Overview

Chaos Labs supports the proposal to deploy Venus on Berachain. This analysis outlines the initial listing of WETH, WBTC, USDC.e, and Honey in the new deployment and provides an overview of the Berachain ecosystem.

Technical Overview

Berachain is an EVM identical Layer 1 blockchain built on BeaconKit, a modular consensus framework that integrates CometBFT, a Byzantine Fault Tolerant consensus engine derived from Tendermint, offering deterministic block production and fast finality. It supports unmodified Ethereum execution clients such as Geth, Reth, Erigon, and Nethermind, ensuring full compatibility with Ethereum tooling and RPC namespaces. Berachain implements single-slot finality (a property where a block is considered finalized immediately after being proposed, without requiring multiple confirmations), along with optimistic payload building, allowing for reduced block times and streamlined execution.

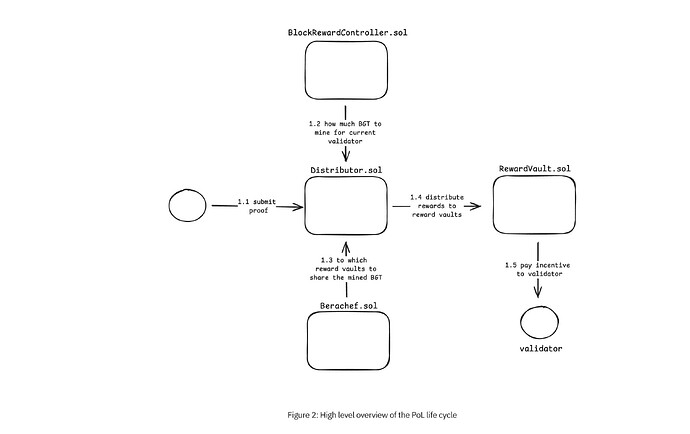

Berachain implements a novel consensus mechanism called Proof-of-Liquidity (PoL), which operates through a dual-token model comprising BERA, the gas and staking token, and BGT, a non-transferable governance and rewards token. Validators stake BERA to participate in block production, and upon proposing a block, receive emissions in BGT. The volume of BGT emitted is determined by the validator’s boost—defined as the share of total BGT delegated to them by users. These BGT emissions must be directed to governance-approved reward vaults linked to applications. In exchange, applications provide ERC-20 incentives to validators at specified exchange rates. Validators receive these incentives directly and may retain a portion as commission, with the rest distributed to their BGT boosters off-chain.

Proof-of-liquidity Lifecycle

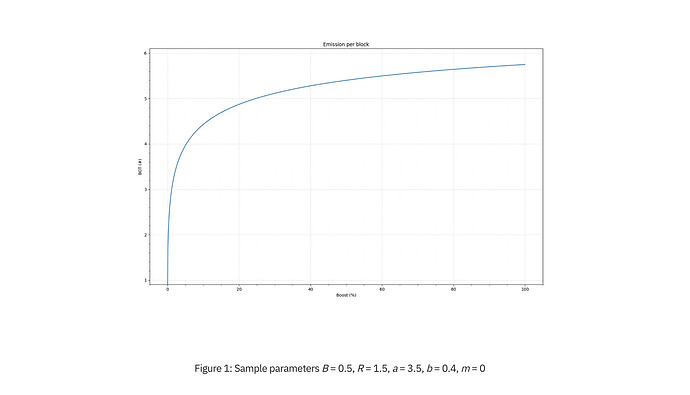

To mitigate boost concentration, Berachain applies a concave scaling function to BGT emissions. As a validator’s boost increases, each additional unit of boost results in a smaller incremental gain in emissions. This diminishing return reduces the incentive to centralize boost among a few large validators and promotes a more distributed delegation landscape.

BGT Emission Scaling

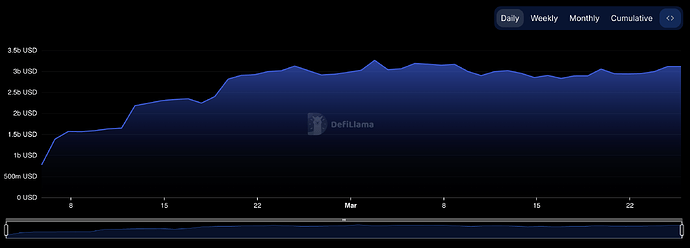

Ecosystem and Market

Berachain has demonstrated consistent TVL growth, surpassing $2B in early February 2025 and reaching $3B by the end of the month. It has since maintained this level. As of the time of writing, the total value locked on Berachain stands at $3.116B.

Berachain TVL Over Time

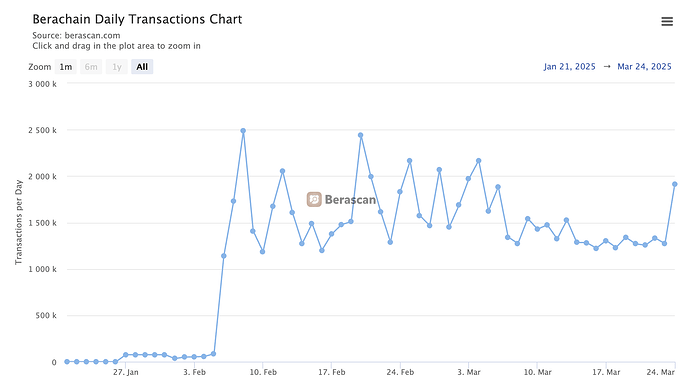

Berachain has also seen a significant increase in daily transaction volume since February 2025. Starting in early February, daily transactions consistently exceeded 1M and peaked at 2.5M transactions in a single day.

Berachain Daily Transactions Chart

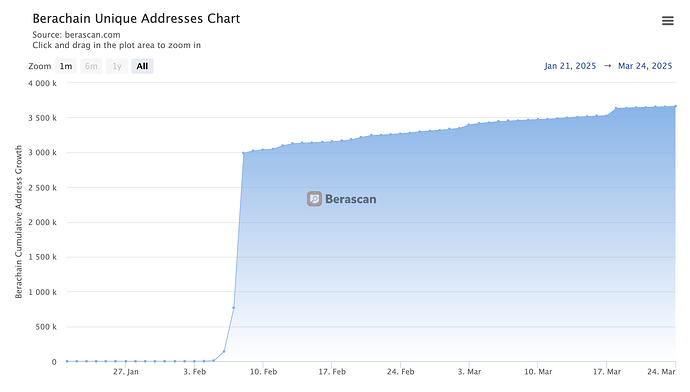

The number of unique addresses on Berachain has also shown consistent growth. Since February 8, 2025, the count has steadily increased, with an average of approximately 10K new addresses added per day. As of the time of writing, the total number of unique addresses stands at 3.66M.

Berachain Unique Address Chart

The Berachain ecosystem has also seen the emergence of many notable projects. In addition to the leading DEXs discussed below, several other protocols on Berachain also exhibit significant TVL. Infrared Finance, with $2.39B in TVL, is a liquid staking protocol that enables users to stake BERA and BGT to mint iBERA and iBGT. These liquid staking tokens are integrated into Berachain’s PoL system and can be further utilized to earn rewards through Infrared-managed vaults and reward participation. Dolomite, holding $649M in TVL, is a lending platform that features isolated margin accounts within a single wallet, supporting collateralization with up to 30 different assets per position.

DEXes

DEX liquidity is critical for the deployment of Venus, as sufficient liquidity ensures efficient liquidations and accurate oracle pricing. Currently, the largest DEX on Berachain is BEX and Kodiak.

- BEX:

- TVL: $1.271B

- 7-Day Cumulative Volume: $242.34M

- Kodiak:

- TVL: $1.15B

- 7-Day Cumulative Volume: $75M

Token

For the initial deployment on Berachain, we recommend a conservative set of assets that have already undergone analysis on other networks. This approach establishes a secure foundation for the new instance, with future listings to be proposed and assessed through standard risk evaluation processes.

Additionally, we recommend including Honey in initial deployment, as it is the native stablecoin of Berachain and holds a central role within the ecosystem. Below, we present a technical analysis of Honey to inform its parameterization.

| Asset |

Supply on Berachain |

Market Cap on Berachain |

24H DEX Volume on Berachain |

Sell Liquidity |

Berascan |

| WBTC |

4,203 |

$364.64M |

$7.62M |

$6.95M |

URL |

| USDC.e |

1,021,347,626 |

$1.02B |

$10.71M |

$10.0M |

URL |

| WETH |

195,492 |

$393.46M |

$8.04M |

$8.10M |

URL |

| Honey |

744,309,079 |

$744.31M |

$30.22M |

$90.01M |

URL |

WBTC, USDC.e, and WETH are all bridged via Berachain’s official bridge, which is built on the LayerZero protocol. The bridge currently supports all tokens included in Uniswap’s token list.

Honey

Technical Overview

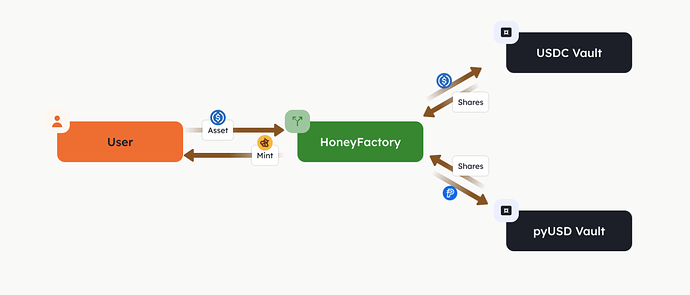

Honey is the native stablecoin of the Berachain ecosystem. It is fully collateralized and maintains a soft peg to the US Dollar. Users can mint Honey by depositing approved collateral into a vault and minting Honey against it. Each vault is specific to a particular collateral type, with its own unique mint and redemption rate. The minting rates are configurable per collateral type through BGT governance.

$HONEY Architecture

The HoneyFactory contract serves as the central component of the Honey stablecoin system, coordinating interactions across all Honey Vaults and handling the minting of new Honey tokens. When users deposit collateral, the HoneyFactory routes these deposits to the appropriate vault and holds the vault shares representing the user’s position. In return, it mints the corresponding amount of Honey tokens to the user.

User can directly stake and get Honey through the SwapHoney UI. Currently, only USDC and BYUSD (pyUSD) will be supported as collateral. Additional collateral assets may be introduced through future governance proposals. Withdrawals of Honey are executed through the HoneyFactory contract. When a user initiates a redemption, the factory first verifies system state, then burns the user’s Honey and calculates the corresponding amount of vault shares based on predefined redemption rates. These shares are then redeemed from the appropriate ERC4626 vaults, and the underlying collateral assets are transferred to the user. The entire process occurs atomically within a single transaction.

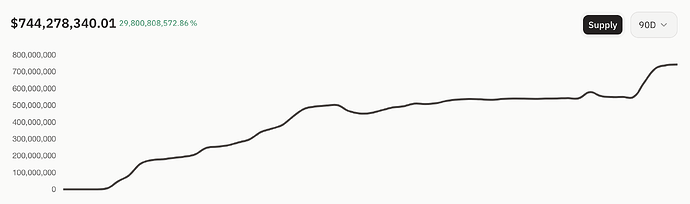

Market and liquidity

Honey’s total supply has demonstrated consistent and steady growth since inception. As of the time of writing, the total supply stands at 744.31M, translating to a market cap of $744M.

Honey Supply Over Time

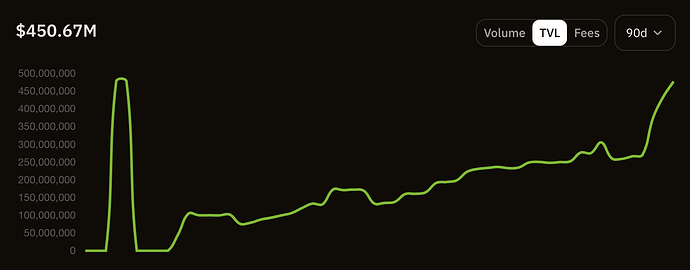

The majority of Honey’s liquidity is concentrated in the BYUSD/Honey pool on BEX, with a total TVL of $505.83M, and the USDC.e/Honey pool on BEX, with a total TVL of $450.67M. Below, we present the USDC.e/Honey liquidity Pool’s TVL over time.

USDC.e/Honey Liquidity Pool TVL Over Time

Volatility

Honey has exhibited minimal volatility relative to its peg, maintaining strong price stability in both the BYUSD/Honey and USDC.e/Honey pools. In both pools, the maximum observed deviation from the $1 peg has remained within just 40bps. Below, we present the volatility of Honey in the USDC.e/Honey pool on Kodiak V3.

Honey Volatility in USDC.e/Honey DEX Pool

Recommendations

Based on the above analysis, Honey is experiencing a steady growth trajectory, with both total TVL and liquidity increasing consistently, providing sufficient support for its proposed listing on Venus. In addition, its price volatility remains minimal and stable.

For these reasons, we recommend aligning Honey’s IR curve and basic configurations with those of USDC.e. However, given that Honey is a newly introduced stablecoin with a relatively short operational history and its dependence on a novel redemption mechanism via the HoneyFactory and vault infrastructure, we recommend setting a slightly more conservative CF and LT to account for potential systemic or liquidity risks.

Oracle

Redstone has integrated its data feeds on Berachain, offering a reliable and secure pricing oracle for Venus. All assets proposed for listing are currently supported by Redstone.

Listing Parameters

Supply and Borrow Cap

Consistent with Chaos Labs’ methodology for initial parameter settings, we recommend setting supply caps at twice the liquidity available under the Liquidation Bonus. However, to account for the novelty and added complexity of the Honey stablecoin, we recommend initially setting them at only 1x of the liquidity available. For borrow caps, we suggest setting them slightly above each asset’s kink level to allow flexibility in the event of increased borrowing demand.

Specification

| Parameter |

WETH |

USDC.e |

WBTC |

Honey |

| Enable Borrow |

Yes |

Yes |

Yes |

Yes |

| Enable Collateral |

Yes |

Yes |

Yes |

Yes |

| Collateral Factor |

70% |

70% |

70% |

68% |

| Liquidation Threshold |

75% |

75% |

75% |

73% |

| Liquidation Bonus |

10% |

10% |

10% |

10% |

| Reserve Factor |

15% |

10% |

15% |

10% |

| Supply Cap |

6,000 |

20,000,000 |

160 |

90,000,000 |

| Borrow Cap |

5,000 |

16,000,000 |

80 |

80,000,000 |

| Kink |

80% |

80% |

45% |

80% |

| Base |

0.0 |

0.0 |

0.0 |

0.0 |

| Multiplier |

0.03 |

0.125 |

0.03 |

0.125 |

| JumpMultiplier |

3.0 |

2.5 |

3.0 |

2.5 |

Disclaimer

Chaos Labs has not been compensated by any third party for publishing this recommendation.

Copyright

Copyright and related rights waived via CC0