Integration of Entangle Data Feeds

Summary

This publication presents the community with the opportunity to add Entangle Universal Data Feeds to the existing Venus Oracle Interface, enhancing the security and robustness of Lending & Borrowing Products.

Abstract

The Universal Data Feed Protocol by Entangle is a system designed to handle, process, and publish data from a variety of sources including currency prices, betting odds, weather information, and much more in a deterministic format.

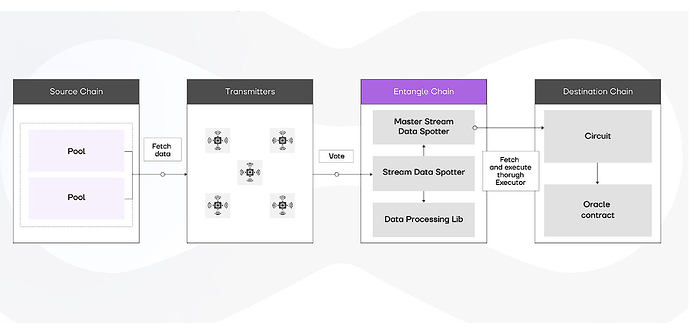

The Universal Data Feed Protocol operates through a distributed network of Transmitter Agents, commonly known as Keepers which are operated by machines off-chain.

These Transmitter Agents gather, format, and package data for submission to the “StreamDataSpotter” smart contract on the Entangle Blockchain. The “StreamDataSpotter” Smart Contract then makes decisions regarding data finalization based on the finalization libraries of individual Distributors.

The finalization library of each Distributor plays a crucial role in determining which Transmitter Agents are eligible for rewards and penalties. This determination is made by comparing the data submitted by the Transmitter Agents against actual values.

Post completion of data finalization, the “Betting Mechanism” is activated, distributing bets and rewards back to the respective Transmitters Agents.

The finalized data is then logged in the global “MasterStreamDataSpotter” contract, where a Merkle root is computed for the entire dataset.

Additionally, the system offers customization options for the frequency of on-chain data updates and the specific type of data to be provided.

This flexibility can lead to reduced overall costs.

Entangle, in its role as a distributor leveraging the “Universal Data Feed Protocol,” intends to publish wstETH/USDT & wstETH/ETH data feeds for the Venus Protocol.

In the graphic above, a simplified process of price updates is illustrated, which includes the following:

-

Fetching data from various sources, including different blockchains & off-chain APIs, and verification through a voting process within the network of Transmitter agents.

-

Processing and finalizing data on the Entangle Blockchain.

-

Retrieving and executing update transactions by the Distributor Conductor to publish a final price on the Oracle Contract on the destination chain

Motivation

The Entangle team seeks to provide a customized Data Feed Solution for the Venus Protocol. After engaging in discussions with the Venus Team and analyzing existing data feeds, particularly wstETH/ETH & wstETH/USDT, the Entangle Team has identified notable potential advantages through its incorporation into Venus’s Oracle Infrastructure. This addition would enhance the security and robustness of Lending & Borrowing Products offered by the Venus Protocol.

Proposal

The proposal includes the inclusion of Entangle Data Feeds in the Venus Oracle Interface.

We intend to initially offer feeds for wstETH/ETH & wstETH/USDT on the BNB Smart Chain.

Suggested parameters (can be changed):

- Format: Push

- Heartbeat - 2 hours

- Price deviation - 0.4%

#2 - Liquid Vaults to L&B Markets on Venus Protocol

Summary

- This publication presents the community with the opportunity to add Liquid Vaults to the Venus DeFi pool or any other pool on the BNB Smart Chain.

Abstract

-

Liquid Vaults is an application developed by Entangle which is designed to improve the capital efficiency of yield-bearing assets.

-

Users are no longer required to choose between generating yields on their assets or leveraging their liquidity positions.

-

Instead, they can now stake their assets with Liquid Vaults, enabling them to reap the benefits of both capital efficiency and flexibility.

-

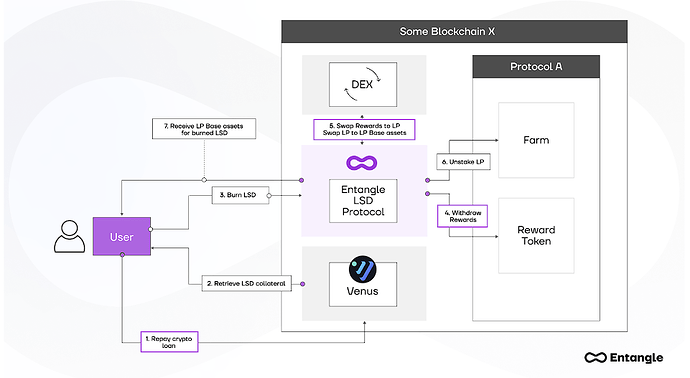

Using Liquid Vaults, Venus DAO users have the ability to stake their LP Tokens and generate composable Liquid Staking Derivatives (LSDs). These are wrapped, composable versions of yield-bearing assets (such as LP tokens) that are enabled through Entangle’s native application Liquid Vaults.

-

These LSDs support the refinancing of yield-generating assets through utilities like Lending & Borrowing, enabling users to enhance their capital efficiency.

-

LSDs, i.e. Liquid Vaults can be converted back into preferred base tokens of a pool pair at any time. Entangle provides a user-friendly interface to facilitate the easy liquidation of these Liquid Vaults as a service.

-

Below, an illustration depicts the user flow for repaying debt on Venus resulting in the receipt of base tokens of a pool pair.

Benefits

- Members of the Venus and Entangle community will be able to leverage Liquid Vaults as collateral, enabling them to borrow assets and thereby enhance their capital efficiency. Consequently, this has the potential to significantly increase the Total Value Locked (TVL) on Venus.

Specification

-

In its initial phase, Entangle proposes integrating Liquid Vaults using Stargate LP Tokens from staked USDT, which currently boast a Total Value Locked (TVL) of $26.3 million.

-

To support the integration of Liquid Vaults, Entangle will provide a “push” price-feed of the Stargate Liquid Vault against USDT.

-

The price will be calculated based on the total supply of Liquid Vaults derived from staked LP Tokens, in addition to circulating LP tokens from staked USDT in the Stargate USDT Pool.

Links

Site - https://entangle.fi/

GitBook - https://docs.entangle.fi/

Discord - Entangle

Twitter - https://twitter.com/Entanglefi