GM - Corn from Yearn here with a proposal to add Yearn Vaults as collateral on Venus Arbitrum and Ethereum lending markets.

Summary:

Yearn proposes adding seven vaults to Venus Arbitrum and Ethereum lending markets.

Arbitrum:

- yvUSDC-1

- yvUSDT-1

Ethereum:

- yvUSDC-1

- yvUSDT-1

- yvDAI-1

- yvUSDS-1

- yvWETH-1

Motivation:

Yearn yield-bearing vault collateral has been used in DeFi for more than 3 years, with over $2B in lifetime deposits into Alchemix, Abracadabra, and others.

Yearn strategies are designed to be always liquid all the time and able to take large deposits with little or no slippage. They rely on one consistent contract regardless of the strategies inside the vault.

Yearn strategies adhere to a risk framework determined by 3rd Party Audits, an internal code review, complexity of the strategy, longevity in the market, team knowledge, TVL impact, and more. Risk details can be found here: Risk Scores | Yearn Docs

The following strategies are in scope of this proposal:

Arbitrum:

- yvUSDC features Aave V3 and Compound V3 Lender strategies.

T30 day APR: 6.55% - yvUSDT features Aave V3 and Compound V3 Lender strategies, as well as Stargate staking.

T30 day APR: 3.92%

Ethereum:

- yvUSDC-1 features Aave V3, Compound V3, and Spark Lender strategies, as well as depositing USDC through MakerDAO’s PSM into sDAI.

T30 day APR: 4.28% - yvUSDT-1 features Aave V3 and Compound V3 Lender strategies.

T30 day APR: 4.85% - yvDAI-1 features Aave V3 and Spark Lender strategies, as well as sDAI.

T30 day APR: 5.24% - yvUSDS-1 features Sky Rewards, Aave, and Compound strategies.

T30 day APR: 6.75% - yvWETH-1 features Aave V3, Compound V3, and Spark Lender strategies, as well as stETH.

T30 day APR: 2.67%

Risks:

Yearn V3 has been audited by the best security firms in the industry: Statemind, Chain Security, and yAudit. These reports and more are available here: yearn-security/audits at master · yearn/yearn-security · GitHub

Additional lending, AMM, leverage, and liquidity mining risks can be found in detail here: Protocol Risks | Yearn Docs

For additional details about price manipulation of Yearn vault collateral please see: yvToken as Collateral | Yearn Docs

Benefits:

Yearn yield-bearing collateral enables maximum yield and capital efficiency. Users benefit from interest earned while in Yearn while leveraging their assets in Venus. Passive income on collateral that continues to generate returns while in use is a prime use case of composability only possible in DeFi.

Yearn Vaults make the best collateral because you aren’t locked into any one particular strategy. If one lending market has a particularly high APR vs another, the strategy will automatically adjust. Meanwhile, the Yearn Vault has one consistent contract that doesn’t change, making it the perfect collateral.

Specifications:

- Yearn agrees to seed $10k per market.

- Vault shares must be entirely non-borrowable.

Pricing:

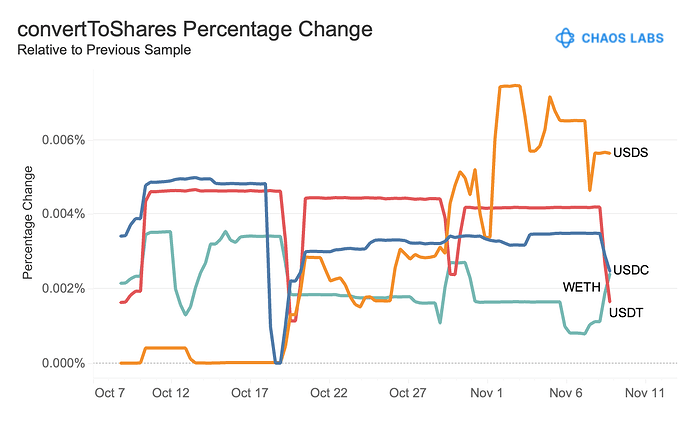

Generic pricing of vault tokens can be done using the standard 4626 convertToShares and convertToAssets functions.

Contracts:

Arbitrum:

- yvUSDC-1:

Vault Contract Address: 0x6FAF8b7fFeE3306EfcFc2BA9Fec912b4d49834C1

Token Contract Address: 0xaf88d065e77c8cC2239327C5EDb3A432268e5831 - yvUSDT-1:

Vault Contract Address: 0xc0ba9bfED28aB46Da48d2B69316A3838698EF3f5

Token Contract Address: 0xFd086bC7CD5C481DCC9C85ebE478A1C0b69FCbb9

Ethereum:

- yvUSDC-1:

Vault Contract Address: 0xBe53A109B494E5c9f97b9Cd39Fe969BE68BF6204

Token Contract Address: 0xA0b86991c6218b36c1d19D4a2e9Eb0cE3606eB48 - yvUSDT-1:

Vault Contract Address: 0x310B7Ea7475A0B449Cfd73bE81522F1B88eFAFaa

Token Contract Address: 0xdAC17F958D2ee523a2206206994597C13D831ec7 - yvDAI-1:

Vault Contract Address: 0x028eC7330ff87667b6dfb0D94b954c820195336c

Token Contract Address: 0x6B175474E89094C44Da98b954EedeAC495271d0F - yvUSDS-1:

Vault Contract Address: 0x182863131F9a4630fF9E27830d945B1413e347E8

Token Contract Address: 0xdC035D45d973E3EC169d2276DDab16f1e407384F - yvWETH-1:

Vault Contract Address: 0xc56413869c6CDf96496f2b1eF801fEDBdFA7dDB0

Token Contract Address: 0xC02aaA39b223FE8D0A0e5C4F27eAD9083C756Cc2

Useful Links:

Site: https://yearn.fi/

Docs: https://docs.yearn.fi/

Github: yearn · GitHub

Twitter: x.com

About Yearn:

Yearn is DeFi’s premier yield aggregator, providing individuals, DAOs, and other protocols with a platform to deposit digital assets and earn yield. Launched in the summer of 2020, Yearn quickly gained recognition for the highest risk-adjusted returns in DeFi with over $6 billion in deposits, largely credited to its core offering, Yearn Vaults.

Today the Yearn Vaults V3 protocol provides builders the tools they need to access every source of yield in crypto. V3 is secure, modular, and built with automation in mind.

Yearn also provides structured yToken products such as yCRV, yETH, and Juiced. These products leverage Yearn’s expertise and active involvement in crypto governance, enhancing user participation and yield through locking, voting, and other mechanisms.

Yearn has demonstrated its expertise in risk management and strategy creation at various global events, including ETHCC, ETHDenver, ETHDubai, ETHAmsterdam, and The Stanford Security Summit. Yearn also contributes as a whitehat to SEAL 911, an experimental Telegram bot created by samczsun which anyone can use to seek help during a hack. Contributors from Yearn have gone on to create the audit education program yAcademy, security services firm yAudit.

Beyond Yearn Vaults, contributors from Yearn have also assisted in the development of various software tools such as Ape-Safe, Apeworx, Allowlist (used by Metamask), Disperse ($1 billion in volume), Vyper, Brownie, Safe, Robowoofy, ERC-4626, Weiroll-py, and yPriceMagic. In terms of funding contributions, Yearn has supported Gitcoin, LexPunk, and Nomic Labs.

Contributors from Yearn have gone on to create the audit education program yAcademy, security services firm yAudit, and Coordinape, a DAO management tool. Additionally, Yearn’s work has been referenced in research conducted by Messari and Ark Invest.

Yearn is maintained by a team of full and part-time contributors and is governed by the YFI token.