Simple Summary

Gauntlet presents a proposal to make the following adjustments to interest rate parameters and reserve factors for Venus assets:

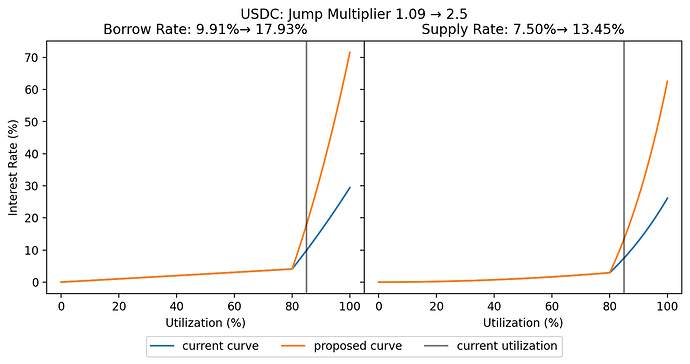

- Raise the jump multiplier for USDC, TUSD, DAI, BUSD and USDT (all stablecoins).

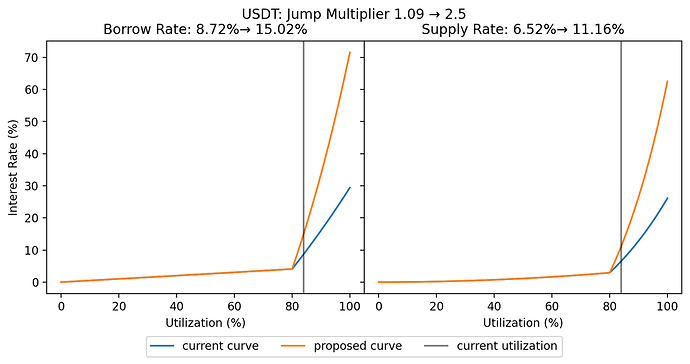

- Lower the kink, raise the multiplier and jump multiplier, and raise the reserve factor for BNB.

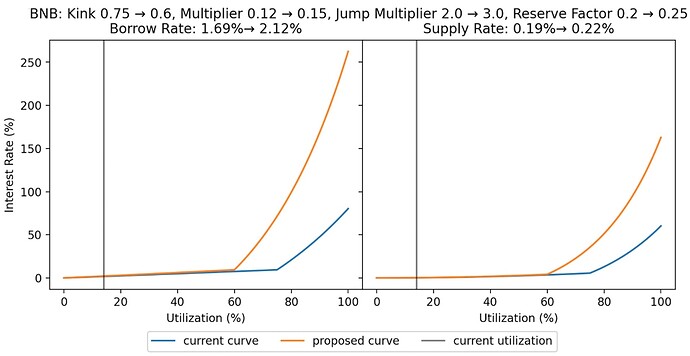

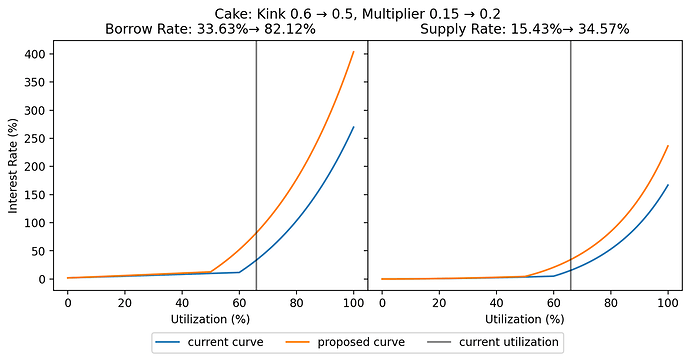

- Lower the kink and raise the multiplier for CAKE.

- Gauntlet has identified these opportunities to adjust the IR Curves to mitigate protocol risk while building protocol revenue via reserves.

Abstract

Many interest rate curves on Venus have not been updated recently. Given the significant shifts in crypto markets, Gauntlet has evaluated assets on Venus and has identified opportunities to adjust parameters for certain assets to benefit the protocol. Using data to model interest rate behavior is a complex task given that user elasticity is likely not constant and behavior will be influenced by general market sentiment (bear and bull markets) and headline-grabbing events. Nonetheless, we introduce frameworks for making data-informed decisions on setting borrower and supplier interest rates. These frameworks apply for when market conditions require the protocol to reduce risk or when strategic opportunities present themselves to increase protocol revenue without materially impacting risk.

Background

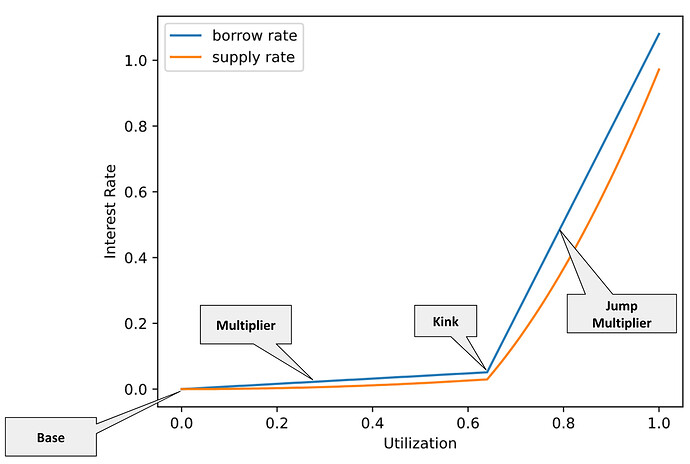

Interest rates are core to lending protocols like Venus: without interest, suppliers have no reason to supply, and borrowers have nothing stopping them from hoarding available borrows. Interest rates are set per asset and are a function of the asset’s utilization (total amount borrowed divided by total amount supplied). All borrowable assets on Venus use a Jump Rate Model as this function, with an example interest rate curve for the Jump Rate Model shown below.

Under the Jump Rate Model, the borrower interest rate slowly increases linearly with utilization until it hits a certain point (the “kink” in the curve), at which point it increases much faster with utilization. The 4 parameters defining this curve are:

- Base: interest rate at 0 utilization

- Multiplier: the slope of the curve below the kink

- Kink: the utilization level at which the slope increases

- Jump Multiplier: the slope of the curve above the kink

All the interest borrowers pay is split between the suppliers (in the form of supplier interest) and the protocol reserves. The reserve factor parameter governs this split for an asset, which is the proportion of the interest that goes to the reserves while the rest goes to suppliers. Thus the supplier interest rate curve is defined in terms of the borrower interest rate curve, where the supplier interest rate is utilization * (borrower interest rate) * (1 - reserve factor).

Methodology

Among other factors, there are two primary reasons to adjust an interest rate curve:

-

mitigate the risk of 100% utilization in a pool

-

build reserves via protocol revenue to cover insolvencies or other expenses in the future

Mitigating risk

The first case of mitigating 100% utilization is of more immediate benefit to the protocol. High utilization is poor UX for suppliers, as it can restrict their ability to withdraw an asset from the pool. For example, if a pool contains $10M in USDT, and $9M is loaned out, the maximum a supplier could withdraw is $1M since the pool cannot exceed 100% utilization. In addition to impacting suppliers, liquidations may be hindered because at 100% utilization, only vTokens (not the underlying collateral) can be seized. If liquidators are concerned they won’t be able to cash these vTokens in for the underlying collateral in time to lock in a profit, this risks leaving the protocol with insolvent debt. Increasing interest rates can be used to motivate borrowers to repay the asset and motivate suppliers to deposit more of the asset. Both would decrease utilization to more desirable levels.

In analyzing historical data, we did find borrower and supplier elasticity varies by asset. Past elasticity to interest rate based on supplies and borrows was considered for each asset when making our recommendations below. In addition, we compared and analyzed high utilization periods of high risk to normal utilization periods of low risk. This includes assumptions as to what timeframes are considered healthy as utilization returns to a safe state. DAI and CAKE were observed to exceed these timeframes. Lowering the kink would trigger higher rates sooner, leaving more time before 100% utilization is reached if demand spikes. Increasing the jump multiplier would incentivize users to react to high utilization levels.

We also observed the concentration risk and relative reserve sizing to consider the risks posed by the current suppliers. A given market asset has concentration risk when most of the supply comes from a single account or a few accounts. In this scenario, if the whale decided to withdraw or gets liquidated, utilization would be pushed to dangerously high levels, possibly even 100%. To analyze the relative reserve size, we compare an asset’s supply on Venus to its market cap and average trading volume. If most of an asset’s market cap or a large amount relative to typical trading volume is supplied, it would be much more challenging for protocol users to bring utilization down if it gets too high.

Building Reserves

The second use case of building reserves is a little more opportunistic in nature. Reserves serve as the rainy day fund for protocols, protecting against unexpected tail case events resulting in insolvencies. Over time they may also be used to fund operations or reduce the reliance on the native token treasury. Moreover, interest rates can be used opportunistically to capture increased reserves when specific market conditions are met. Opportunities present themselves when:

-

Users are inelastic to interest rate changes AND/OR

-

An outsized opportunity for yield exists in the market, such that borrowers would be willing to pay a higher premium on the asset (Venus can capitalize from a market upswing)

For instance, if we find that suppliers are inelastic to changes in interest rate, there is an opportunity to increase the reserve factor with a low expectation of decreased supply. We didn’t find any such opportunities for Venus currently, but will be continuing to analyze this for future recs.

Motivation & Recommendations

Stablecoins

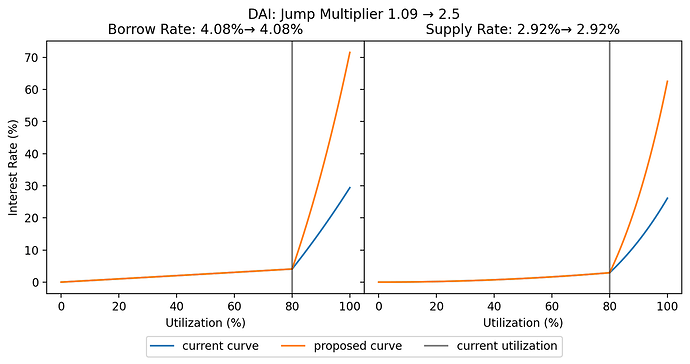

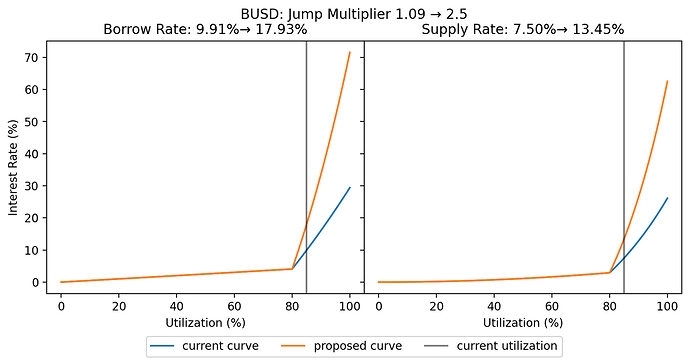

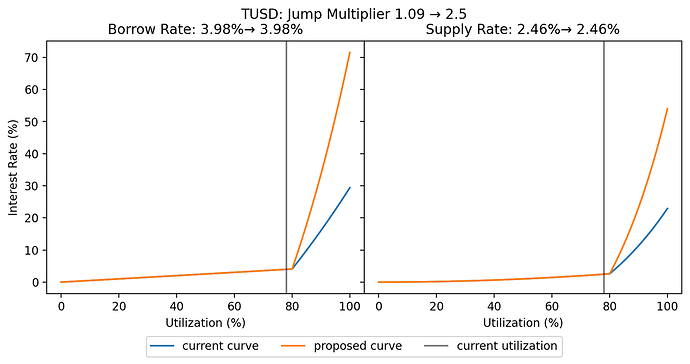

An ideal interest rate curve would incentivize a decrease in utilization when interest rates get close to 100% through a very high interest rate. With the current stablecoin interest rate curve, the maximum borrower rate (the rate at 100% utilization) is 29.4%, and the maximum supplier rate is 26.1%. Compared to similar lending protocols, these maximum rates are quite low.

Historical data has shown that when stablecoin utilization gets too high, it takes a while for it to return to reasonable levels through either total supply increasing or total borrows decreasing. This has particularly been true for DAI, USDC, TUSD, BUSD and USDT.

In order to incentivize borrowers to exit their positions and suppliers to enter when utilization gets too high, we recommend raising the jump multiplier from 1.0 to 2.5 which would raise the maximum borrow rate to 71.5% and the maximum supplier rate to 62.5% (except TUSD which will have a maximum supply rate of 54.0% due to its higher reserve factor). This will serve to reduce the risk of a liquidity crunch affecting Venus. The changes are shown below for each stablecoin.

Large Cap

BNB

Out of the large cap tokens (WETH, BTCB, and BNB) the interest rate curve of BNB is concerning. When the utilization of BNB spiked it has often taken a while for utilization to return to more reasonable levels, just like with the stablecoins. As such, we recommend raising the jump multiplier from 2.0 to 3.0.

BNB currently has concentration risk from an outsized user position (0x489a8756c18c0b8b24ec2a2b9ff3d4d447f79bec)

In order to incentivize more suppliers to enter the market (thus diluting the pool ownership of this account) and disincentivize new borrows (which could lead to a liquidity crunch if this user decides to pull their BNB out), we recommend lowering the kink from 0.75 to 0.6 and raising the multiplier from 0.12 to 0.15. To offset the additional interest this account would be earning from increased rates, we recommend raising the reserve factor from 0.2 to 0.25.

Small Cap

CAKE

CAKE is another asset that takes a while to recover from spikes in utilization. In our analysis of the utilization rates as a time series, we can observe that utilization generally stays above the kink point and frequently has spikes

We recommend lowering the kink from 0.6 to 0.5 and raising the multiplier from 0.15 to 0.2 in order to reduce the risks of a liquidity crunch affecting CAKE.

Specifications

The table below summarizes the proposed interest rate and reserve factor parameters, with changes denoted by an arrow.

| Token | Base | Kink | Multiplier | Jump Multiplier | Reserve Factor |

|---|---|---|---|---|---|

| USDC | 0.00 | 0.80 | 0.05 | 1.09→2.5 | 0.10 |

| BUSD | 0.00 | 0.80 | 0.05 | 1.09→2.5 | 0.10 |

| USDT | 0.00 | 0.80 | 0.05 | 1.09→2.5 | 0.10 |

| TUSD | 0.00 | 0.80 | 0.05 | 1.09→2.5 | 0.20 |

| DAI | 0.00 | 0.80 | 0.05 | 1.09→2.5 | 0.10 |

| BNB | 0.00 | 0.75→0.6 | 0.12→0.15 | 2.0→3.0 | 0.2→0.25 |

| Cake | 0.02 | 0.6→0.5 | 0.15→0.2 | 3.00 | 0.25 |

Next Steps

- Gauntlet will monitor community feedback to assess how to proceed. If the community aligns on updating IR curves per the above recommendations, Gauntlet will put them up for a governance proposal.

- Gauntlet will monitor the effects of these IR curve adjustments and follow up with next steps after we have collected enough data. We estimate updates to come in Q2.

By approving this proposal, you agree that any services provided by Gauntlet shall be governed by the terms of service available at gauntlet.network/tos.