We propose the implementation of Efficiency Mode (e-mode) in the Core pool on BNB Chain codebase (where most of Venus liquidity is concentrated). E-mode will create subgroups of markets with specialized collateral factors (CF), liquidation thresholds (LT), and liquidation incentives. Users must opt-in to an e-mode group and can only borrow assets from that specific group, which helps limit risk.

Once this feature is released, Venus Protocol will create specific e-mode groups with increased CF and LT values and reduced liquidation incentives. Potential candidates include:

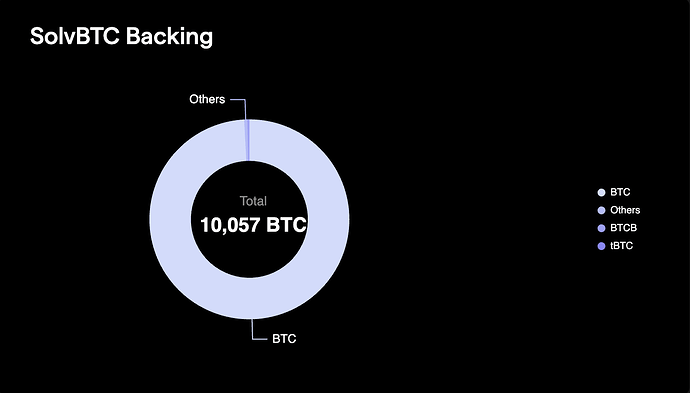

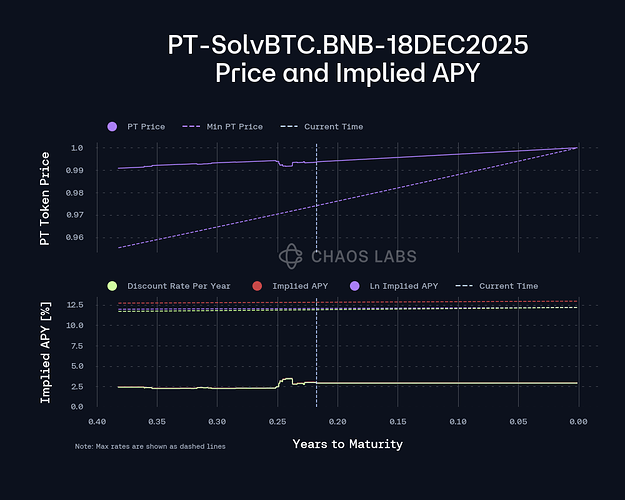

- BTC e-mode group: including BTCB, SolvBTC and xSolvBTC

- BNB e-mode group: including WBNB and asBNB

Additionally, we propose implementing the Liquidation Threshold concept in the Core pool on BNB Chain. Isolated Pools already incorporate this feature, which helps reduce liquidation risks for users.

Problems to be Solved:

- Lack of competitive Max LTVs compared to other lending protocols.

- Liquidity fragmentation in the current Venus Protocol model, based on Isolated Pools.

- Currently, in the Core pool on BNB Chain, Max LTV (used to calculate user borrowing power) and Liquidation Threshold (used to calculate user health factor and determine liquidation eligibility) share the same value. This increases liquidation risk for users.

Solution Proposed:

- Implement the e-mode feature (originally developed by AAVE) exclusively in the Core pool on BNB Chain, which is the platform’s largest liquidity pool.

- Note on Isolated Pools: these pools currently lack sufficient liquidity to justify e-mode development. Additionally, Isolated Pools use a different codebase than the Core pool, which would require separate development work.

- Implement the Liquidation Threshold feature in the Core pool on BNB Chain. Markets in that pool will have a different value for the Max LTV and Liquidation Threshold.

Benefits for the Protocol/Community:

- Higher Max LTV for specific pairs, increasing capital efficiency for suppliers.

- Enhanced leveraged strategies, leading to increased TVL and protocol income.

- Reduced liquidation incentives to attract more borrowers.

- Lower liquidation risk

Details

How e-mode will work on Venus Protocol

e-mode groups

- Venus Protocol will support the creation of e-mode groups through Governance

- Each e-mode group will define:

- List of markets in the group

- For each market:

- Whether the market can be borrowed

- e-mode maximum Loan-to-Value (max LTV)

- e-mode Liquidation Threshold (LT) - which must exceed the max LTV

- e-mode Liquidation Penalty (LP) - the additional percentage of the collateral that liquidators receive during liquidation

- One market can belong to multiple e-mode groups simultaneously (similar to AAVE’s implementation in their recent AAVE Liquid E-mode)

User Interaction

- Users must opt-in and opt-out of e-mode

- The system always validates that a user’s Health Factor remains above 1 after e-mode transitions (users cannot be liquidated immediately after opting in or out of an e-mode group)

- Each user can belong to either no e-mode group or exactly one e-mode group

- Users cannot opt-in to an e-mode group if they have debt in a market that isn’t borrowable within their desired e-mode group

- Example 1:

- User has debt in BNB

- User wants to enable ETH Correlated e-mode group (which doesn’t include BNB)

- Result: User cannot opt-in to the “ETH Correlated” e-mode group

- Example 2:

- User has debt in wstETH

- User wants to enable ETH Correlated e-mode group (where wstETH exists but isn’t borrowable)

- Result: User cannot opt-in to the “ETH Correlated” e-mode group

- Example 1:

- Once in e-mode:

- Only assets in the selected category can be borrowed

- For supplied assets outside the e-mode category, the system applies the default max LTV and LT values

- When an e-mode group is enabled, the system uses e-mode parameters for calculating borrowing power and liquidation logic

- Users can still supply assets outside the e-mode group to earn yield and increase borrowing power (though without any boost)

- Liquidation Logic: ****When a user in e-mode is liquidated: use the category-specific risk parameters (LT, LP)

Governance Controls

Venus Protocol Governance will be able to:

- Create new e-mode groups

- Add or remove markets from e-mode groups

- Enable or disable markets as collateral/borrowable within e-mode groups

- Set or modify the max LTV, LT, and LP parameters for markets in an e-mode group

- Enable or disable entire e-mode groups

How Liquidation Threshold will work on the BNB Chain Core pool

This will function exactly as it currently does in the Isolated Pools:

- Max LTV (Collateral Factor) determines the user’s borrowing power. Example:

- Max LTV of USDT: 80%

- If a user deposits 100 USDT and enables it as collateral, they can borrow up to 80 USD from any borrowable market in the Core pool

- Liquidation Threshold determines the user’s health factor and liquidation eligibility. Example:

- Liquidation Threshold of USDT: 85%

- If a user deposits 100 USDT, they can borrow up to 80 USD. Assuming they borrow the maximum amount in USDC (80 USDC)

- The user’s health factor becomes 1.0625 (100 USDT * 85% / 80 USDC). Their debt would need to increase to 85 USDC before liquidation becomes possible. This 5 USDC “safety buffer” is the key benefit of implementing the Liquidation Threshold concept

- Liquidation Threshold will always be greater than or equal to the Max LTV. It will typically be higher, creating a security buffer for users.