On August 9th, BitGo announced plans to transfer the management of the WBTC product to a new joint venture with BiT Global in 60 days. This transition will shift WBTC custody from its current U.S.-based jurisdiction to multiple locations, including Hong Kong and Singapore. The newly formed partnership aims to integrate closely with the Tron ecosystem, which may influence the oversight of WBTC management.

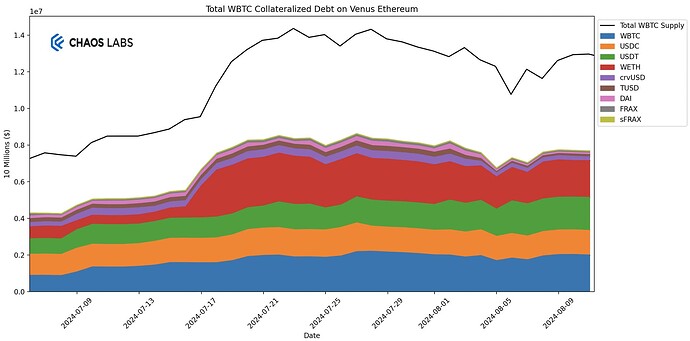

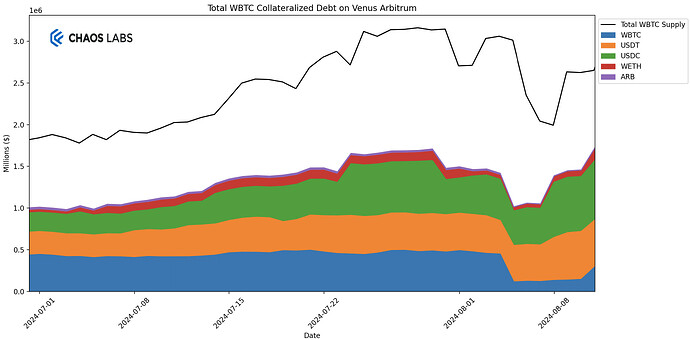

It is essential to approach this situation methodically, given the capital involved in the WBTC market on Venus. With $7.7 million in debt against $12.89 million in supplied WBTC on Venus in the Ethereum Core Pool market, and $1.72 million in debt against $3.04 million in supplied WBTC on Venus in the Arbitrum Core Pool market—any recommendations must be approached with caution to ensure the preservation of Venus’ market position.

The cumulative sum of debt growth over time on Venus Ethereum Core Pool, collateralized by WBTC.

The cumulative sum of debt growth over time on Venus Arbitrum Core Pool, collateralized by WBTC

Current Stance:

- Given the limited public information available about the upcoming event in approximately 60 days, issuing a risk-off recommendation at this stage would be premature and could have negative implications for the Venus Protocol. Currently, there are no observable fundamental changes to custody or proof of reserves, and the legal framework appears solid in preventing rehypothecation or tampering with user-minted WBTC.

Action Plan:

- Active Monitoring: We will continuously monitor the situation, staying vigilant for any new developments or information releases related to the upcoming event.

- Timely Updates: As more details emerge, we will promptly update the forum to keep the Venus community informed.

- Future Recommendations: Based on the evolving information landscape, we will issue new recommendations as necessary to ensure the market’s safety and stability.