As part of the RWA initiative, @Steakhouse explored the possibility to invest in LATAM governments bonds. The idea was to be differentiated of all other protocols using t-bills as a source of safe and liquid yield.

Our analysis showed that LATAM governments bonds trading is rather exotic with most countries not being investment grade and bonds structure is less standardized leading to some complexities.

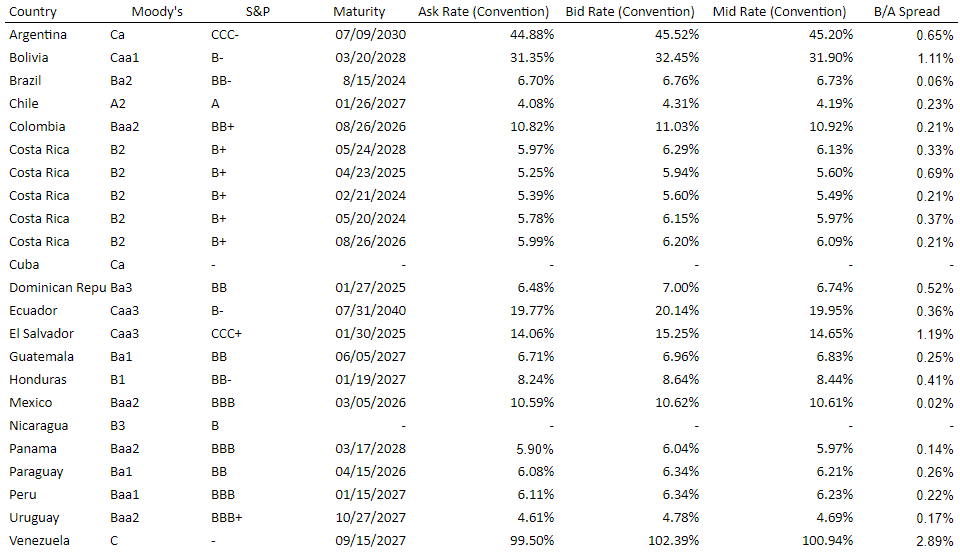

We compiled a list of traded bonds below. As you can see, liquidity is quite thin as expressed in the bid/ask spread which is significant. We looked for the shorter maturity bonds and it is clear that there isn’t an as vibrant market as for US Treasury Bills. If we look at Costa Rica, the next maturity is 4 months and the spread remains significant. Moreover, the spread versus US safe asset is not significant which regard to the non-investment grade rating.

Based on this analysis, investing in such products doesn’t seem a good fit for liquidity management. Venus doesn’t have longer term capital at the current stage for investments in our view.

Happy to hear more from Venus community on the topic.