Summary

This proposal suggests adding a Mountain Protocol wrapped USDM (wUSDM) Core Pool to Venus on Ethereum Mainnet, Arbitrum, Optimism, and zkSync. This recommendation comes as an opportunity to add a USD-denominated yield-bearing asset fully backed by US Treasuries, hence creating a more capital-efficient lending asset (as compared to non-yield-bearing stablecoins) that will ultimately bring great benefits to both Venus and its users.

The proposal is to add ETH, OP and ARB on Phase 1 and add zkSync on Phase 2 once the zkSync native USDM has been issued and the liquidity pools are seeded.

About Mountain Protocol

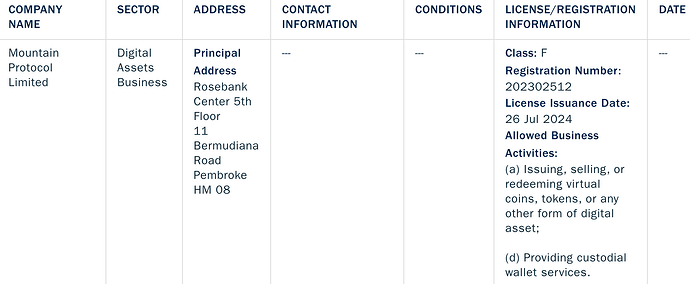

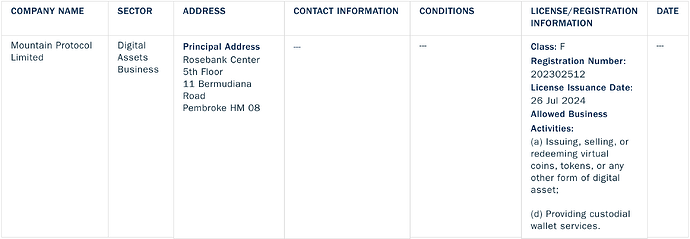

Mountain Protocol is a regulated entity by the Bermuda Monetary Authority (Class F license #202302512). This regulatory oversight ensures a high-standard of compliance and safety for USDM holders. Mountain Protocol has received funding from prominent investors in the crypto space, such as Coinbase Ventures, Multicoin Capital, Castle Island Ventures, among others.

USDM has undergone multiple risk assessments by blue-chip DeFi buyers, including:

- Arbitrum DAO: link

- Ethena Reserve Fund: link

- Curve PegKeeper: link

- Compound (upcoming): link

- Whitelisted for Optimism’s Yield-Bearing-Asset dominance campaign: link

USDM has also undergone multiple independent risk assessments:

- Bluechiop stablecoin risk assessment (A-): link

- Steakhouse risk assessment: link

- S&P price stability assessment (Strong): link

Finally, USDM is integrated into Chainlink’s CCIP, which allows users to use USDM across all the markets. This is live for ETH, OP, ARB (as well as Polygon POS and Base), and will be added to zkSync close after launch, allowing for seamless interest arbitrage across Venus markets.

About USDM and wUSDM

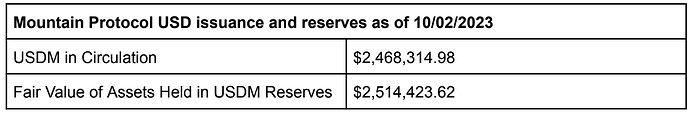

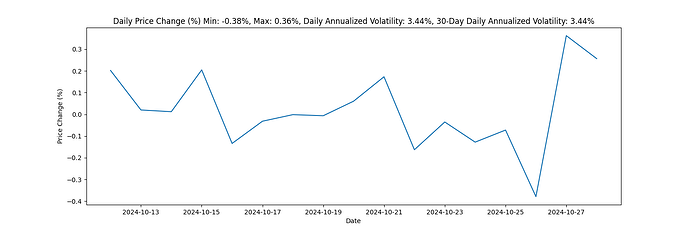

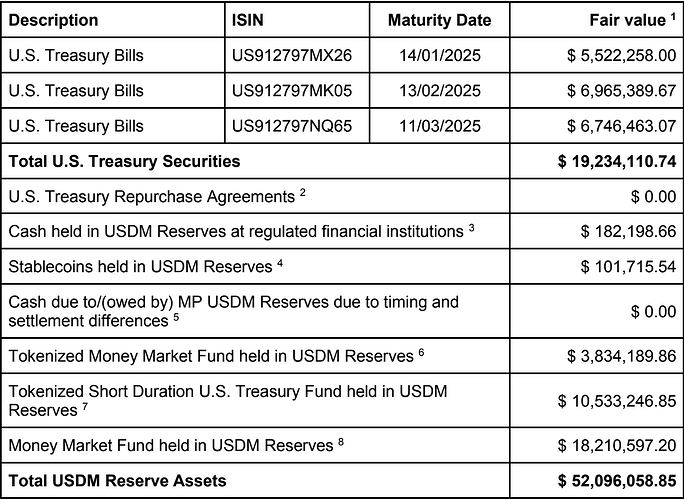

USDM, the first product offered by Mountain Protocol, is a regulated, permissionless, and yield-bearing stablecoin, fully backed by US Treasuries. It is designed to maintain a consistent value pegged to the US dollar, making it a reliable digital asset for transactions and savings. Peg is kept by having primary customers buy/sell USDM at $1 and by the US Treasuries held as collateral for USDM on a bankruptcy remote SPV: USDM Reserves Ltd.

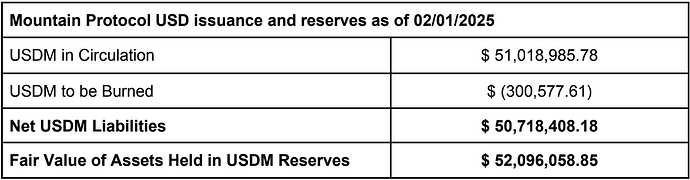

USDM follows a proven model used by all the well-known stablecoins, rewarding holders daily through a rebasing mechanism, currently at a 5% APY. The wrapped USDM (wUSDM), on the other hand, is built as a value-appreciating token that ensures its price increases reflect all the rewards that USDM has generated over time. This token was created to address integration challenges with protocols that were not built for rebasing assets. Current TVL is $59M distributed between Ethereum, Arbitrum, Optimism, Polygon PoS and Base. Upcoming chains include zkSync and Solana for Q4-2024, and BSC on Q1-2025, among others.

Benefits to the Venus Community

- More efficient stablecoin deposit asset: wUSDM deposits by users allows them to leverage two yield sources. When stablecoin borrow rates are high, users can benefit from borrow rates. When rates are low, users get to benefit from the native rewards of USDM. This means that users can deposit without needing to constantly rebalance their positions.

- Yield-bearing collateral: Users depositing stablecoins to borrow volatile assets can now benefit from a yield-bearing stablecoin, effectively reducing their net borrow rate

- Leveraged exposure to wUSDM yield: Users would be able to loop and leverage their lending of wUSDM by borrowing other non-yield-bearing tokens which could be automated with other integrations such as Contango in the future, increasing Venus TVL and revenue.

- Market Diversification: wUSDM will be the first yield-bearing RWA to be onboarded into Venus, expanding Venus’s offerings to users while also attracting USDM holders seeking for an added yield.

- Interest rate arbitrage: USDM offers native bridging via Chainlinks CCIP, allowing users to arbitrage interest rates across Venus markets on different chains.

- Chain-specific benefits: There is a growing interest from blockchains to incentivize the use of yield-bearing assets and RWA-backed coins, which could translate into future blockchain incentives granted to Venus. For example:

- ZKsync will be supporting USDM deployment by diversifying some of their treasury into USDM as well as deploying initial DEX liquidity and incentives. We intend to direct some of our incentives towards Venus Protocol as we believe lending markets to be a key element for the expansion of USDM on the ecosystem. If this was also leveraged with XVS rewards as approved for current pools it would highly promote the lending of USDM and the profitability of looping strategies.

- USDM has been whitelisted at inception for the ‘Optimism Dominance in Yield-Bearing Assets’ campaign, which includes a Mission dedicated specifically to protocols including YBAs as collateral. This means that if Venus requests to be whitelisted as an eligible protocol, the wUSDM in the Core Pool could have OP incentives subsidizing both lending and borrowing of wUSDM, which would also give more room for looping and leveraging to users.

Proposal Author Information

Martin Carrica - CEO and Co-founder of Mountain Protocol

Telegram: @mcarrica

Twitter: @mcarrica

Linkedin: Martin Carrica - Mountain Protocol | LinkedIn

Specifications

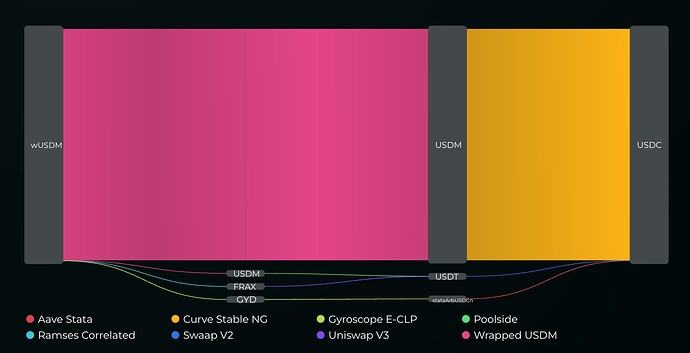

Global metrics

Market Cap: US$ 59.3M total

DEX Liquidity: US$39.9M total

Token Holders USDM: 3,745

Token Holders wUSDM: 564

Ethereum

USDM Token Address: 0x59D9356E565Ab3A36dD77763Fc0d87fEaf85508C

wUSDM Token Address: 0x57F5E098CaD7A3D1Eed53991D4d66C45C9AF7812

Total Supply: 42.5M

Token Holders USDM: 670

Token Holders wUSDM: 204

DEX Liquidity: 24.5M

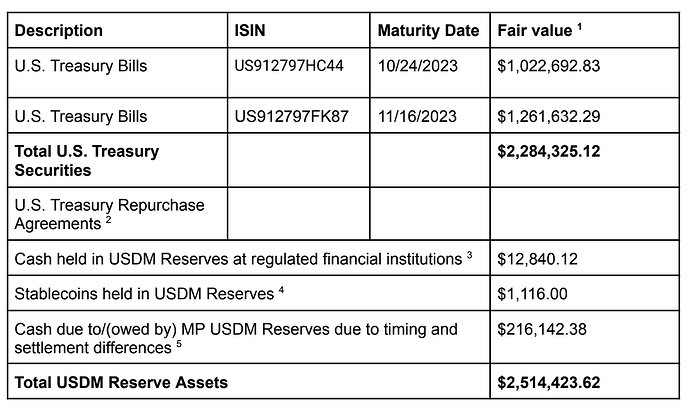

Main pools:

DeGate - USDM total liquidity of US$ 10.7M

Curve sDAI/USDM total liquidity of US$ 11M

Curve USDM/crvUSD total liquidity of US$ 1M

Curve USDM/USD3 total liquidity of US$ 1M

Curve USDM/3crv total liquidity of US$ 830k

Arbitrum

USDM Token Address: 0x59D9356E565Ab3A36dD77763Fc0d87fEaf85508C

wUSDM Token Address: 0x57F5E098CaD7A3D1Eed53991D4d66C45C9AF7812

Token Supply: 8.9M

Token Holders USDM: 1,447

Token Holders wUSDM: 190

DEX Liquidity: US$7.5M

Main pool: Curve USDM/USDC total liquidity of US$ 7.5M

Optimism

USDM Token Address: 0x59D9356E565Ab3A36dD77763Fc0d87fEaf85508C

wUSDM Token Address: 0x57F5E098CaD7A3D1Eed53991D4d66C45C9AF7812

Total Supply: 3.7M

Token Holders USDM: 149

Token Holders wUSDM: 116

DEX Liquidity: US$6.0M

Main pool: Curve USDM/USDC total liquidity of US$ 5.7M

zkSync

NOTE: zkSync USDM is not yet live. For the listing of USDM on zkSync there may be a differnet on-chain vote to match the timing of the deployment, as laid out above.

USDM Token Address: 0x7715c206a14ac93cb1a6c0316a6e5f8ad7c9dc31

wUSDM Token Address: TBC

Total Supply: N/a

Token Holders USDM: N/a

Token Holders wUSDM: N/a

DEX Liquidity: N/a

Main pool: N/a

Socials and Resources

Mountains Protocol Website

Docs

Price feeds

- Chainlink USDM Price Feed (Ethereum / Arbitrum / Optimism)

- Chronicle Oracle wUSDM Price Feed

Additional Information