Overview

Chaos Labs provides an adjustment to USD1’s parameters in order to better align it with its risk profile and increase its functionality on Venus.

Motivation

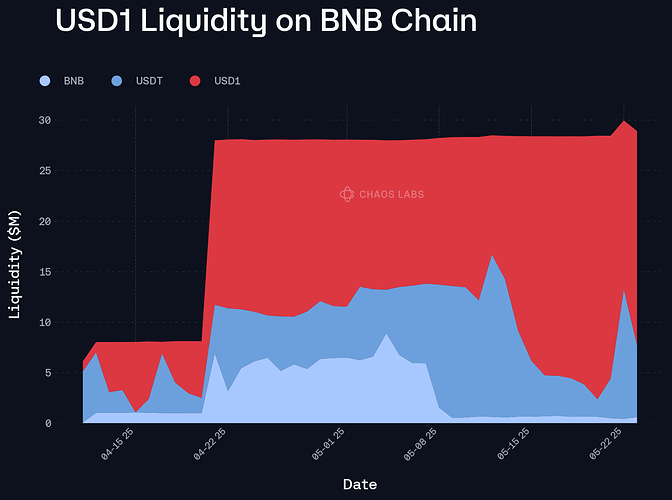

In recent weeks we have had an opportunity to observe USD1’s liquidity and price volatility. Its liquidity has been mostly static since the end of April, with shifts in the balance between USD1 and USDT/BNB based on trading flows.

This stable liquidity is an encouraging sign for the asset, though we note that the trading flows have led to relatively more USD1 in pools than the assets it is paired with.

However, the asset’s peg stability has been somewhat poor, with a large depeg on May 12.

This appears to be the result of liquidity dynamics, and the asset’s fundamental value was not affected.

Taking these factors into account, we recommend allowing the asset to be used as collateral at a somewhat conservative CF. Specifically, we recommend setting the value to 50%, noting that there is not typically significant demand to use stablecoins as collateral.

Specifications

| Parameter | Value |

|---|---|

| Asset | USD1 |

| Chain | BNB |

| Pool | Core |

| CF | 50.00% |

Disclaimer

Chaos Labs has not been compensated by any third party for publishing this recommendation.