Core Pool BNB IR Curve Update

Summary

Investigating possible improvements to the Interest Rate curve formula to better align with the observed behavior in the Venus BNB core pool, influenced by events on Binance launchpads. The goal is to promote higher utilization by introducing a fixed, elevated borrow APY beyond a specified max utilization threshold, aiming to stimulate more demand and consequently enhance reserve factor revenue.

Increasing the utilization comes with two significant risks:

- Bad debt as a result of insufficient liquidity to perform liquidation

- The inability of suppliers to withdraw BNB

Ultimately, the decision to take these risks in order to increase revenues lies with the DAO. If the DAO chooses to increase utilization, we recommend retaining the current formula but with adjusted parameters that encourage heightened utilization during these spikes alongside an adequate buffer for liquidation events, thereby leading to improved protocol revenues. Reducing available liquidity during spikes may occur, but the historical distribution of suppliers and the percentage of total supplied BNB utilized as collateral suggest it’s unlikely to be a significant concern.

Motivation

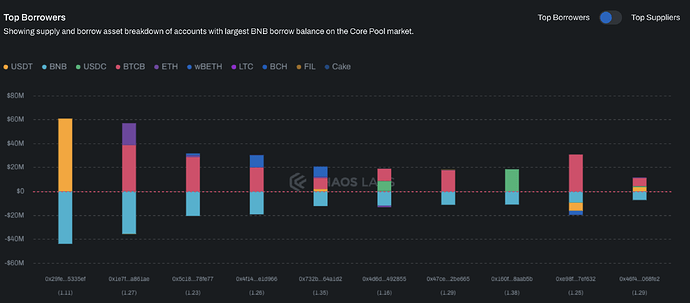

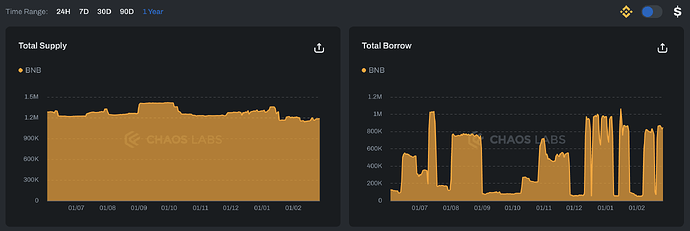

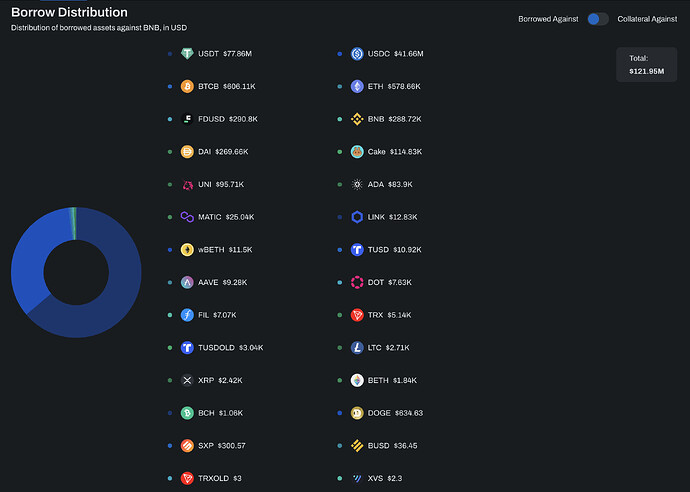

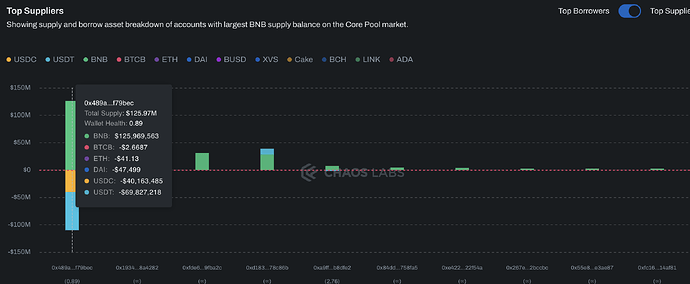

The consistent stability of the BNB supply contrasts with the variable borrow volumes, highlighting a prevalent pattern. It appears that BNB suppliers tend to refrain from withdrawing from the pool while simultaneously taking on minimal debt and do not engage in launch pool activities when feasible. In contrast, other users actively borrow BNB using external collateral assets like BTC and USDT.

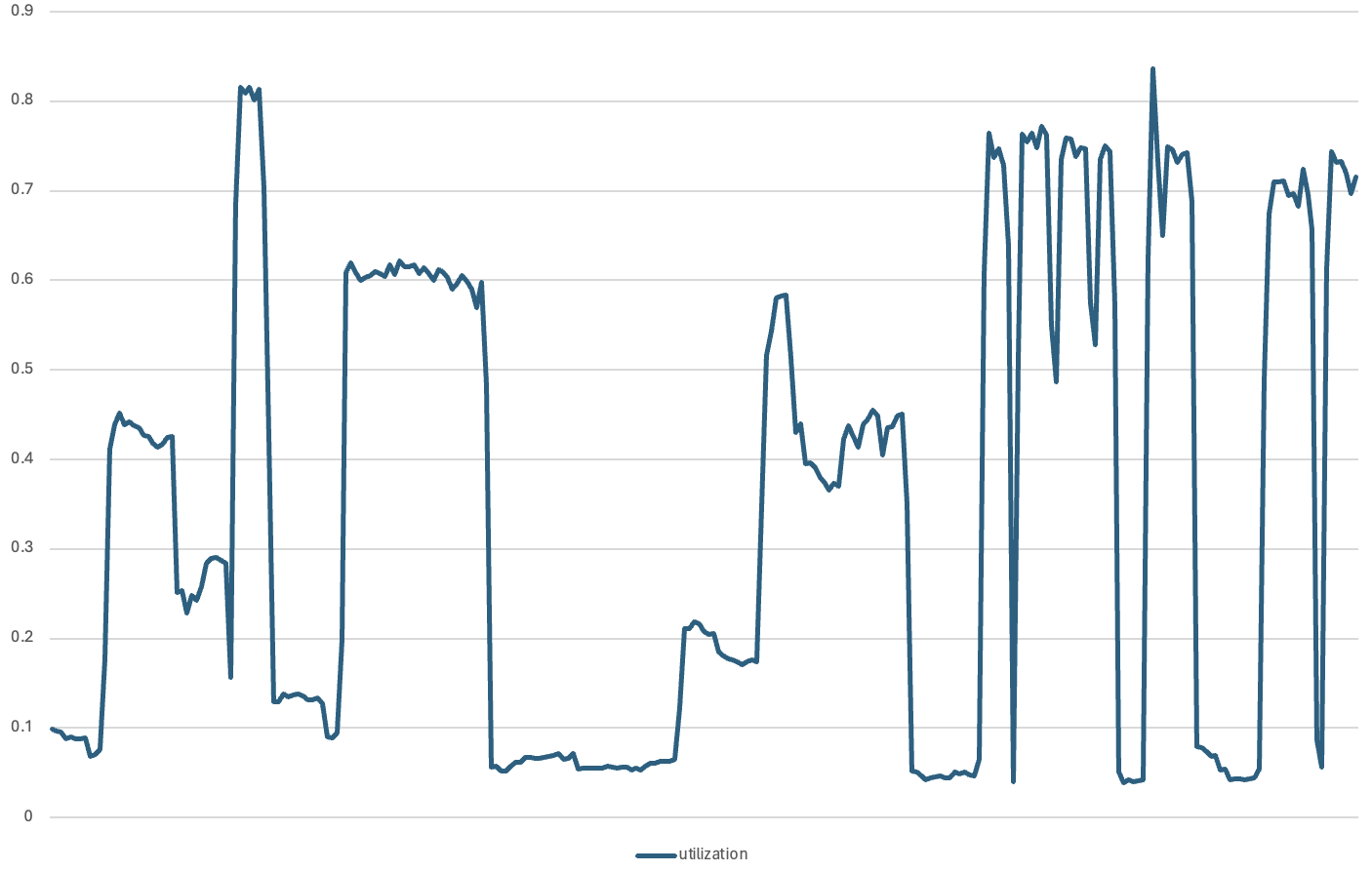

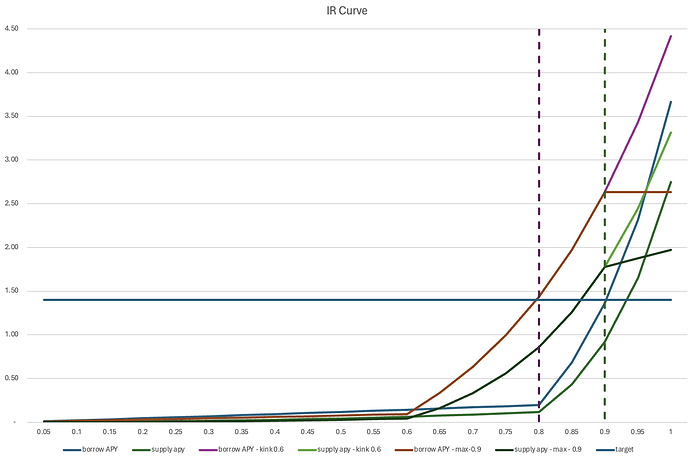

Upon analyzing utilization rates during impactful events like the introduction of launchpads/pools, we observed a peak threshold of around 80%. Building upon this, we define the target APY as the rate presently achieved under 80% utilization (approximately 140% borrow APY).

Adjustments:

Below, we portray three distinct scenarios:

- The existing IR curve formula.

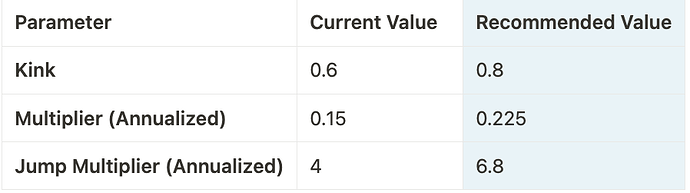

- Adjust the existing IR formula with an augmented kink, along with adjustments to the multiplier and jump multipliers. Formally, the Kink increased from 0.6 to 0.8, the Multiplier increased from 0.15 to 0.225, and the Jump Multiplier increased from 4 to 6.8.

- Adjust the current IR curve formula with an incorporated cap on borrow APY at a predefined max utilization threshold.

- Current IR curve - (borrow/supply APY at 0.6 kink - in legend)

- Adjusted parameters with the current formula (borrow/supply APY - in legend). This results in an adjustment whereby the target APY is expected to be reached at 90% utilization.

- Current parameters with cap (borrow/supply APY - max - 0.9 - in legend)

- target (horizontal line) - target APY

Our recommendation favors the second option – adjusting parameters in the existing formula. This approach aims to attract increased utilization by offering equivalent expected borrowing rates at higher utilization levels while preserving an ample buffer for potential liquidations through further rate increases. This strategic adjustment is expected to generate increased revenues for the protocol, marking a 7% increase at the target APY.

Conversely, setting a cap for borrowing APY at the empirically defined expected target rate (140% APY) at some 90% utilization rate may encourage utilization above this threshold, thereby leading to an inadequate buffer for theoretical liquidation events.

It’s worth noting that only 25% of all supplied BNB is utilized as collateral, with the exploiter accounting for 90% of this value ($110M out of $122M). Consequently, as of today, only 2.5% of all supplied BNB can theoretically become eligible for liquidation.

##Recommendations