Overview

Chaos Labs supports creating a BNB E-mode including asBNB, slisBNB, and WBNB, as their strong structural linkage ensures highly correlated value behavior. This setup enhances capital efficiency for users without introducing material additional risk. Below, we present our analysis and initial parameter recommendations.

slisBNB

slisBNB is Lista DAO’s liquid staking derivative for BNB, representing tokenized staked positions on the BNB Smart Chain. slisBNB accrues yield from BNB staking rewards. These rewards are auto-compounded and reflected in the increasing slisBNB/BNB exchange rate, allowing holders to earn yield through value appreciation rather than additional token distribution.

slisBNB is minted when users deposit BNB into Lista DAO’s staking contract. The deposited BNB is delegated to Lista’s whitelisted validators on the BNB Smart Chain through the StakeHub contract, participating in PoS consensus to earn native staking rewards. The contract then issues slisBNB to the user at an exchange rate determined by the total pooled BNB and the current slisBNB supply. This exchange rate gradually increases as staking rewards accrue, meaning each slisBNB represents a larger share of the underlying BNB over time. All minting operations are handled by the StakeManager contract, which controls issuance and ensures consistency between the total staked BNB and the circulating slisBNB supply. This minting process is atomic — users receive slisBNB instantly without waiting for validator confirmation or unbonding delays.

Redeeming slisBNB works as the reverse of minting. When a user initiates a redemption, their slisBNB is burned, and an equivalent amount of BNB is queued for withdrawal from Lista DAO’s validator pool. Unlike minting, the redemption process is not atomic: it involves a mandatory unbonding period (currently at 7 days) to allow delegated BNB to be unstaked from validators. Once the unbonding period ends, the user can claim their BNB directly.

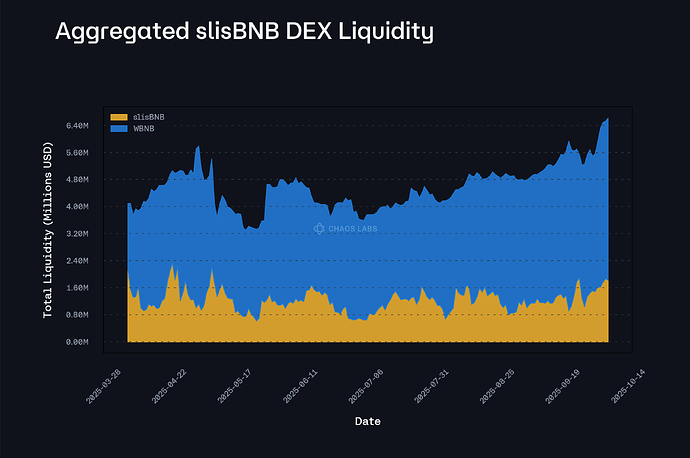

For slisBNB holders seeking an immediate exit, they can instead utilize on-chain liquidity: primarily through the slisBNB/WBNB liquidity pool on PancakeSwap, which holds approximately $6.37M TVL, and the slisBNB/WBNB pool on THENA, with around $321.46K TVL. Below, we present the aggregated slisBNB liquidity over time. Over the past six months, liquidity has consistently exceeded $4M and has shown a clear upward trend over the past two months, indicating strong exit capacity under stressed market conditions.

asBNB

As we analyzed in this post, asBNB is a liquid staking derivative of BNB issued by Aster and powered by Lista DAO. It represents staked BNB that continues to earn yield from the BNB ecosystem, including Binance Launchpool rewards that increase its net asset value and Binance Hodler and Megadrop rewards that are converted and distributed as additional asBNB.

asBNB is created when users deposit BNB or slisBNB into Aster’s system. If BNB is used, it’s first converted into slisBNB through Lista DAO’s staking process. That slisBNB is then sent to Lista’s infrastructure, where it becomes clisBNB — an internal accounting token that tracks each user’s staked position and the rewards earned from Binance Launchpools. As Launchpool rewards accumulate, they are converted back into BNB and added to the total pool value, which increases the net asset value of asBNB. If a Launchpool is ongoing, minting requests are queued until it ends to ensure fair value updates.

When a user redeems asBNB, the process works in reverse to minting. The user calls the burnAsBnb() function on Aster’s Minter contract, which transfers their asBNB back to the contract. The Minter then calculates how much slisBNB that amount represents using the current NAV. The asBNB tokens are burned, and an equivalent amount of slisBNB is withdrawn from the YieldProxy contract and sent back to the user’s wallet. If there’s an ongoing Launchpool, withdrawals are temporarily queued until the pool ends and the NAV is updated, ensuring rewards are properly accounted for before redemption. Once processed, the user always receives slisBNB, not BNB, even if they originally deposited BNB to mint asBNB.

Recommendation

Given the yield-bearing nature of slisBNB and asBNB and their expected leverage looping use case, we recommend designating both assets as collateral-only and non-borrowable within the BNB E-Mode, with slisBNB not being permitted either as collateral or as borrowable outside of this mode.

The parameters for slisBNB as collateral asset outside of the BNB E-Mode will be provided at a later time, following additional coverage of the asset.

For slisBNB, its nature as a liquid staking derivative directly backed by staked BNB ensures that its intrinsic value closely tracks BNB’s price, with only gradual appreciation from staking rewards. As a result, its price behavior remains highly correlated to WBNB, justifying the use of more permissive risk parameters within the E-mode framework.

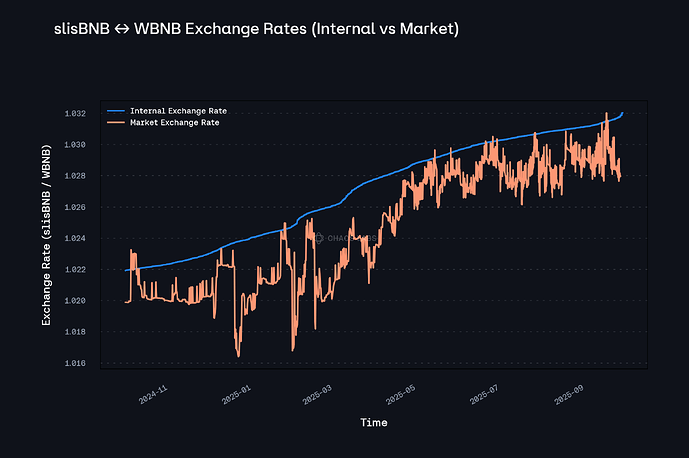

At the same time, the market exchange rate between slisBNB and WBNB has remained highly stable relative to its internal exchange rate over the past year, with a maximum deviation of only 77 bps. This demonstrates that slisBNB’s collateral pricing has closely tracked its actual market value, posing no evidence of overpricing risk. Such consistent alignment further supports the rationale for adopting permissive risk parameters for slisBNB within the BNB E-mode.

It is reasonable, however, to assign asBNB more conservative parameters than slisBNB, given the additional abstraction layer in its staking and redemption flow. That said, since users can withdraw asBNB to slisBNB atomically, the exit path for both assets under stressed market conditions is effectively the same. Although conversions from asBNB to slisBNB are not immediate during ongoing Launchpools, no new Launchpool events have taken place since May 2025, which effectively means that asBNB’s redemption process currently operates without delay. However, given the uncertainty over whether future Launchpools may resume, we recommend maintaining slightly more conservative risk parameters for asBNB relative to slisBNB for now. Should it become clear that no further Launchpool events will occur, we will revisit this decision and consider aligning asBNB’s parameters with those of slisBNB.

Meanwhile, we expect the implementation of the BNB E-Mode to boost leverage-looping behavior. To align with this, we are also preparing a proposal to adjust the WBNB and BNB IRM, aiming to maximize users’ capital efficiency without introducing additional risk.

Specification

slisBNB Core Listing parameters

| Parameter | Value |

|---|---|

| Asset | slisBNB |

| Collateral | No |

| Borrowable | No |

| Supply Cap | 20,000 |

| Borrow Cap | - |

| Collateral Factor | - |

| Liquidation Threshold | - |

| Liquidation Incentive | - |

| Kink | - |

| Base | - |

| Multiplier | - |

| JumpMultiplier | - |

BNB E-Mode Parameters

| Parameter | Value | Value | Value |

|---|---|---|---|

| Asset | asBNB | slisBNB | WBNB |

| Collateral | Yes | Yes | No |

| Borrowable | No | No | Yes |

| Collateral Factor | 89% | 90% | - |

| Liquidation Threshold | 92% | 93% | - |

| Liquidation Incentive | 4% | 4% | - |

Disclaimer

Chaos Labs has not been compensated by any third party for publishing this recommendation.