We propose the implementation of Leveraged Positions, encompassing “Boost” and “Repay with collateral” in the core pool on BNB Chain, where most of the liquidity on Venus protocol is concentrated. This feature will allow users to loop their positions multiple times in one click from a simple-to-use interface instead of having to loop their assets manually.

Leveraged strategies are currently the primary use case on lending protocols, generating most of the revenue. Leveraged Positions will allow Venus users to create automated, recursive leveraged positions, for example, supplying collateral, borrowing against it, and re-supplying multiple times, in a single seamless action, without manual loops or third-party bots.

By introducing this feature, Venus can offer more capital-efficient strategies directly within the protocol, enabling users to gain leverage on their assets in a safer, permissionless, and user-friendly manner. These strategies will enhance protocol stickiness, expand DeFi use cases, and increase revenue through higher asset utilisation.

Leveraged Positions will leverage flash loans under the hood to execute these operations more efficiently and at lower cost.

1. Existing problems

Venus today is powerful too for DeFi leverage, but currently is inefficient. Users who want to loop assets must manually repeat a borrow → swap → supply cycle many times, often requiring 5–20 separate transactions. This process is time-consuming, gas-intensive, and error-prone, with each step introducing execution risk and potential transaction failure.

Exiting or reducing leveraged positions is similarly cumbersome. Users must source the borrowed asset externally, perform multiple swaps, and unwind loops manually, which becomes especially difficult during volatile market conditions.

2. How Leveraged Positions solves those problems

The Leveraged Positions feature replaces manual looping with a single, atomic transaction powered by flash loans. Boost automates the entire leverage-building process, while Repay with Collateral automates deleveraging and position closure.

By executing all steps in one transaction, the feature removes repetitive actions, reduces gas costs, eliminates intermediate failure risk, and ensures the position is only created if it is safe by design.

3. Benefits to users

Users gain instant access to high-leverage strategies without advanced technical knowledge. Positions that once required dozens of transactions can now be opened or closed with one click.

This improves capital efficiency, saves time and gas, reduces operational complexity, and makes leveraged strategies accessible to a much broader range of users. Importantly, safety checks ensure that boosted positions always maintain a health factor above 1 at execution.

4. Details

How it works

When a user clicks Boost, Venus calculates the maximum safe leverage based on unused borrowing power and the collateral’s loan-to-value ratio. A flash loan temporarily borrows additional liquidity, swaps it into the selected collateral, and supplies it back to Venus. This internal loop repeats within the same transaction until the target leverage is reached, after which the flash loan is repaid.

For Repay with Collateral, Venus withdraws supplied collateral, swaps it into the borrowed asset, and repays the debt directly — all atomically and without requiring the user to hold the borrowed token.

User interaction

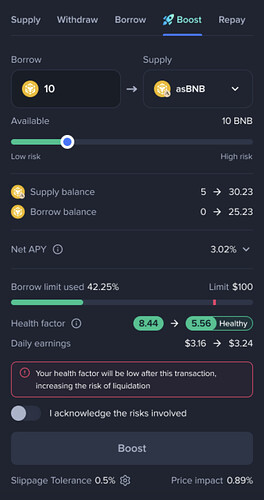

From the user’s perspective, the process is simple and transparent. The interface shows the maximum boostable amount, resulting leverage, and updated health factor before confirmation.

Users can boost, partially deleverage, or fully close positions with one click, without manual calculations, external swaps, or sourcing assets from outside the protocol.

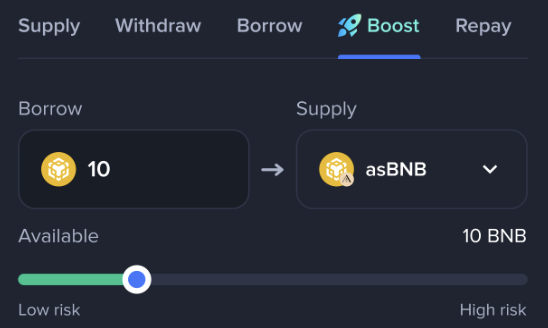

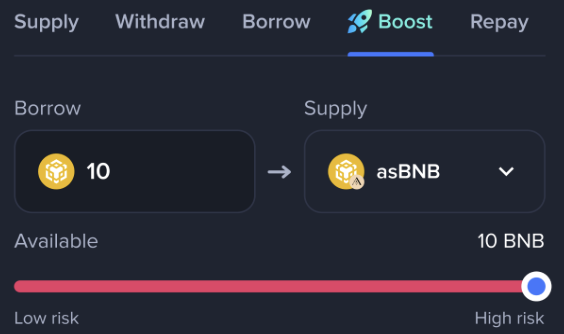

The Venus UI will display different colours along the Boost slider to indicate risk level as users slide to increase their leverage.

Before executing the feature, a warning will be displayed to ensure users are aware of the heightened risks associated with increased leverage. Users will need to toggle to accept the risk warning before being allowed to enter the leveraged position.

5. Swap related features

Several one-click solutions will facilitate the management of users’ positions and therefore enhance the protocol’s stickiness. At launch, only the Repay with Collateral functionality will be available, while the other features continue to be worked on.

- Repay with Collateral: This will allow users to repay, partially or fully, their debts using funds deposited in a different Venus market. For example, if a user’s debt is in USDC and their collateral is in USDT, this one-click solution will allow them to partially or fully repay their USDC debt, reducing the USDT collateral.

- Collateral Swapper: Users will be able to change, partially or fully, their deposited funds from one market to another in a single transaction via the Venus app, without repaying their debts first. For example, if a user has a leveraged position with PT-USDe-30OCT2025 as collateral and USDC as debt, they will be able to move their collateral to a new PT-USDe-30JAN2026 (fictional market) with one click, without adjusting their debt.

- Debt Swapper: This is similar to the Collateral Swapper flow but for debts. Users will be able to move their debt from one market to another without adjusting their global positions first. For example, if a user has a BTCB debt and the price of BTCB starts increasing, they could choose to move their debt to USDT without repaying anything. Later, they could move their debt back from USDT to BTCB.

- Swap and Repay: This will allow users to repay, partially or fully, their debts using an asset different from the underlying token of the market. For example, if a user’s debt is in WBNB but they only have USDT in their wallet, this one-click solution will allow them to repay their debt using USDT.

- Swap and Supply: This will allow users to supply funds to a Venus market even without holding the underlying asset in their wallet. For example, if a user has USDT and wants to supply funds to the USDC Venus market, this one-click solution will allow them to supply USDC using their USDT funds.

All these features will use DEX aggregators under the hood to get the best rates. Previously, Venus enabled the “Swap and Repay” and “Swap and Supply” features without using aggregators, which limited the usability of these features.