Overview

Chaos Labs supports the listing of USD1 within Venus’s BNB Core pool. Below is our analysis and recommendations for initial risk parameters.

USD1

USD1 is a U.S. dollar–backed stablecoin launched by World Liberty Financial Inc., with custody and infrastructure support provided by BitGo. Designed to maintain a 1:1 peg with the U.S. dollar, USD1 is fully backed by short-term U.S. government treasuries, U.S. dollar deposits, and other cash equivalents.

USD1 is currently deployed on both the Ethereum and Binance Smart Chain (BNB Chain) networks, with plans for expansion to other blockchains. To mint USD1, users must sign up for a BitGo account and, upon approval, initiate a mint request by sending U.S. dollars to the issuer’s bank. Upon receipt, USD1 tokens are issued directly to the user’s BitGo wallet. Redemption follows a similar process in reverse, allowing users to convert USD1 back to fiat currency.

USD1’s reserves are subject to regular audits by independent third-party accounting firms (there are no readily available details on these audits at this time) to ensure transparency and maintain the 1:1 backing.

It is important to note that, as of now, USD1 is not yet tradable on centralized exchanges.

Market Cap & Liquidity

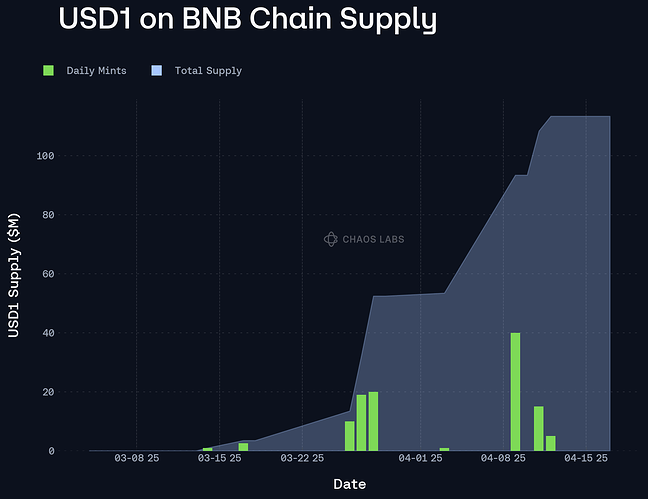

USD1’s market cap on BNB Chain has increased rapidly in recent weeks, reaching over 110M; it has a market cap of just 14M on Ethereum as of this writing.

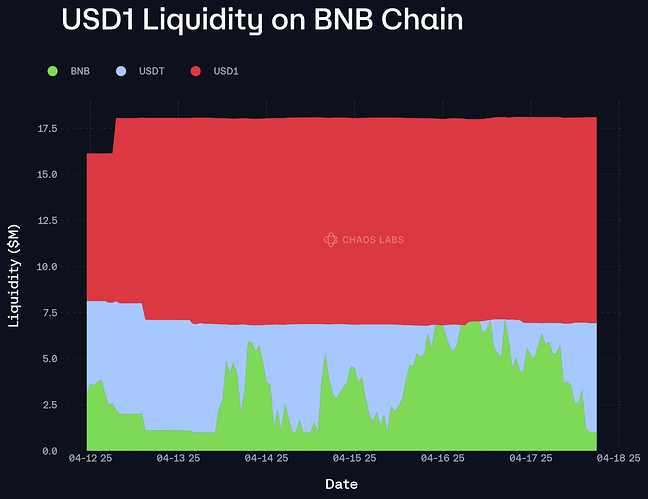

Its liquidity has been very stable since launch, at least $6M combined in BNB and USDT liquidity paired against it.

This amount of liquidity is sufficient to support the asset’s listing on Venus at this time.

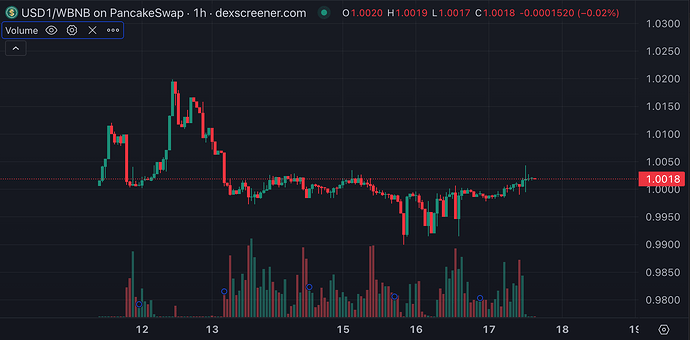

Additionally, it has demonstrated relatively strong peg stability in its short amount of time trading. However, this is not enough price data from which to draw strong conclusions regarding its stability.

Collateral Factor

As suggested in the proposal, given the nascent nature of the asset, as well as historically low demand for using stablecoins as collateral, we recommend listing the asset with a CF of 0%. This has the further benefit of ensuring that users do not loop the asset with itself, taking up valuable borrowable liquidity. As this market develops and more public information becomes available, we may recommend increasing the asset’s CF.

Supply and Borrow Caps

We recommend setting the supply cap at 2x the liquidity available under the Liquidation Penalty. This leads to a recommendation of 16M, with a borrow cap set to 90% of this value.

Oracle Configuration/Pricing

There do not appear to be any price feeds available from Venus-trusted oracle providers at this time. However, until this is available, it is acceptable to use a value of 1 as a placeholder given that the asset cannot be used as collateral.

Specification

| Parameter |

Value |

| Asset |

USD1 |

| Chain |

BNB Chain |

| Pool |

Core |

| Collateral Factor |

0% |

| Liquidation Penalty |

10.00% |

| Supply Cap |

16,000,000 |

| Borrow Cap |

14,400,000 |

| Kink |

80% |

| Base |

0.0 |

| Multiplier |

0.10 |

| Jump Multiplier |

2.5 |

| Reserve Factor |

25% |

Disclaimer

Chaos Labs has not been compensated by any third party for publishing this recommendation.