Summary

This proposal aims to move multiple assets from isolated pools to the core pool. Since the introduction of isolated pools, the protocol has faced a significant competitive disadvantage, limiting our growth opportunities. If you’re a yield farmer like me, you’ll understand that the way isolation works on Venus is highly inefficient, and this needs to be changed. Assets like wstETH, SlisBNB, Floki, weETH, and others should be moved to the core pool to have access to adequate liquidity.

Core Problem and Examples

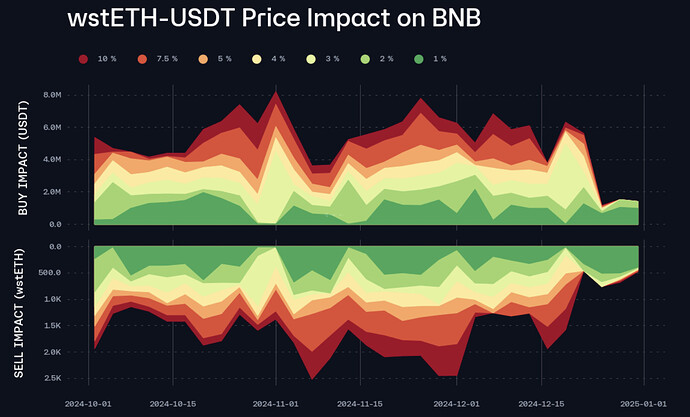

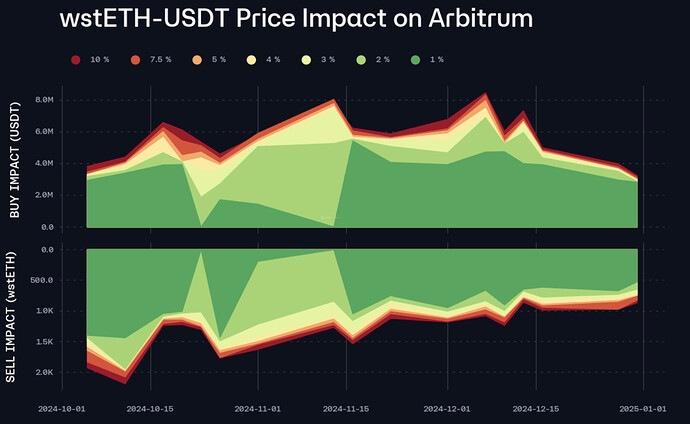

One of the issues with isolated pools is that when Venus deploys a new isolated pool (such as the LST pool on the BNB Chain), we provide very little liquidity for new borrowers, making it difficult for them to loop their assets. To understand the mindset of loopers: if someone deposits 300k in wstETH and tries to borrow ETH to maximize their yield, they will end up losing money because:

- There is only 5k in ETH available to borrow.

- If they borrow all the ETH, the APY will hit the kink and jump to a very unprofitable level.

However, if we move wstETH from an isolated pool to the core pool, borrowers will have access to a large amount of ETH liquidity, enabling them to loop their assets profitably.

Unfortunately, competitors like AAVE have taken advantage of this mistake and deployed wstETH on their core market. Now, wstETH suppliers are moving to AAVE instead of Venus, which is unacceptable because Venus should be the dominant platform on BSC.

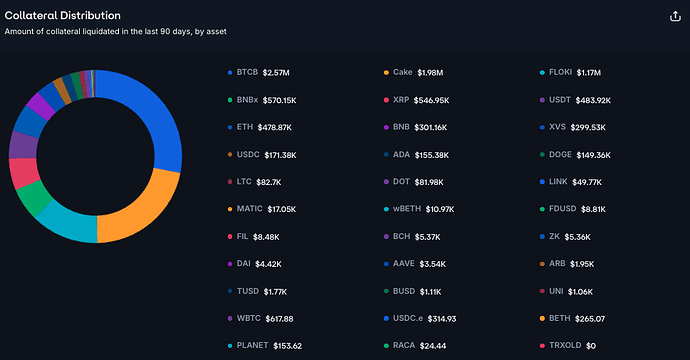

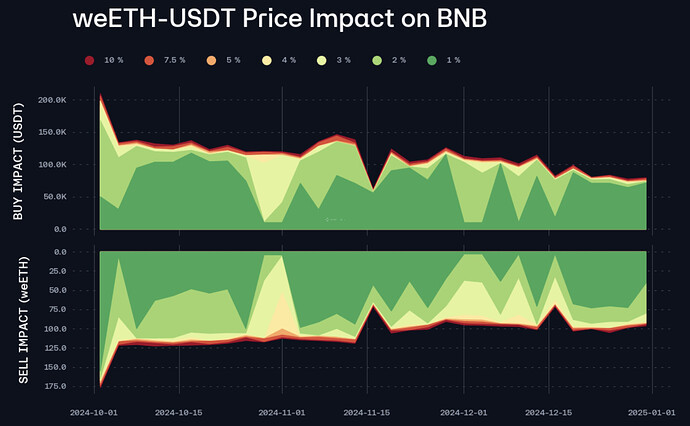

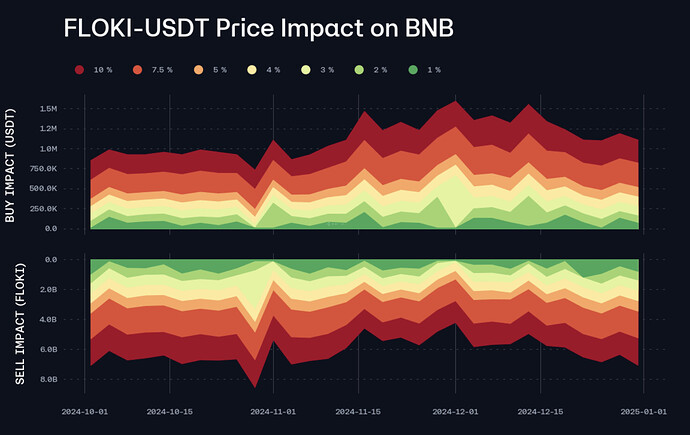

Another issue is that assets like Floki, which have much higher liquidity and value than assets like LTC, are sitting in isolated pools, limiting their growth potential. From a security perspective, LTC, with 250k in on-chain liquidity, should be in an isolated pool, while Floki, with 10M in on-chain liquidity, should be in the core pool. As the largest BSC meme coin, Floki users should have access to our core liquidity to borrow and leverage their assets freely.

Arguments

One argument against moving assets like wstETH to the core pool is the risk of oracle failure or a hack of Lido, which could lead to a Black Swan event for the entire DeFi ecosystem. However, Lido and wstETH have been battle-tested countless times, and their price has rarely deviated significantly. Even in those instances, the impact was minimal. Additionally, the LST pool on Ethereum’s mainnet is already larger than the core pool, so the protocol would still see significant effects whether or not assets are isolated.

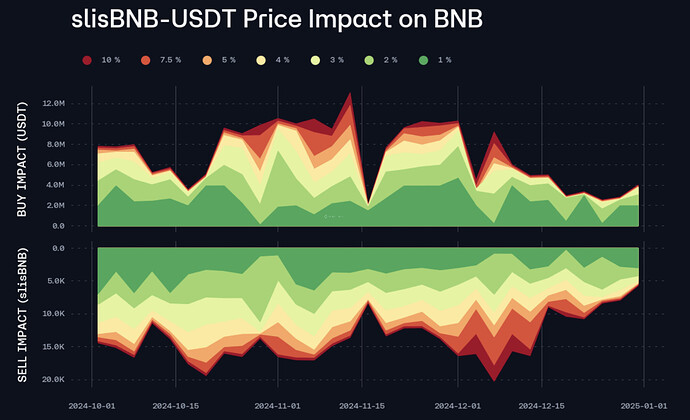

Another argument is that the on-chain liquidity for assets like SlisBNB is relatively low. However, we must consider that, in the worst-case scenario, the protocol could still redeem the asset on ListDAO for a 1:1 ratio, minimizing any potential negative impact.

List of Assets

I recommend the following assets be moved from isolated pools to the core pool:

- wstETH (Arb mainnet and BSC)

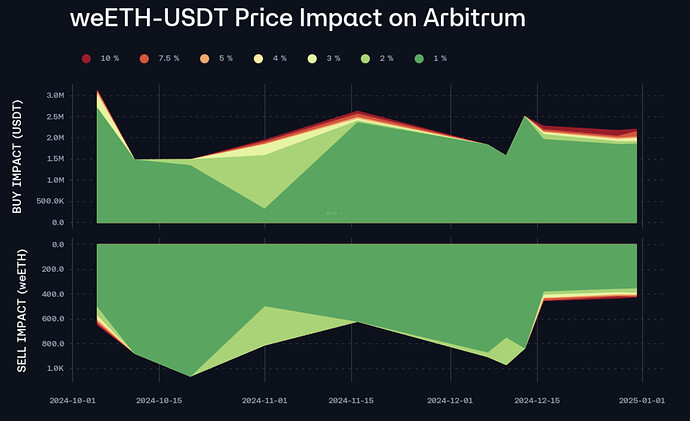

- weETH (Arb mainnet and BSC)

- Floki (BSC)

- SlisBNB (BSC)

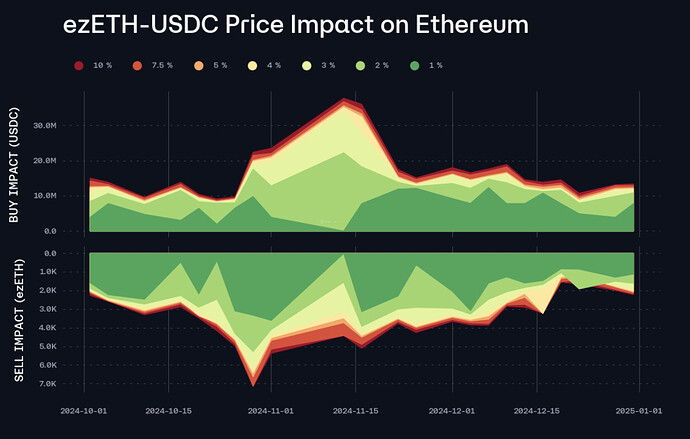

- ezETH (Mainnet)

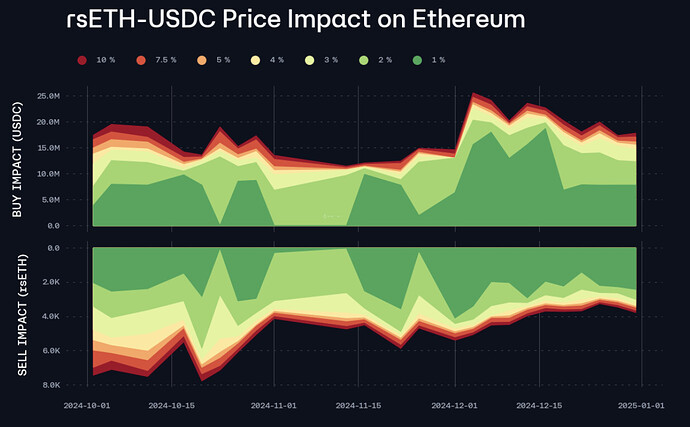

- rsETH (Mainnet)

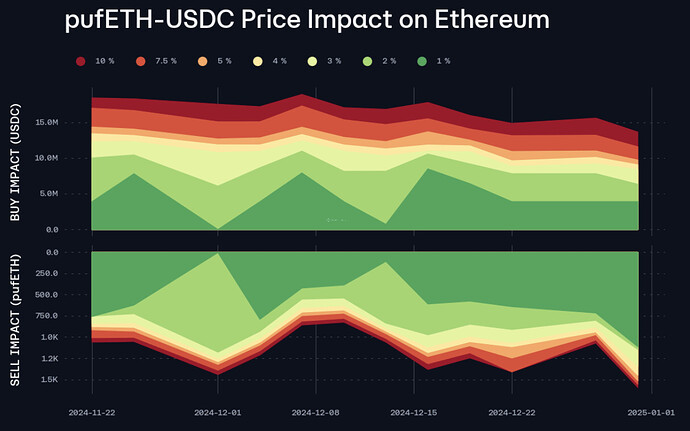

- pufETH (Mainnet)

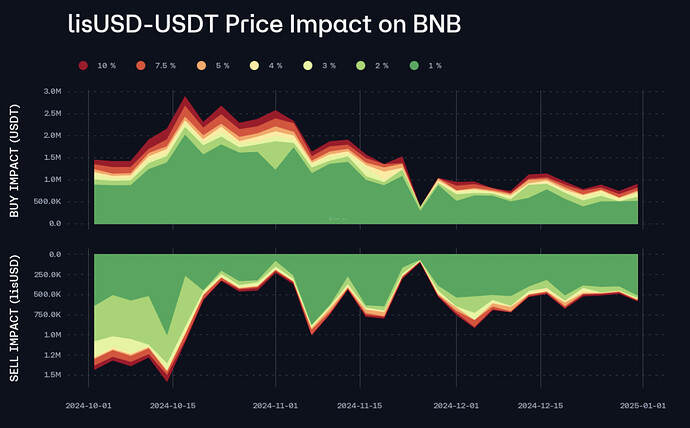

- lisUSD (BSC)

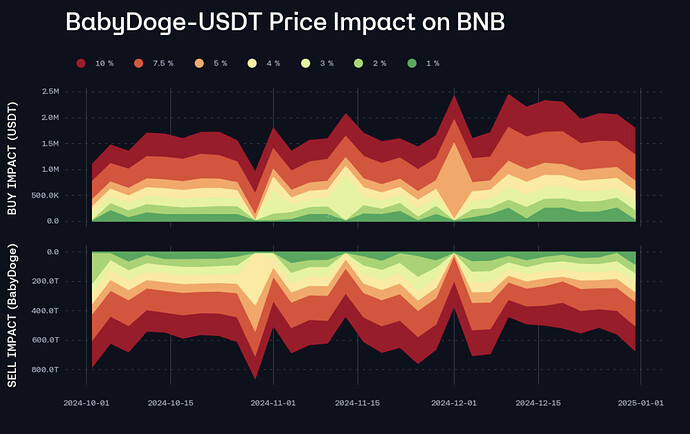

- Babydoge (BSC)

- sUSDe (Mainnet)

- USDe (Mainnet)

- Pendle assets (Mainnet)

Conclusion

this proposal emphasizes the need to move several assets from isolated pools to the core pool within the Venus protocol. The current isolation strategy has put the protocol at a competitive disadvantage by limiting liquidity and growth opportunities. By transferring assets like wstETH, SlisBNB, Floki, and weETH to the core pool, Venus can provide higher liquidity, improve borrowing conditions, and enhance profitability for yield farmers and borrowers. Addressing these inefficiencies will help Venus reclaim its position as the leading Money market on every chain, while mitigating the risks associated with isolated pools.