Overview

Chaos Labs supports listing swETH and rswETH on Venus Protocol’s Ethereum deployment. Below are our analyses and recommendations for initial risk parameters. We do not recommend listing swBTC at this time.

swETH

swETH is an ETH liquid staking token offered by Swell. It carries a total supply of 100K swETH distributed between 19,499 holders on Ethereum; 64K swETH is deposited in Eigen. Given the expected use case of the asset in leveraged yield farming, we recommend listing it in the Liquid Staked ETH isolated pool.

Swell has stated its intent to begin operating with a permissioned group of professional node operators, which are whitelisted in the operator registry contract. When ETH is staked in the swETH contract, it is pooled until there is enough for a 32 ETH deposit, after which the next whitelisted validator is selected using a round robin. Yield is returned in swETH’s price, similar to wstETH. Withdrawals are dependent on the beacon chain exit queue time and the validator sweep state. 90% of staking rewards are sent to the staker, 5% to the node operator, and 5% to the Swell DAO treasury. This is identical to Lido’s 10% fee on staking rewards, which is also split evenly between node operators and the DAO treasury.

Liquidity

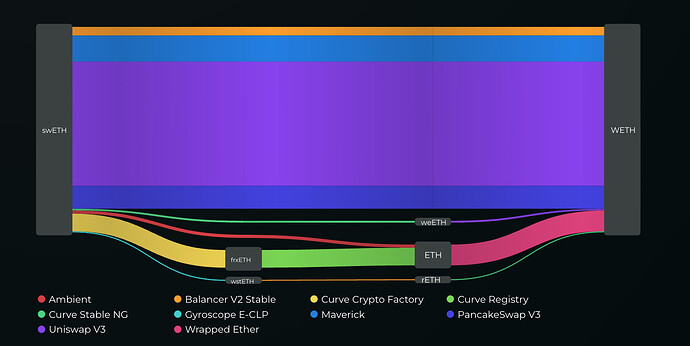

swETH is primarily paired with WETH, and its liquidity is concentrated on Uniswap V3.

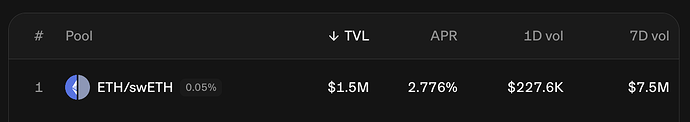

Its average daily trading volume across all venues over the last 180 days is $1.85M.

Volatility

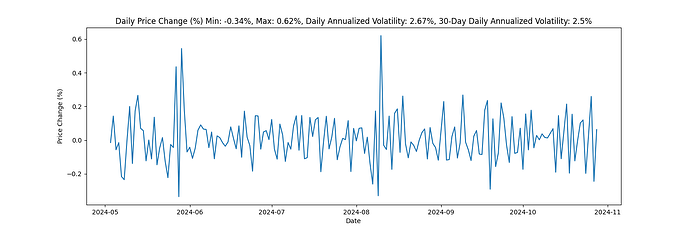

swETH has slightly higher than normal volatility relative to ETH for an ETH LST, at 2.5% daily over the last 30 days.

Collateral Factor, Liquidation Threshold, and Liquidation Bonus

Given the asset will be placed in an isolated pool with only ETH-correlated assets (save PT-weETH, which is not borrowable), we are able to recommend more aggressive collateral parameters that will facilitate leveraged yield farming. Given its slightly elevated volatility and relatively limited DEX liquidity, we recommend aligning its parameters with sfrxETH, with CF set to 90%, LT to 93%, and LB to 2%.

Interest Rate Curve

We do not anticipate strong borrowing demand for the asset; we recommend aligning its curve with other non-WETH assets in the isolated pool, with a Kink at 45% and Multiplier and JumpMultiplier of 0.09 and 3.0, respectively.

Supply and Borrow Cap

We recommend setting supply caps according to our usual methodology, at two times the liquidity available below the liquidity bonus; we recommend setting the borrow cap at 10% of this value given the asset type. Thus, we arrive at a recommendation of 820 and 82, respectively.

Pricing

Given the availability of swETH withdrawals, for which there is a buffer for fast withdrawals, and which is otherwise subject the normal ETH staking withdrawal queue, we recommend pricing the asset according to its exchange rate to prevent liquidation cascades.

rswETH

rswETH is Swell’s liquid restaking offering, and largely uses swETH’s set of smart contracts, save its integration with Eigen’s Eigenpod Manager contracts. Swell offers withdrawals at the exchange rate through its app; waits for withdrawals can extend beyond 21 days. The timing is based on the Eigen withdrawal queue (up to 7 days), the Beacon chain exit queue, and the validator sweep cycle (up to 9 days). As with swETH, there is a buffer that allows smaller withdrawals to be processed immediately.

Regarding its competition, it is one of the smaller major LRTs, with a supply twice that of uniETH but slightly more than a third of rsETH’s supply; it represents 2.5% of the total LRT supply.

As above, 90% of the rewards are returned to stakers, 5% to node operators, and 5% to the treasury. This is identical to the payout of weETH. Swell’s documents state that its AVS selection framework is still under construction.

Liquidity

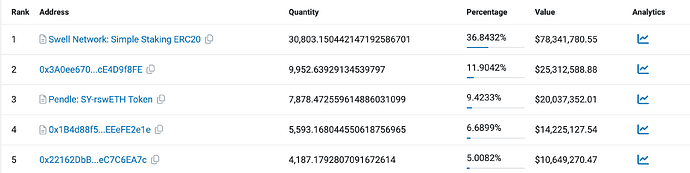

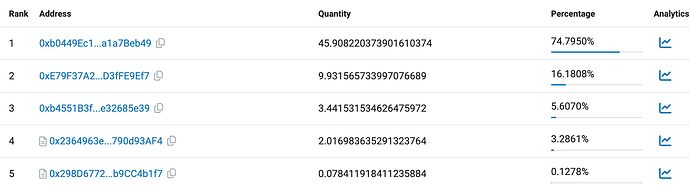

On Ethereum, the total supply of rswETH is 83.6K, with 8,787 holders. Currently, 36% is deposited in the Simple Staking contract in preparation for the launch of Swell’s L2, earning depositors bonus Swell and Eigen incentives.

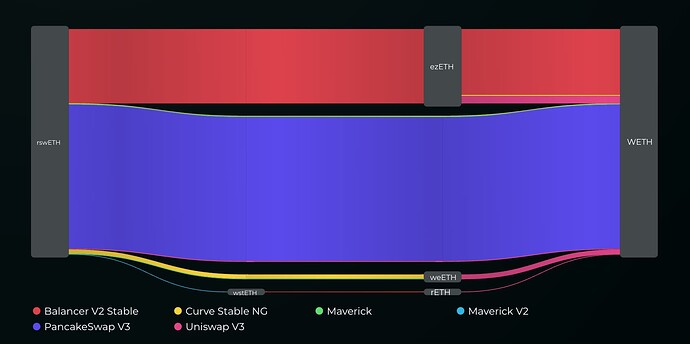

On Ethereum, its DEX liquidity is concentrated on PancakeSwap and Balancer.

The asset has an average daily volume of $3.3M over the last 180 days across all venues.

Volatility

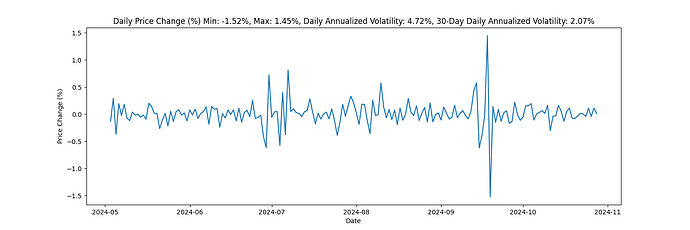

The asset has low volatility relative to ETH, at 2.07% daily over the last 30 days, demonstrating strong peg stability.

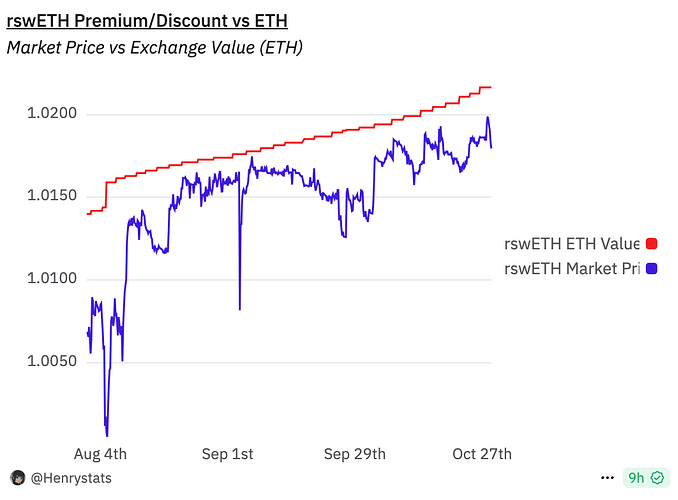

rswETH has demonstrated some volatility relative to its exchange rate, though it has also demonstrated mean reversion following persistent discounts.

Collateral Factor, Liquidation Threshold, and Liquidation Bonus

Given the asset’s low volatility relative to ETH, its placement in the Liquid Staked ETH pool, its liquidity profile, and higher duration risk than swETH, we recommend setting slightly more conservative parameters than swETH.

Interest Rate Curve

As above, we do not anticipate significant borrowing demand for this asset and thus recommend aligning its parameters with swETH’s.

Supply and Borrow Cap

We recommend setting supply caps according to our usual methodology, at two times the liquidity available below the liquidity bonus; we recommend setting the borrow cap at 10% of this value given the asset type. Thus, we arrive at a recommendation of 3,700 and 370, respectively.

Pricing

Given the availability of withdrawals, the asset’s low volatility relative to ETH, and its demonstrated mean reversion, we recommend pricing the asset according to its exchange rate.

swBTC

swBTC is a liquid restaking token representing WBTC deposited in Symbiotic, Eigen, and Karak; its contracts are based on Yearn v3 and have been audited twice. Withdrawals through Swell using the exchange rate currently take three days, this will lengthen as the WBTC is deployed and faces additional withdrawal delays.

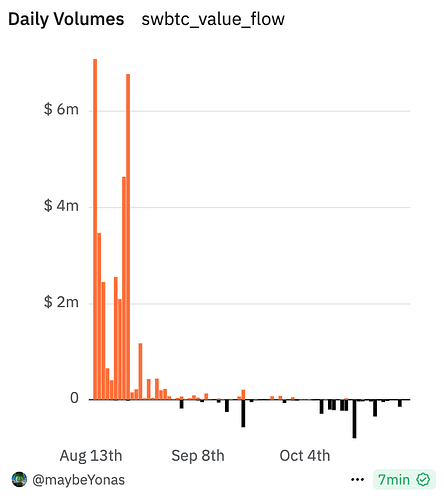

We note that growth of the asset has slowed significantly, and there have not been significant deposits since August, instead there have been multiple large withdrawals in October. This limits the potential growth of a hypothetical Venus market.

Liquidity

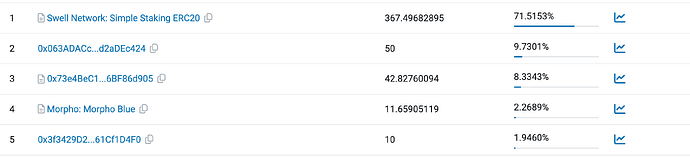

Its current on-chain supply is 513, with 418 holders; supply is highly concentrated in the aforementioned pre-L2 launch contract.

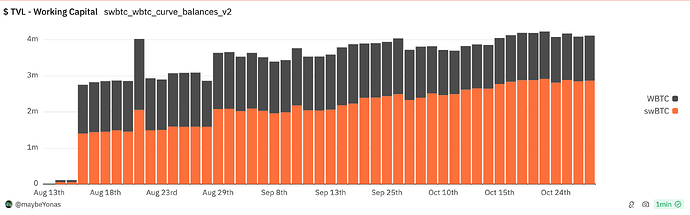

swBTC’s on-chain DEX liquidity is primarily paired with WBTC on Curve.

While its liquidity in this pool has grown slightly since August, the provided liquidity is highly concentrated with a single holder, who represents nearly 75% of the pool. If the user were to remove their liquidity, it could become difficult to process liquidations.

Additionally, the relative amount of WBTC in the pool has decreased over time, moving from 50/50 to 70/30 swBTC/WBTC.

Its average market cap since launch is $31M and its average trading volume is just $8K.

Volatility

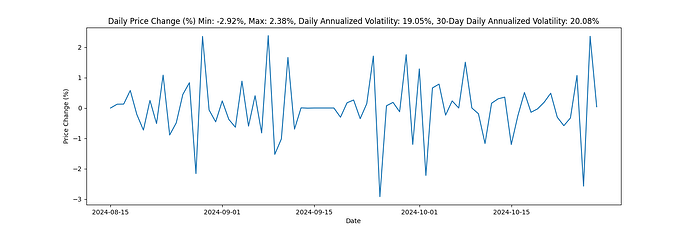

swBTC’s volatility relative to BTC is quite high, at 20% daily over the last 30 days. However, as mentioned above, the asset’s volume is very low, feeding in to this volatility.

Analysis

Given the highly concentrated liquidity, low volume, and lack of recent growth, we find that the risk of this asset currently outweighs the potential benefit for Venus.

Recommendation

| Asset |

swETH |

rswETH |

| Chain |

Ethereum |

Ethereum |

| Pool |

Liquid Staked ETH |

Liquid Staked ETH |

| Collateral Factor |

90% |

87% |

| Liquidation Threshold |

93% |

90% |

| Liquidation Incentive |

2% |

2% |

| Supply Cap |

820 |

3,700 |

| Borrow Cap |

82 |

370 |

| Kink |

45% |

45% |

| Base |

0.0 |

0.0 |

| Multiplier |

0.09 |

0.09 |

| Jump Multiplier |

3.0 |

3.0 |

| Reserve Factor |

25% |

25% |

Disclaimer

Chaos Labs has not been compensated by any third party for publishing this recommendation.