Overview

Chaos Labs supports the proposal to deploy Venus on Base. The following analysis focuses on the initial listings of WETH, AERO, cbBTC, cbETH, USDC, wstETH, ezETH, and weETH.base in the new deployment, as well as an analysis of the Base ecosystem.

Technical Architecture

Base is an Ethereum Layer 2 blockchain developed by Coinbase and launched in 2023. It utilizes Optimism’s OP Stack to enhance scalability and reduce transaction costs. As an Optimistic Rollup, Base processes transactions off-chain and submits them to Ethereum for final validation, thereby increasing throughput and decreasing fees.

Base is EVM-compatible, enabling developers to deploy Ethereum smart contracts without changes, ensuring seamless integration. It inherits Ethereum’s security by using it as a settlement layer, ensuring transactions are validated and protected by Ethereum’s decentralized network.

However, as with other Optimistic Rollups, Base introduces a challenge: the potential delay in transaction finality due to the fraud-proof window inherent in Optimistic Rollup designs. To maintain security, Optimistic Rollups implement a challenge period (up to seven days) during which fraudulent transactions can be contested. This delay ensures security but affects transaction finality, particularly for withdrawals to Ethereum. Currently, the top protocols on Base include Aerodrome, Morpho Blue, Aave V3, and Moonwell.

Ecosystem and Market

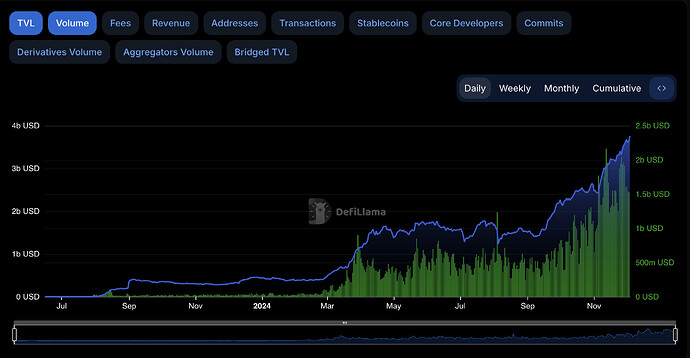

Base has experienced significant growth in TVL since its launch in July 2023. Within three months of its launch, Base’s TVL grew to over $300 million USD. It then reached $1 billion for the first time in late March 2024. Throughout its growth trajectory, there have been no significant declines; instead, it has shown consistent, steady growth, demonstrating the stable progress of the Base ecosystem. As of December 2024, Base’s TVL has reached $3.6 billion USD, establishing it as one of the leading Layer 2 solutions.

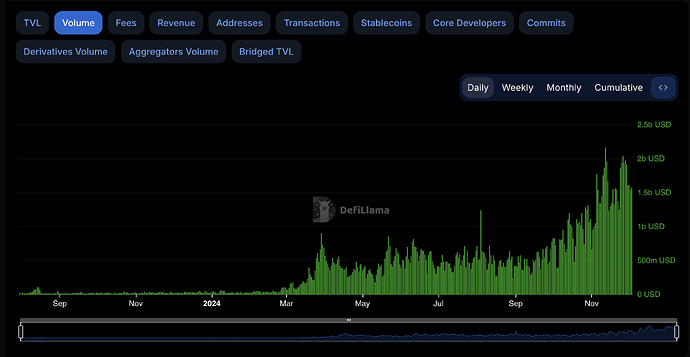

The volume and transactions have shown a steady growth trend over the past six months. In the past two weeks, some noticeable peaks in transactions were observed, largely driven by the surge in memecoins transactions.

DEXs

The presence of numerous DEXs with consistent liquidity is a key requirement to ensure efficient liquidation in a new Venus deployment. In the case of Base, multiple DEXs maintain sufficient liquidity to allow for the creation of the instance. The most relevant ones are:

- Aerodrome

- TVL: $1.604B

- 7-day Cumulative Volume: $7.054B

- Uniswap

- TVL: $441.76M

- 7-day Cumulative Volume: $4.045B

- Alien Base

- TVL: $76.75M

- 7-day Cumulative Volume: $137.69M

- Sushi

- TVL: $33.23M

- 7-day Cumulative Volume: $89.74M

Tokens

As initial assets on Base, we recommend a strict list of assets that have previously been analyzed on other chains, with the addition of AERO given its important role in the Base ecosystem; Chaos Labs has previously evaluated this asset for listing on other protocols and deemed it acceptable. These listings are intended to provide a starting ground for the new deployment, with additions to be proposed and analyzed in the future.

Chaos Labs analyzed the following assets, examining each asset’s liquidity paired with the asset with which it is most likely to be used on Venus’ Base deployment:

| Asset |

Supply on Base |

Market Cap on Base |

7 Day Cumulative # of Transactions |

Liquidity |

Basescan |

| WETH |

210,146 |

$815M |

18.32M |

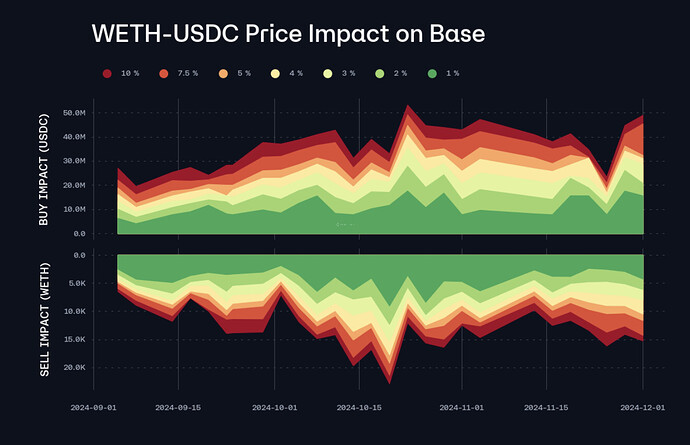

$108M (with USDC) |

URL |

| USDC |

3,233,185,647 |

$3.23B |

6.19M |

$108M (with WETH) |

URL |

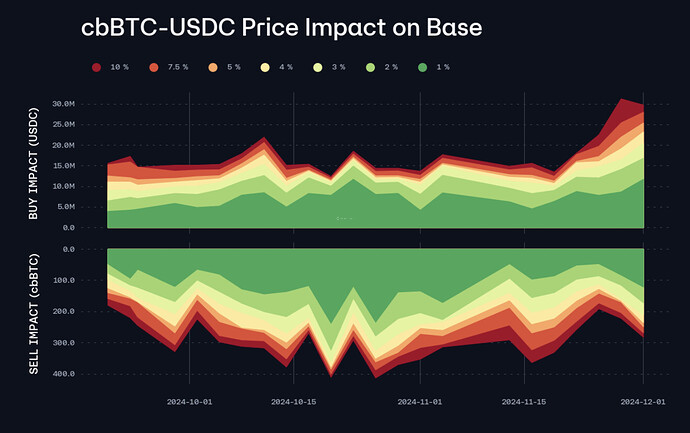

| cbBTC |

4,054 |

$400M |

1.19M |

$53M (with USDC) |

URL |

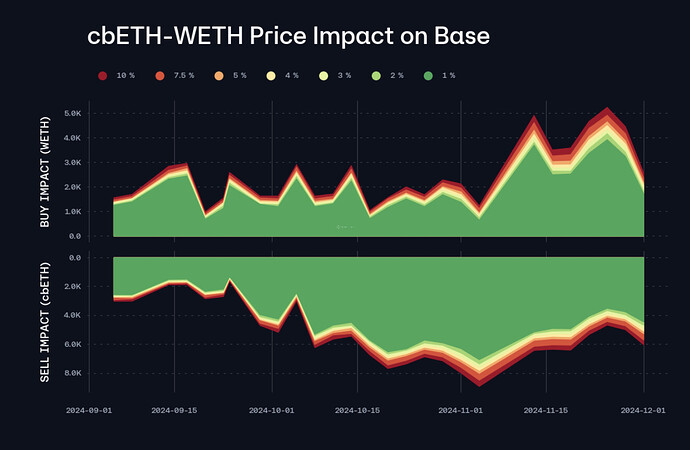

| cbETH |

41,427 |

$174M |

179.18K |

$62M (with WETH) |

URL |

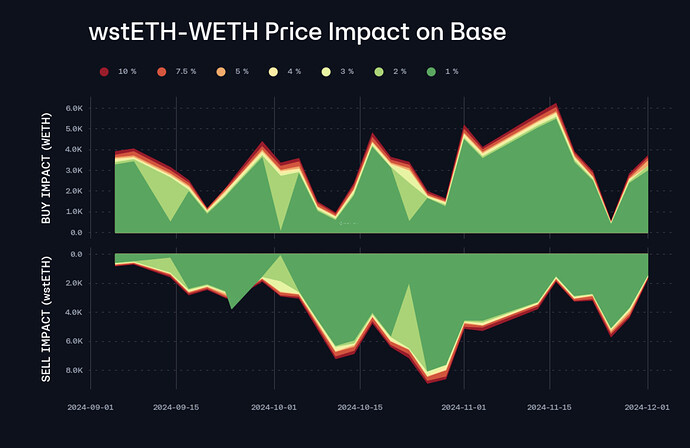

| wstETH |

44,377 |

$204M |

59.19K |

$24M (with WETH) |

URL |

| ezETH |

3,590 |

$14.4M |

13.84K |

$4.5M (with WETH) |

URL |

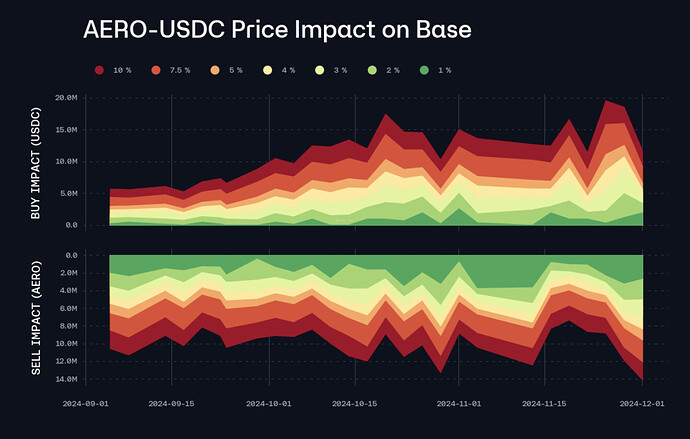

| AERO |

1,386,783,691 |

$2.6B |

1.72M |

$114M (with USDC) |

URL |

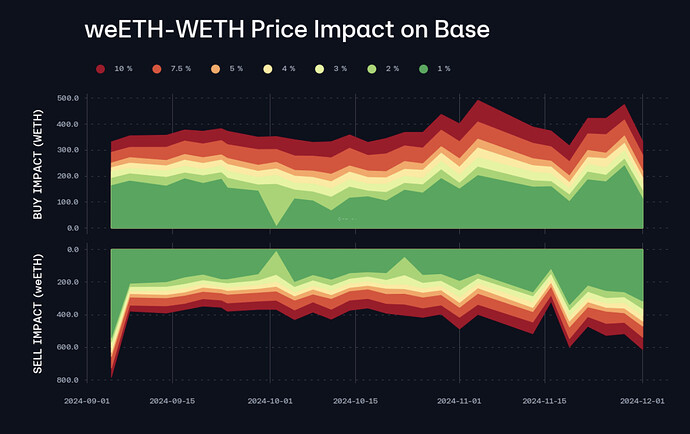

| weETH.base |

49,288 |

$202M |

19.71K |

$27M (with WETH) |

URL |

| WBTC |

0.167 |

$16,462 |

28 |

N/A |

URL |

Given WBTC’s low on-chain supply and redundancy with cbBTC, we do not recommend listing the asset at this time. While there are bridged versions with more liquidity, we do not recommend using these because of cbBTC redundancy as well as elevated risks associated with bridged tokens.

Oracles

Chainlink has integrated its Data Feeds on Base, providing Venus access to reliable data sources. All the proposed asset listings are supported by Chainlink Feed.

For ETH-correlated assets, we recommend using the ETH/USD Chainlink oracle, augmented with Chainlink’s exchange rate feeds, to ensure precise pricing in ETH-correlated pools and support efficient looping.

Listing Parameters

Supply and Borrow Caps

In line with Chaos Labs’ approach to setting initial supply caps, we recommend supply caps set to 2x the liquidity available under the Liquidation Incentive’s price impact. We also recommend setting the borrow caps slightly over the Kink of each asset to allow for a borrow rate increase to follow a surge in demand for both WETH and AERO. For LSTs/LRTs, we recommend setting their borrow caps to 10% of the supply cap. For USDC, we recommend setting the borrow cap at 90% of the supply cap. For WETH in the isolated pool, we set the caps according to the borrowing power of other assets.

The recommended caps are as follows:

-

WETH (Core)

Supply Cap: 10,000 WETH

Borrow Cap: 9,000 WETH

-

WETH (Isolated Pool)

Supply Cap: 9,200 WETH

Borrow Cap: 8,300 WETH

-

cbBTC

Supply Cap: 400 cbBTC

Borrow Cap: 200 cbBTC

-

cbETH

Supply Cap: 5,000 cbETH

Borrow Cap: 500 cbETH

-

wstETH

Supply Cap: 3,000 wstETH

Borrow Cap: 300 wstETH

-

ezETH

Supply Cap: 800 ezETH

Borrow Cap: 80 ezETH

-

AERO

Supply Cap: 12,000,000 AERO

Borrow Cap: 6,000,000 AERO

-

USDC

Supply Cap: 30,000,000 USDC

Borrow Cap: 27,000,000 USDC

Isolated Pool

Given the anticipated use cases, we recommend listing cbETH, wstETH, ezETH, and weETH.base in an isolated pool with WETH as a borrow-only asset to avoid WETH-WETH looping. The parameters will be optimized to make LST and LRT leverage as efficient as possible.

Specification

Following the above analysis, we recommend the following initial parameters for the creation of the Base deployment.

|

WETH |

USDC |

cbBTC |

AERO |

| Enable Borrow |

Yes |

Yes |

Yes |

Yes |

| Enable Collateral |

Yes |

Yes |

Yes |

Yes |

| Collateral Factor |

80% |

75% |

73% |

40% |

| Liquidation Threshold |

83% |

78% |

78% |

45% |

| Liquidation Incentive |

10% |

10% |

10% |

10% |

| Reserve Factor |

15% |

10% |

20% |

25% |

| Supply Cap |

10,000 |

30,000,000 |

400 |

12,000,000 |

| Borrow Cap |

9,000 |

27,000,000 |

200 |

6,000,000 |

| Kink |

90% |

80% |

45% |

45% |

| Base |

0.0 |

0.0 |

0.0 |

0.0 |

| Multiplier |

0.03 |

0.08 |

0.15 |

0.2 |

| JumpMultiplier |

4.5 |

2.5 |

2.5 |

3.0 |

ETH-Correlated Isolated Pool

| Parameter |

Value |

Value |

Value |

Value |

Value |

| Asset |

WETH |

cbETH |

wstETH |

weETH.base |

ezETH |

| Collateral |

No |

Yes |

Yes |

Yes |

Yes |

| Borrowable |

Yes |

Yes |

Yes |

Yes |

Yes |

| Supply Cap |

9,200 |

5,000 |

3,000 |

400 |

800 |

| Borrow Cap |

8,300 |

500 |

300 |

40 |

80 |

| Collateral Factor |

- |

90% |

90% |

90% |

90% |

| Liquidation Threshold |

- |

93% |

93% |

93% |

93% |

| Liquidation Incentive |

- |

2.0% |

2.0% |

2.0% |

2.0% |

| Kink |

90% |

45% |

45% |

45% |

45% |

| Base |

0.0 |

0.0 |

0.0 |

0.0 |

0.0 |

| Multiplier |

0.03 |

0.09 |

0.09 |

0.09 |

0.09 |

| JumpMultiplier |

4.5 |

0.75 |

0.75 |

0.75 |

0.75 |

Additional Parameters

- Close Factor: 50%

- minLiquidatableCollateral: 100 USD

XVS Bridge Parameters:

Base bridge to/from Ethereum, BNB, Arbitrum, Optimism, ZkSync, and opBNB.

- Daily limit: $100,000

- Single transaction: $20,000

- Mintable XVS on Base: 500,000 XVS

Disclaimer

Chaos Labs has not been compensated by any third party for publishing this recommendation.

Copyright

Copyright and related rights waived via CC0