Summary

This post provides an initial risk assessment and recommendation for deploying Venus on Unichain. Our analysis focuses on key technical aspects of Unichain that are relevant to Venus’s security, efficiency, and overall ecosystem viability.

Technical Overview

Unichain is an optimistic rollup designed to house DeFi applications by improving transaction efficiency and optimizing market execution. It leverages the OP Stack and introduces two key innovations: Verifiable Block Building and the Unichain Validation Network (UVN).

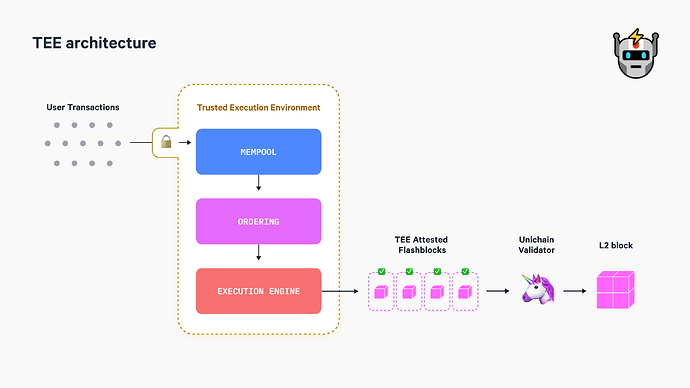

The Verifiable Block Building system, developed in collaboration with Flashbots, optimizes transaction processing by splitting blocks into four Flashblocks, achieving 200-250 millisecond effective block times. This system employs Sequencer-Builder Separation, where block building is handled independently by a Verifiable Block Builder operating within a Trusted Execution Environment (TEE). The TEE ensures transparent and verifiable transaction ordering by enforcing predefined rules in a secure, isolated execution environment. It provides cryptographic attestations, allowing external parties to verify that transactions are ordered according to protocol specifications, eliminating discretionary sequencing manipulation.

As transactions are streamed into the TEE builder, they are incrementally committed to Flashblocks, which serve as pre-confirmations before full block finalization. By introducing Flashblocks, Unichain bypasses the high fixed latency found in traditional rollup architectures, where serialization overhead and state root generation delays make sub-second block times infeasible. Instead of waiting for full block construction, transactions receive early confirmations, significantly reducing latency and improving execution speed.

Rollup Boost, Flashbots

The integration of Flashblocks improves liquidation efficiency and oracle responsiveness by providing liquidators an advantage over standard optimistic rollups, which have longer block finality times. While Flashblocks offer faster execution and finality, their reliance on Flashbots’ Rollup-Boost sequencing, still in early deployment, necessitates further validation under volatile conditions before adopting more aggressive liquidation thresholds.

The Unichain Validation Network (UVN) mitigates single-sequencer risks by introducing a decentralized network of validators that independently verify the blockchain state. Unlike traditional rollups, where a single sequencer controls block ordering and finality, UVN ensures additional verification by requiring validators to confirm proposed blocks. Node operators must stake UNI on Ethereum, with the highest stake-weighted participants becoming active validators responsible for attestations, block validation, and earning rewards.

Active validators must remain online and operate a Reth Unichain node to validate proposed blocks. Upon verification, they sign block hashes and publish them to the UVN Service smart contract, ensuring public attestations of block validity. The smart contract then cross-checks these attestations and distributes rewards based on stake-weighted contributions. Validators who fail to provide a valid attestation forfeit their compensation, which rolls over to the next epoch.

Bridge Infrastructure

Unichain is expected to support Wormhole and LayerZero as its primary bridging solutions shortly after launch. Thanks to the availability of these bridges, a significant number of assets already listed on Venus Ethereum instance are expected to go live on the chain shortly after launch. In this recommendation, we will only provide initial parameters for WETH and USDC, as these assets will be available at the time of launch.

Market & Ecosystem

As Unichain’s public mainnet is not yet live, we will use data from the Unichain Sepolia Testnet as a reference at this time.

Since November 2024, the number of new transactions on the Unichain Testnet has consistently remained above 500K per day. November 2024 recorded the strongest performance, with a peak reaching approximately 1.7M transactions. Since January 2025, daily new transactions have stabilized within the 500K to 1M range.

Unichain Testnet Daily New Transaction

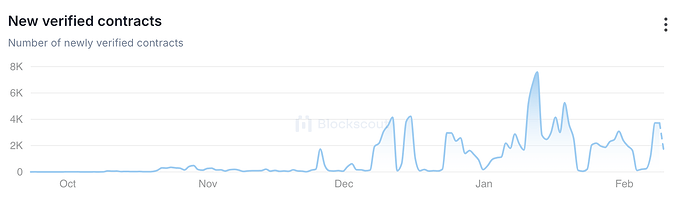

Moreover, the number of new verified contracts has maintained a steady upward trend. Since January 2025, daily verified contract counts have continued to rise, surpassing 7K on January 12, 2025. As of now, the total number of verified contracts on-chain stands around 145K.

Unichain Testnet Daily New Verified Contracts

Since Unichain’s public mainnet is not yet live, we are unable to provide an analysis of its ecosystem projects at this time.

Liquidity and DEXes

Currently, due to limited available information, we are unable to provide a data-driven analysis of Unichain’s DEXes and liquidity. However, two known mechanisms are directly relevant to future liquidity considerations.

First, Unichain is set to enhance DeFi by integrating multiple versions of Uniswap, particularly Uniswap v4, which introduces “hooks”—customizable smart contract functionalities. These hooks allow for the deployment of unused liquidity into lending markets like Venus, thereby improving capital efficiency. However, careful integration is required to ensure sufficient withdrawal liquidity remains available in the lending markets.

Second, Unichain’s intent-based architecture, aligned with ERC-7683, facilitates seamless cross-chain liquidity aggregation, enabling efficient arbitrage between DEX pools while minimizing slippage. In this model, users define a high-level objective, such as swapping tokens or providing liquidity, and solvers—decentralized entities responsible for execution—determine the most efficient way to fulfill the request across multiple chains. ERC-7683 standardizes the format for these intents, enabling interoperability between different protocols and networks.

Incentives

Unichain has allocated two grants totaling $900,000 to lending markets. Only two protocols are expected to receive support. Deploying Venus on the Unichain launch could provide an advantage by attracting grants and incentives.

Assets

We recommend beginning with WETH and USDC as the first listed assets on the Venus instance on Unichain. While additional assets will be provided in the future following their launch on the network, these assets are essential to bootstrap the instance and are expected to have the most robust liquidity.

Due to the limited available data on DEX liquidity, supply, and demand, we recommend initializing the market with the highly conservative parameters outlined below. Chaos Labs will actively monitor market dynamics post-launch and provide updated parameter recommendations as more data becomes available and the market matures.

Oracles

Unichain is expected to support Pyth Network and Redstone as its initial oracle providers. We recommend the use of Redstone oracle feeds for the initial assets listed.

To mitigate manipulation risks, Venus may benefit from adopting pivot and fallback oracles.

Specifications

| Parameter |

Value |

Value |

| Asset |

WETH |

USDC |

| Chain |

Unichain |

Unichain |

| Pool |

Core |

Core |

| Collateral Factor |

70.00% |

70.00% |

| Liquidation Threshold |

75.00% |

75.00% |

| Liquidation Penalty |

10.00% |

10.00% |

| Supply Cap |

350 |

1,000,000 |

| Borrow Cap |

300 |

850,000 |

| Kink |

80.00% |

80.00% |

| Base |

0.0 |

0.0 |

| Multiplier |

0.03 |

0.125 |

| Jump Multiplier |

3.0 |

3.0 |

| Reserve Factor |

10% |

10% |