Overview

Given the current structure and risk profile of solvBTC, Chaos Labs supports adopting a BTC/USD price oracle rather than relying on the secondary market price feed for solvBTC on Venus.

Technical Analysis

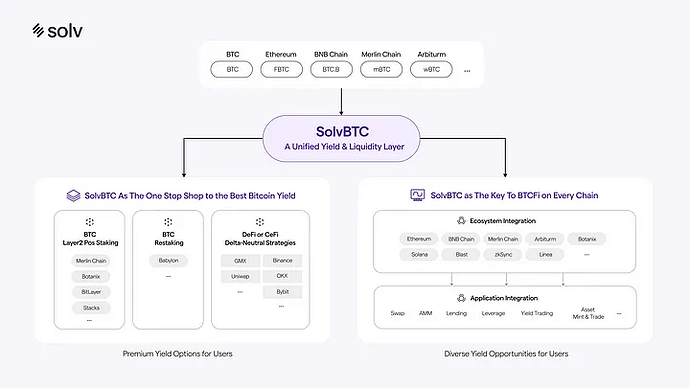

Solv Protocol leverages tokenization to bring Bitcoin onto EVM-compatible chains. Users can deposit either native BTC or supported wrapped BTC tokens (such as WBTC, BTCB, BTC.b, etc.). Based on user preference, Solv issues either solvBTC or BTC-based liquid staking tokens (solvBTC.LSTs) like solvBTC.BBN, solvBTC.BERA, and solvBTC.JUP.

Its primary value proposition is to unify the fragmented liquidity of these various BTC representations across multiple blockchains—enabling seamless interoperability and more efficient use of Bitcoin within the DeFi ecosystem.

solvBTC is a non-yield-bearing token that is not staked in any DeFi protocol—meaning it is free from DeFi smart contract risks or potential slashing events.

In contrast, the LST variants (solvBTC.LSTs) represent BTC that is actively staked in DeFi protocols on their respective chains. These tokens generate yield for holders but also carry additional risk due to exposure to underlying DeFi protocols.

Technical Architecture

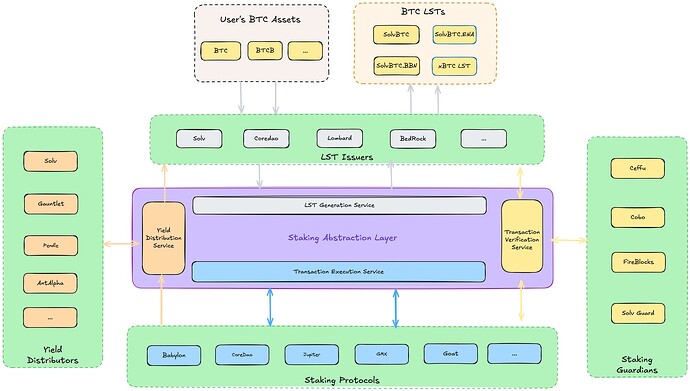

Issuing BTC-based wrappers (solvBTC) and BTC LSTs (solvBTC.LSTs) is inherently complex due to the lack of a native smart contract layer on the Bitcoin network. While these tokenized versions of BTC are deployed on EVM chains, the underlying transactions and value typically reside on the Bitcoin network. To streamline this process, Solv Protocol has introduced the Staking Abstraction Layer (SAL), a core infrastructure component that abstracts away these complexities and simplifies integration across chains.

Mint

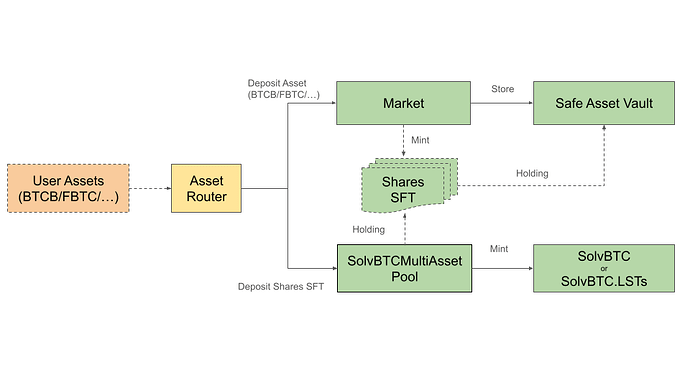

When users want to mint SolvBTC, they can do so using native BTC and a range of wrapped BTC assets, including WBTC, cbBTC, FBTC, tBTC, BTCB, BTC.b, M-BTC, and RBTC, across 11 different networks. Minting solvBTC with native BTC is only supported on BNB Chain, meaning the minted solvBTC will initially be received on BNB Chain. However, it can be bridged to other chains via Chainlink’s CCIP.

To mint solvBTC on EVM based chains, the user calls the createSubscription() function in the SolvBTCRouter contract. Within this function, the OpenFundMarket.subscribe() function is invoked, which calculates how much value the user will receive based on the deposited currencyAmount.

In the implementation of OpenFundMarket.subscribe(), we see that:

$value = currencyAmount * pow(10, shareDecimals) / NAV$

However, the Net Asset Value (NAV) used in the calculation is determined based on the poolInfo.valueDate, which is specific to each poolID, in relation to the current block.timestamp.

- If

block.timestamp < poolInfo.valueDate, the NAV is hardcoded to 1.

- If

block.timestamp > poolInfo.valueDate, the NAV is dynamically pulled from a price oracle via the NavOracle contract using the getSubscribeNav() function.

Based on the NAV, the amount of solvBTC or solvBTC.LST tokens minted is determined accordingly.

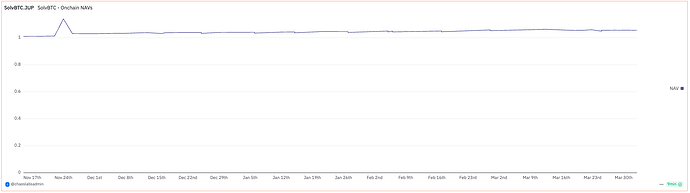

NavOracle.setSubscribeNavOnlyMarket() function is used to update the on-chain NAV value, and the SetSubscribeNav event is emitted once the NAV is set. Looking at the NAV values for the top BTC wrappers backing solvBTC—such as WBTC, cbBTC, BTCB, and fBTC—it appears that the NAV is updated a few times per week for each asset on average, but it is consistently set to 1.

Aside from solvBTC, the Solv protocol also offers yield-bearing LST products, such as solvBTC.JUP, which utilizes a delta-neutral strategy to generate yield on Jupiter. The earned rewards are streamed to users by increasing the asset’s value, meaning its exchange rate relative to solvBTC. In the case of solvBTC.JUP, the on-chain NAV is updated to reflect the rewards—or losses—accrued by token holders.

To mint SolvBTC via a native BTC deposit on Bitcoin network, users send BTC to designated addresses managed by a trusted custodian.

An oracle system continuously monitors the Bitcoin network to ensure transaction finality. It verifies critical details such as output scripts, block confirmations, and transaction integrity, ensuring each deposit meets stringent security standards.

Once a deposit is confirmed, the Staking Abstraction Layer (SAL) generates a deposit proof—a data package containing the depositor’s transaction details, the amount of Bitcoin deposited, and the intended recipient’s address on the destination chain.

This deposit proof is then relayed to the destination chain—currently supported only on BNB Chain—where a minting smart contract validates the proof against internal records and reserve balances. Upon successful verification, the contract mints an equivalent amount of SolvBTC and transfers it to the user’s wallet.

Redemption

Redemptions work in reverse compared to minting, with a few additional nuances. To initiate a redemption, the user calls the createRedemption() function on the SolvBTCRouter contract. The user must send their solvBTC tokens back to the contract, which burns them and mints an ERC-721 redemption token. This token represents the user’s claim on a future redemption payout and is sent to the user’s address. ERC-721s are non-fungible tokens and can be transferred or sold on secondary markets. This allows users to sell their future redemption payout rights in advance at a discount to access immediate liquidity, similar to how factoring works in traditional finance. However, while this is technically possible, active and liquid secondary markets for such discounted future claims have not yet materialized on-chain.

Once the redemption request is created, it is processed off-chain by the Solv Protocol.

According to Solv Protocol, user redemption requests are expected to be processed within 7 days. Requests submitted on weekends or public holidays are processed collectively on the following business day.

Redeeming native BTC on the Bitcoin network is not currently supported — minting with native BTC into solvBTC is a one-way process for now. As a result, you can only redeem wrapped BTC assets such as WBTC, cbBTC, tBTC, FBTC, and others.

After the redemption is settled off-chain, the user can claim their underlying collateral by calling the claimTo() function on the MultiRepayableDelegate contract. This triggers MultiRepayableConcrete.claimableValue() for the specific redemption ID. The claimableValue() function calculates the claimable amount based on the redemption NAV, which is updated via an oracle. However, similar to how the mint NAV is handled, it is updated infrequently and is often set to 1, effectively setting the exchange rate between solvBTC and other wrapped BTCs to 1:1.

Once the claimable value is determined, the corresponding ERC-3525 tokens (acting as receipts) are burned, and the underlying assets are unlocked and made available to the user.

In addition, Solv Protocol also allows redemptions to be canceled before being claimed and enables matured redemptions to be claimed in multiple parts if needed.

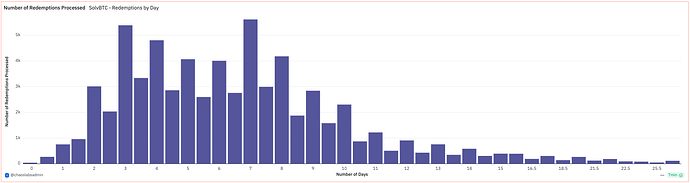

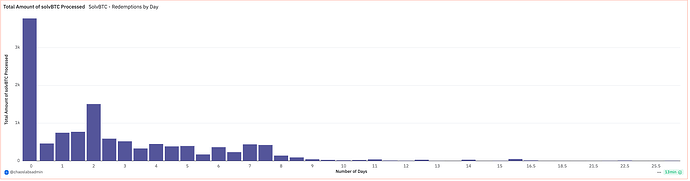

Redemption Processing Times on BNB Chain

According to Solv Protocol, most redemptions should typically completed within 7 days.

The average redemption time on BNB Chain varies significantly depending on the size of the redemption. Notably, high-value redemptions over 50 BTC are often processed much faster—usually within 2 days.

As shown in the left-hand chart, over 60% of all redemptions have been processed and claimed in under 7 days. Meanwhile, the right-hand chart highlights an even more striking trend: nearly 70% of total solvBTC redemptions by value have cleared in under 3 days, underscoring a clear prioritization of high-value redemptions.

Bridging

SolvBTC leverages integrations with Chainlink’s Cross-Chain Interoperability Protocol (CCIP) to enable cross-chain transactions. This makes solvBTC available across a wide range of networks, including Ethereum, BNB Chain, Arbitrum, Merlin, Avalanche, Mantle, Bob, Base, Linea, Mode, Taiko, Bera, Corn, Rootstock, Sei, Soneium, Sonic, zkSync Era, AILayer, Core, and Bitlayer.

Collateral Risk

The collateral risk for solvBTC primarily stems from the underlying wrapped Bitcoin tokens that back it. While solvBTC minted using native BTC (only supported on BNB Chain) carries minimal custody and smart contract risks, solvBTC minted from wrapped BTC tokens like WBTC, cbBTC, FBTC, tBTC, BTCB, BTC.b, M-BTC, and RBTC inherits the risks associated with these tokens. These risks include:

-

Custodial Risks:

Tokens like WBTC and cbBTC rely heavily on centralized custodians such as BitGo and Coinbase, respectively. Failure, insolvency, or security breaches at these custodians could jeopardize the redeemability or value of solvBTC collateralized with these tokens.

-

Smart Contract Risks:

Wrapped BTC tokens deployed on EVM-compatible chains are vulnerable to smart contract exploits, bugs, or governance attacks. Issues in underlying token contracts (e.g., FBTC, tBTC, BTC.b) could directly affect solvBTC’s collateral backing.

-

Potential Wrapped BTC Depeg:

Even though Solv Protocol has an oracle to track the exchange rate with other wrapped BTCs, the oracle updates are irregular, and it consistently maintains a fixed 1:1 exchange rate.

This introduces risks if the underlying wrapped BTC collateral significantly deviates from its peg. In such a scenario, users could mint solvBTC at an inflated valuation, effectively passing on collateral risk into DeFi lending markets. Consequently, solvBTC may become undercollateralized, potentially causing delayed redemptions, or financial losses for users and DeFi protocols that accept solvBTC as collateral.

Overall, solvBTC’s collateral risk profile depends heavily on the quality and security of its underlying wrapped Bitcoin tokens.

Security and Transparency Features

Solv Protocol enhances security through its Core and Innovative Reserve strategies, while fostering transparency via its collaboration with Chainlink’s Proof of Reserve and the Asset Backing Overview Dashboard.

Core Reserves and Innovative Reserves

Solv Protocol’s reserves are categorized to balance security:

- Core Reserves: These include native BTC, and BTCB. Chosen for their resilience, broad adoption, and strong liquidity profiles. Core Reserve Assets are exempt from minting caps or cross-chain rate limits, reflecting their stability and reliability.

- Innovative Reserves: This category encompasses newer or ecosystem-specific wrappers like cbBTC, wBTC, fBTC, BTC.b, and tBTC. While these assets offer potential opportunities and broader DeFi participation, they involve varying degrees of custodial and smart contract risk. To mitigate exposure, Solv Protocol imposes minting caps and cross-chain rate limits on these reserves. Governance by the SolvDAO will eventually decide adjustments to these parameters and determine whether any Innovative Reserves graduate to Core Reserve status.

Chainlink Proof of Reserve Integration

To further enhance transparency and security, Solv Protocol has integrated Chainlink’s Proof of Reserve (PoR). This integration enables real-time, on-chain verification of Solv’s assets under custody. By leveraging Chainlink’s decentralized oracle network, Solv ensures that its asset collateralization can be independently verified by users at any time, thereby fostering greater trust and confidence in the platform’s financial integrity. The Proof of Reserves (PoR) oracle for Solv Protocol is currently live only on the BNB Chain, but it accounts for the protocol’s entire TVL.

Asset Backing Overview Dashboard

Solv Protocol offers an Asset Management Dashboard that provides transparency by listing all addresses managing collateral within the protocol. This dashboard allows anyone to view the specific wallets and their respective balances, offering insight into the distribution and custody of assets. However, it’s important to note that while the dashboard is a valuable resource for identifying asset-holding addresses, some data points may not be updated in real-time and are subject to periodic refreshes. Therefore, for the most current information, consider cross-referencing with other real-time data sources or tools.

Oracle Configuration/Pricing

SolvBTC is predominantly minted using native BTC, providing a strong foundation of high-quality collateral with minimal custody and smart contract risk. In contrast, other BTC wrappers to mint solvBTC such as WBTC, cbBTC, and FBTC carry higher risks due to custodianship or protocol-level exposure. To mitigate systemic risk from these assets, Solv Protocol enforces minting caps and cross-chain rate limits.

Moreover, Chainlink’s Proof of Reserve integration is already live on BNB Chain, enabling independent verification of solvBTC’s asset backing and adding an extra layer of transparency.

Considering the robust safeguards around solvBTC minting, the PoR integration, and improved market liquidity, we believe that moving from a solvBTC/USD market oracle to a BTC/USD oracle is acceptable from a risk management perspective. This change reduces unnecessary, volatility-induced liquidations caused by short-term price depegs and aligns with best practices adopted for other BTC wrappers.

Therefore, we support configuring the BTC/USD feed as the price oracle for solvBTC in the Venus Core Pool.

Disclaimer

Chaos Labs has not been compensated by any third party for publishing this recommendation.

Copyright

Copyright and related rights waived via CC0