Overview

Chaos Labs provides an adjustment to UNI’s parameters in order to better align it with its risk profile and increase its functionality on Venus.

Motivation

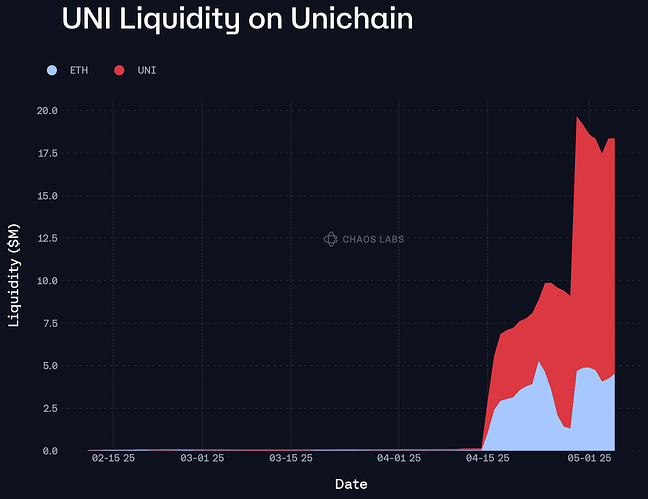

In recent weeks UNI’s liquidity on Unichain has increased dramatically, creating a vastly different risk dynamic for the asset. It is currently paired with roughly $5M worth of ETH on Uniswap.

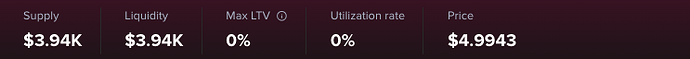

This is a significant improvement from its listing conditions; specifically, its low liquidity led us to recommend that the asset be listed as supply-only. As a result, it has had relatively low uptake on Venus, with just under $4K supplied.

We recommend allowing the asset to be used as collateral, aligning its LT with that on the BNB Chain Core instance: 55%. We recommend setting the asset’s CF to 50%.

Additionally, we recommend allowing the asset to be borrowed. Specifically, we recommend setting its IR curve equivalent to that of other volatile assets, allowing relatively cheap borrowing until the Kink, set to 45%. We recommend setting its Reserve Factor to 25%, finding that supply yield is unlikely to be a motivating factor for suppliers and prioritizing building a safety buffer for the asset.

Finally, we recommend increasing the asset’s supply and borrow caps in accordance with our usual methodology, setting the supply cap to 2x the liquidity available below the Liquidation Incentive. This leads to a recommendation of 4M UNI. We recommend setting the borrow cap to 50% of this value.

Specifications

| Parameter | Value |

|---|---|

| Asset | UNI |

| Chain | Unichain |

| Pool | Core |

| Supply Cap | 4,000,000 |

| Borrow Cap | 2,000,000 |

| CF | 50.00% |

| LT | 55.00% |

| Liquidation Incentive | 10% |

| Base | 0 |

| Multiplier | 0.15 |

| Jump Multiplier | 3.0 |

| Kink | 45% |

| Reserve Factor | 25% |