## Summary

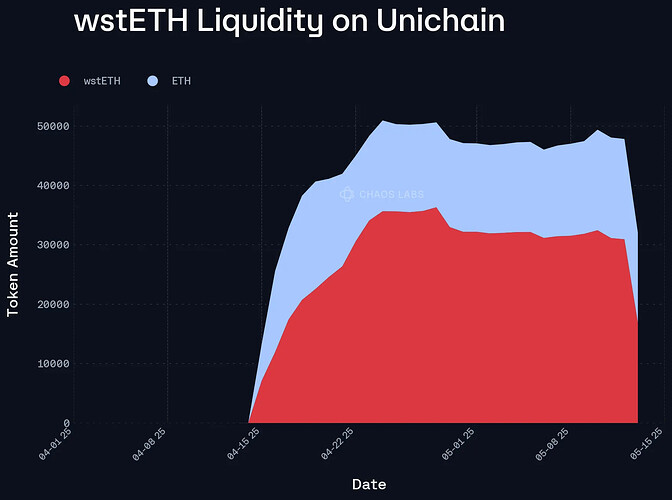

This proposal seeks to list Lido’s Wrapped Staked ETH (wstETH) as a collateral asset on Unichain’s Core Pool. Given wstETH’s deep liquidity, strong adoption, and critical role in the Ethereum staking ecosystem, its inclusion will enhance Unichain’s lending and borrowing market. The listing will allow users to borrow against their staked ETH while maintaining staking yield, improving capital efficiency and expanding Unichain’s user base.

## Background

Lido’s wstETH is a wrapped version of stETH, designed to be compatible with DeFi applications by ensuring a stable balance while maintaining staking rewards. wstETH is one of the most widely used liquid staking derivatives (LSDs), with extensive integration across major DeFi protocols. Listing wstETH on Unichain will attract ETH stakers looking for additional utility without unstaking their assets.

## Motivation

Integrating wstETH into Unichain’s Core Pool aligns with the protocol’s goals of expanding high-quality collateral choices and attracting more liquidity. The listing will:

- Enhance Capital Efficiency: Users can use staked ETH as collateral to borrow assets while still earning staking rewards.

- Expand User Base: The popularity of wstETH within DeFi will drive new users to Venus.

- Increase Protocol Revenue: Borrowing activity around wstETH will generate additional fees for Venus.

- Improve DeFi Accessibility: Users seeking leverage or additional liquidity on staked ETH will benefit from a seamless experience.

About Lido

Lido.fi is a decentralized liquid staking platform behind stETH & wstETH that allows users to participate in Ethereum staking to earn ETH rewards without sacrificing liquidity.

Website: https://lido.fi/ 1

Twitter: x.com

Discord: Lido

Specifications

Oracle & Price Feeds: Chainlink Oracle