Credix Finance Monthly Update - May 2023

Initial Disclosures:

- The material herein is proprietary, for informational purposes only, and subject to change.

- All content in this document and all associated discussions are non-binding on any involved party.

- Please review all information carefully.

The information provided herein is for the sole purpose of establishing a potential business relationship between the parties and specifically for providing a preliminary non-binding proposal to Venus, and is subject to adjustment, change, and discussion. This overview may include or be based in part on projections, valuations, estimates and other financial data supplied by third parties, which has not been verified by Credix. This information should not be relied upon for the purpose of investing. Any information regarding projected or estimated returns are estimates only and should not be considered indicative of the actual results that may be realized or predictive of the performance of any investment. Past performance is not indicative of future results. The structure of the deal is in its developmental stage and - as such - is merely contemplated and subject to adjustment. Credix may at any moment withdraw all or part of the Proposal. All financial modeling is subject to assumption and error, and Credix reserves the right to modify, alter, and correct. Use or application of any model implies acceptance of the risk(s) of error, and waives liability for the model’s creator. The creator of the model is not responsible for the correctness or accuracy of the model. Rates are subject to change. Further, conflicts of interest may exist by and among the Parties, including that members of each entity may hold or acquire beneficial interests in each of the other Parties, their affiliates, and/or related entities. All investments carry risk, including the risk of loss of entire investment. Under no circumstances does Credix provide investment advice, tax advice, legal advice, or financial advice. This is not an offer to sell or a solicitation of an offer to buy securities.

Introduction & Background

We would like to share monthly performance updates on our Liquidity Pool, as Credix excitedly awaits beginning the risk assessment phase with @Steakhouse to implement our proposal to collateralize VAI with $20M of Real World Assets.

For a TL;DR background, Credix proposed establishing a partnership whereby Venus will deploy $20 million in the Credix Liquidity Pool, a basket of senior-secured structured debt facilities issued to FinTech lenders in key Latin American markets with a targeted 12.0% APY. The proposal was posted on March 28th with Steakhouse approved to begin a risk assessment via Snapshot on April 25th. In this interim time as Steakhouse and Venus finalize other initiatives before pivoting to Credix, we will endeavor to keep the Community informed of our key updates.

Credix May Update

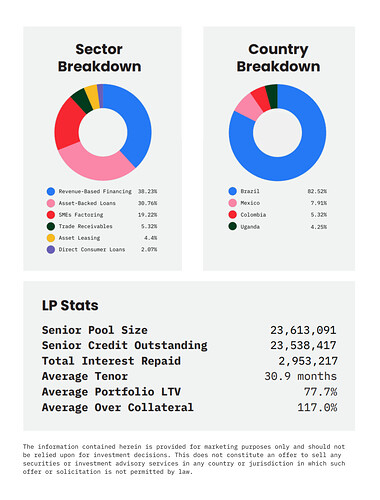

Looking back on the month of May, our Liquidity Pool posted a 12.5% APY for month and a 13.4% APY for the trailing 90 days. The pool continued its pristine track record with 0 delinquencies. The Liquidity Pool ended May with 18 active deals having an average 117% over-collateral ratio across the pool.

Below are some of the many recent highlights and for more exclusive updates, please sign up here!

We’re excited to share Credmei launched its first deal with Addem Capital as an underwriter on the Credix platform!

The deal is a 24-month revolving facility with an 80% Senior Tranche by the Credix Liquidity Pool and a 20% Junior Tranche underwritten by Addem Capital. The originator provided first-loss capital as over-collateral.

You can learn more about this deal on our Medium (here), where we took a closer look at Credmei, their diligence process resulting in an impressive track record, and their first deal with Addem Capital.

Chaim Finizola, Chief Growth Officer at Credix, was invited to join esteemed experts in the field during the Brazilian Central Bank’s first public webinar on tokenization. Alongside Fábio Araujo, economist and coordinator of the Real Digital project, Bruno Batavia, and Henrique Videira, they delved into various topics including global liquidity, regulatory changes, tokenized fixed income, and the developments of the Brazilian CBDC, the Real Digital.

Curious to learn more? Check out the recording of the webinar here (toggle on translation).

Last Friday, Credix participated in Valor Capital Group’s highly anticipated yearly crypto event in São Paulo, which was marked by the presence of Roberto Campos and João Pedro Nascimento, president of the Brazilian Central Bank and the CVM. Other speakers included the chairman of Itaú and Credix investor Ricardo Marino, and our colleagues at Coinbase, Chainalysis Inc., and Bitso.

In Valor Econômico’s article, Thomas Bohner highlighted the company’s leading role in the tokenization of assets in Latin America (article in Portuguese here).

Below is a snapshot of our Liquidity Pool metrics at the end of May. Sign up here for access to the full Liquidity Pool Performance Report to get the latest stats in your inbox!

Credix and Circle have proven to be great partners when it comes to transforming global debt capital markets, expanding access to capital in developing economies, and unlocking new investment opportunities.

Through innovative solutions, leveraging cutting-edge blockchain technology, and the USDC stablecoin, we enhance transparency, efficiency, and speed in investments. Dive deeper into our collaboration and learn about our shared vision for a more inclusive global financial system in Circle’s latest blog post here!

Feature release! Until recently, we were only able to bring new credit facilities on-chain. We got the feedback that funds would be keen to bring their existing facilities on-chain because of operational efficiencies and distribution options it creates. And that’s exactly what this release is all about. With the latest platform upgrade, funds can now tokenize their existing credit deals, increasing the scalability of their business and tapping into a wider pool of potential investors.

To know more about our latest product release, head over to our blog post here.

Concluding Thoughts

As we conclude this update, we celebrate the progress made in the past month and look forward to the next exciting steps. We’re eager to commence the risk assessment phase with @Steakhouse, a crucial step towards implementing our proposal to collateralize VAI with $20M of Real World Assets. With a solid record in our Liquidity Pool and the innovative features added to our platform, we remain dedicated to transforming global debt capital markets and unlocking more inclusive financial opportunities together.