Summary:

This proposal seeks to introduce BAL (Balancers governance token) as a core pool on Ethereum mainnet. It aims to provide more Defi utility and use cases for Venus’s Ethereum deployment along with a more diverse set of collateral options to foster greater liquidity and user engagement within the Venus Protocol.

Motivation:

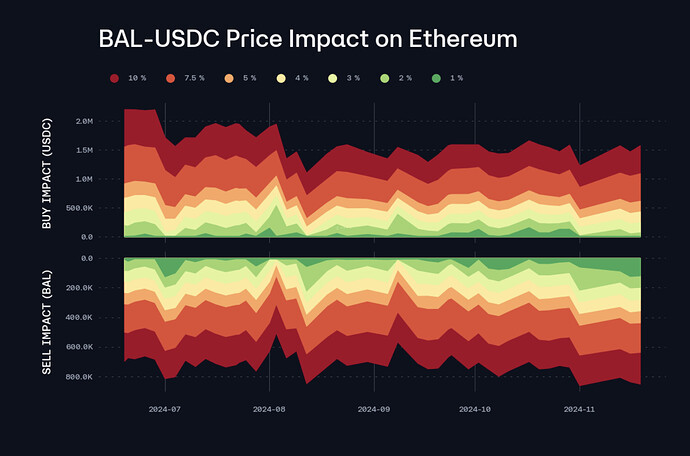

- Liquidity: BAL has strong liquidity on Ethereum mainnet, with ~$36m at time of writing.

- Market Acceptance: A widely distributed token, with a long history on Ethereum. It is an asset that has the potential to drive strong volumes and utility to Venus Protocol.

- Listing BAL on mainnet expands the asset offering on Venus, enhancing its position as a leading Defi protocol.

Risks:

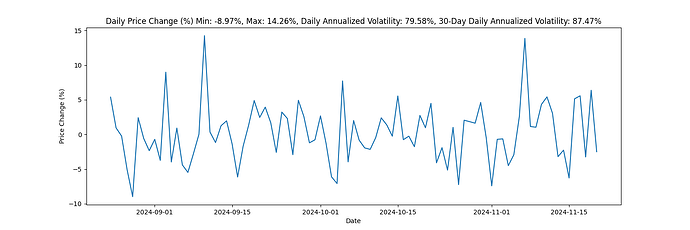

- Volatility Risk: As with all ERC-20 tokens, the value of BAL could fluctuate sharply which could affect the stability of the Venus platform.

- Smart Contract Risks: As with any Governance token, there are inherent smart contract risks, and any exploit of the Balancer contracts themselves could have big impacts on the value of BAL. However, Balancer has undergone multiple audits and has solidified itself as a bluechip AMM without issue for a long period of time.

Benefits:

- Increased Asset Diversity: The addition of BAL provides Venus users with another asset to use as collateral or borrow, catering to different risk profiles.

- The addition of BAL brings us closer in line with our competitors, with BAL being offered as a collateral asset on multiple other lending platforms.

Background:

Balancer is a decentralized finance (DeFi) protocol built on Ethereum that enables automated portfolio management and liquidity provision. It operates as a non-custodial platform for creating and managing customizable liquidity pools, which can have multiple assets with varying weights. Unlike traditional liquidity pools, Balancer allows for unequal weightings of assets in pools (e.g., 80% ETH, 20% DAI), giving users more flexibility in portfolio allocation.

Specifications:

Contract Address: 0xba100000625a3754423978a60c9317c58a424e3d

Oracle & Price Feeds: Implementation expected with Redstone

Community Involvement:

We recommend that the Venus community support this proposal and, if agreed, request Chaos Labs to analyse and provide risk parameters for the safe integration of BAL into Venus Protocol.

We look forward to the community’s feedback and the successful adoption of BAL.