This is beautiful. I was just thinking that XVS needed more utility. i think this is a great way to do that.

what you are referring for XVS liquidation pool?

great idea! I would really like to see this happening

You miss a few important thing from your equation.

- The contract cant liquidate anyone by itself, someone has to make a transaction to initiate which costs gas/money

- If the liquidator is not getting anything from it, why would he do it ?

- There are currently around 13000 account that are borrowing from Venus, are you ready to monitor these accounts and send the liquidation transaction for hundreds of accounts in a few minutes in case the market is crashing, so the protocol does not suffer any loss ?

This documentation does not answer xyz questions at all. The doc says:

Anyone may call the public

liquidateTroves()function, which will check for under-collateralized Troves, and liquidate them. Alternatively they can callbatchLiquidateTroves()with a custom list of trove addresses to attempt to liquidate.

The question is: why would anyone actively monitor undercollateralized accounts and pay the gas fee to liquidate them if the collateral is distributed to the Stability Pool depositors (and not to the liquidator)? Small accounts will quickly become undercollateralized and will not be liquidated with that protocol.

Go to find out the answer or give the answer by self.

If you can’t give the answer by self that mean you still didn’t understand some very simple things.

When you find out something you can’t understand or think it has some problems, give your solution is the best way.

There is no why, just need a UI for liquidation, liquidation shouldn’t only become some coder’s game, is it a very difficult work for Developers or just they didn’t want to develop it ?

Ok I will give the answer.

Monitoring all accounts to check if one is liquidable is costly and complicated. But let’s assume that a benevolent developer built that monitoring tool for the community and a UI that goes with it.

If a user sees that some accounts are liquidable on the UI, they have to pay 100$ in gas fee to liquidate them. The profit from liquidation will go to the stability pool. The user would only get 1$ from that liquidation from it’s deposit in the stability pool. Consequently, the user would lose 99$ by calling that liquidation, so he will not call it.

Only if very large accounts are in default would it be worth it for a user to liquidate them, considering that all the profit is shared in the stability pool.

Conclusion: Accounts will not be liquidated. That is the answer.

Oh, you give your answer, then please go to somewhere find what you want, thks, please don’t waste your time in here and waste my time.

I didn’t have much time to waste in such simple things what you didn’t understand.

It would be nice if we could keep the discussion a little more civilised… No need to argue.

Doesn’t Alpaca Finance have a liquidation protocoll already?

[…] we have an in-house bot to do this, which uses 100% of the fee on buyback and burn of the […] token. However, anyone is free to do this as well, which we’ve allowed to avoid single-point of failure and centralization.

Another idea would be a user interface for liquidations like For.tube, Alpha-Homora-BSC and mcl.multiplier.finance have…

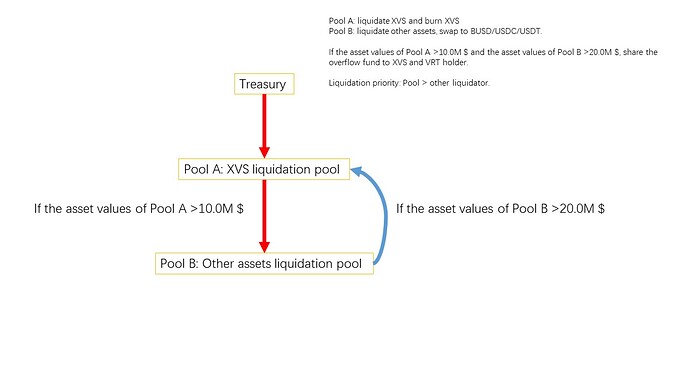

I think that can design a liquidation pool for normal users, they can deposit different token money in and let the pool help them to liquidate and distribute the liquidation profit, of course, they must afford the risk of liquidation.

I lost my all xvs in liquidation

I never thought it will go 40