DEPLOY VENUS ON OPBNB

I. INTRODUCTION

I propose the deployment of the Venus Protocol on opBNB. There is a unique window of opportunity for Venus to become the leading money market on opBNB, a new high-performance layer-2 solution within the BNB ecosystem, built using the OP Stack.

II. ABOUT OPBNB

opBNB is a new high-performance layer-2 solution within the BNB ecosystem, built using the OP Stack. Leveraging its block size of 100M, opBNB’s gas fees remain stable and low cost, making it a great solution for widespread adoption. From gaming and DeFi, opBNB caters to a diverse set of needs while delivering optimal performance.

III. RATIONALE

1. First mover advantage: Venus has a unique opportunity to become the leading money market whilst opBNB is still small. Large money markets have their eyes on the BNB ecosystem so it is best to deploy sooner rather than later.

2. Gateway to Binance’s users: Binance has recently deepened its integrations with opBNB in order to help onboard more users onto the chain. As market sentiment continues to improve, opBNB will likely emerge as one fo the most attractive L-2 solutions for mass retail.

3. Improved defensibility: 2023 saw more competition among chains through the proliferation of L-2s. There is a higher bar for scalability and cost. Venus has the opportunity to strengthen its edge by meeting users on this expectation.

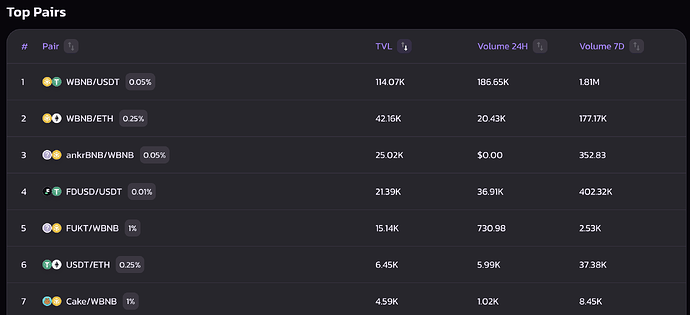

4. Grow TVL: opBNB is growing in momentum (thanks in part to a new TVL incentive campaign and growing incentives from PancakeSwap). It is only a matter of time until lend/borrow activity kicks off.

5. Strong roadmap at opBNB: opBNB has published its ambitions for the ecosystem in its community-driven wishlist. These product innovations will likely drive more activity on the chain and ultimately flow to a native Venus on opBNB.

IV. FUTURE ROADMAP FOR OPBNB

Based on current governance activity, the opBNB community is prioritising the following:

1. High Performance

a) 200M gas limit per block

b) Increased capacity from 100M/second to 200M/second to become the highest capacity of L2s. The high capacity of opBNB will allow it to support on-chain games and high frequency DeFi with TPS 10,000

2. Affordability - 10x Cheaper

a) Design the Data Availability layer of the opBNB on the BNB Smart Chain based on EIP4844 and BNB Greenfield in order to help reduce the transaction cost 10x times than current level

3. Security and Scalability

a) Embrace the Multiple Proof in OP Stack solution to provide a more flexible, secure proof for Optimistic Rollups

b) Multiple node types (Archive node / Full node / Fast node)

Other priorities for the Core Chain

- Bridging L2 Networks for Seamless Cross-Chain Activity 7

- opBNB Data Availability Layer on Greenfield 1

- Empowering opBNB with Advanced Analytics Support

- Accelerating opBNB Node Synchronization

- Long Term Archive Service Support

- Fair MEV Infrastructure Enhancement

opBNB dApp priorities

- ZK-based Data exchange

- opBNB On-chain Identity

- opBNB On-chain Games

- Decentralized Social Network

- Perp Dex

- Stablecoin Payments

IV. IMPLEMENTATION

Subject to community feedback, I propose:

- Conduct the necessary audits for opBNB to ensure security and reliability

- Collaborate closely with the opBNB development team to optimize integration and UX

- Launch a dedicated marketing campaign to strengthen brand equity and onboard more users

- Deepen wallet integrations for Venus on opBNB to drive user acquisition efforts

IV. CONCLUSION

opBNB is part of a wave of new L-2s lowering the barriers to access DeFi with more scalable / low-cost infra. Supporting opBNB is a strategic move that aligns with our commitment to bring community-driven finance to the world.

APPENDIX

opBNB docs: Getting Started | BNB Optimistic Rollup