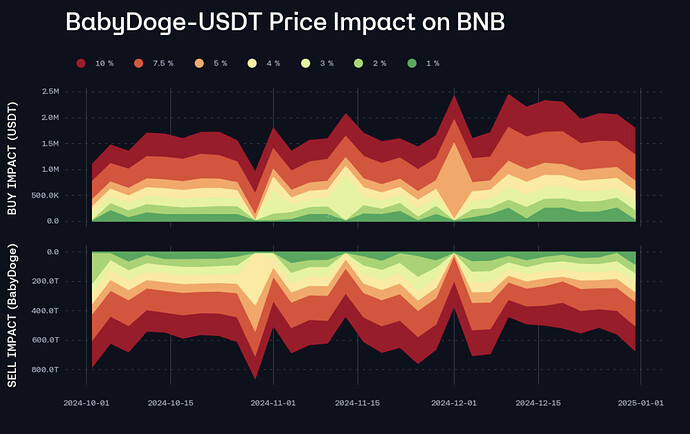

Baby Doge

Baby Doge is highly volatile, calling for conservative parameters when it is listed in the Core market.

Its liquidity has been stable, which allows us to recommend listing it in the Core pool with a 25% CF.

sUSDe and PT Tokens

sUSDe is a highly liquid asset that has achieved significant adoption on other protocols. We could recommend listing it in the Core pool with reduced collateral parameters relative to its isolated pool. However, we do not recommend re-listing the associated PT tokens in the Core pool due to their unique characteristics and elevated risk.

Supply and Borrow Caps

Supply caps are set according to our usual methodology, at 2x the liquidity available at a price slippage equivalent to the Liquidation Incentive. Borrow caps for LST/LRTs are set at 10% of supply caps, while they are set slightly above the Kink for other assets. For Ethena assets, we recommend aligning their cap values with the existing values in the isolated pool.

Other Parameters

We recommend aligning other parameters, including the IR curves and Reserve Factor, with the existing listing of each asset.

Next Steps

We may issue recommendations to deprecate existing markets by decreasing caps and adjusting Reserve and Collateral Factors.

Specification

We have included a row indicating whether Chaos Labs recommends re-listing each asset.

| Parameter | ||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Asset | wstETH | wstETH | weETH | weETH | FLOKI | slisBNB | ezETH | rsETH | pufETH | lisUSD | BabyDoge | sUSDe |

| Network | BNB | Arbitrum | BNB | Arbitrum | BNB | BNB | Ethereum | Ethereum | Ethereum | BNB | BNB | Ethereum |

| Market | Core | Core | Core | Core | Core | Core | Core | Core | Core | Core | Core | Core |

| Collateral Factor | 78.5% | 78.5% | 77.5% | 77.5% | 35% | 72% | 72% | 72% | 72% | 72% | 25% | 72% |

| Liquidation Threshold | - | 81% | - | 80% | - | - | 75% | 75% | 75% | - | - | 75% |

| Supply Cap | 650 | 20,000 | 200 | 2,500 | 14,000,000,000 | 11,000 | 7,000 | 9,000 | 2,500 | 1,400,000 | 160,000,000,000,000 | 50,000,000 |

| Borrow Cap | 65 | 2,000 | 20 | 250 | 7,000,000,000 | 1,100 | 700 | 900 | 250 | 1,250,000 | 80,000,000,000,000 | - |

| Recommended | Yes | Yes | No | No | No | No | No | No | No | No | No | No |

Disclaimer

Chaos Labs has not been compensated by any third party for publishing this recommendation.