Summary

This proposal seeks to integrate Chaos Labs’ Risk Oracle into the Venus protocol, to enhance the efficiency and accuracy of risk parameter updates. The Risk Oracle will enable real-time and automated adjustments to market configurations, reducing manual intervention and improving the trading experience for users.

This potential integration continues Venus’ commitment to making the protocol as transparent and antifragile as possible, ensuring that the core functions of data truth, risk-based market parameters, and protocol upkeep continue to be performed by independent leaders in the space.

Motivation

Chaos Labs is the Risk Manager for Venus protocol, performing a range of economic and security risks, including providing specific market parameters for Venus. These parameters are currently offered based on periodic time-based reviews and in response to specific market or associated events that affect the risk profile of markets (ex., Significant utilization spikes or increasing number of liquidations). These recommendations are then manually updated and reviewed continuously per the abovementioned process. While effective, this process is time-consuming and introduces a latency in responding to market changes. This latency causes market parameters to be more conservative than they would otherwise be, as they need to account for a reasonable range of market conditions without frequent updates.

Integrating the Risk Oracle allows for increasing automation of parameter updates over time, ensuring that market parameters—such as supply and borrow caps, interest rates, and more—are adjusted in real-time based on global market data. This will boost the protocol’s competitiveness by optimizing execution costs through more accurate risk parameters and reducing development efforts.

Rationale

Integrating Chaos Labs’ Risk Oracle is a beneficial step forward for Venus as it means continuing to move towards a more automated and responsive risk management system. The Risk Oracle will offer the protocol:

Real-Time Updates: Implement real-time updates for parameters like supply caps, which ensures that supply caps remain appropriate relative to market demand, preventing over-exposure or liquidity constraints, and maintaining the protocol’s stability and competitiveness.

Automated Adjustments: Automatically updating parameters such as interest rates enables the protocol to maintain a balance between lending and borrowing through dynamic rate adjustments.

Enhanced Market Stability: Dynamically adjust parameters based on real-time data to ensure the protocol remains resilient against sudden market changes.

Resilience: This would further make the protocol more antifragile and less reliant on contributors for providing all updates while still retaining the protocol’s risk and security mechanisms.

Specification

Risk Oracle Integration

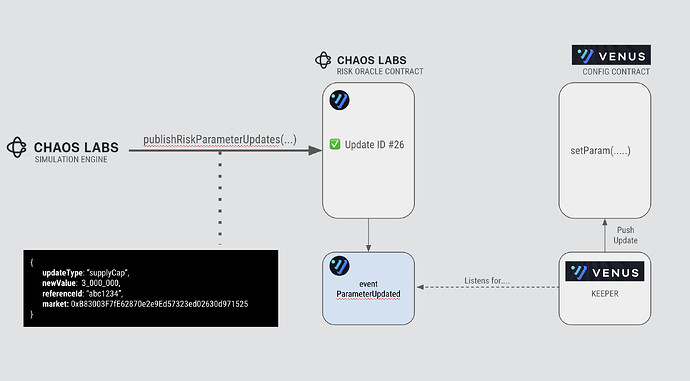

Data Source: Venus will read risk parameter recommendations from the Chaos Labs’ Risk Oracle.

Parameter Updates: The Risk Oracle will feed data into the Venus’ protocol, where a Keeper will observe updates, validate them, and execute transactions to update on-chain market configurations.

Control Mechanism: The Keeper will not have direct control over the parameters. Instead, during transaction execution, the Venus contract will read values from the Risk Oracle and use them to update the markets.

Update Frequency

Real-Time Updates: Parameters like supply and borrow caps will be updated in real-time to ensure optimal conditions.

Periodic Updates: Certain parameters will be periodically reviewed and adjusted on a scheduled basis, ensuring the protocol remains aligned with long-term market trends.

Validation and Safety:

The Keeper will automatically check updates within a predefined valid range to ensure the protocol’s safety and integrity.

Initial updates will use narrower ranges for extra security.

Implementation Process

- Initially, the Oracles will have support for supply and borrow cap updates.

- In the future, the Chaos Labs Risk Oracles will also support updates for other risk parameters across the Venus protocol.

Reference

Chaos Labs Risk Oracles https://chaoslabs.xyz/solutions/risk-oracles

Conclusion

Integrating Chaos Labs’ Risk Oracle into Venus will enhance the protocol’s adaptability and resilience by automating real-time adjustments of key parameters like supply and borrow caps, interest rates, and collateral requirements. This integration will improve risk management, optimize liquidity, and maintain competitive rates, ultimately strengthening Venus’ position in the DeFi market while reducing operational complexity.