Summary

Amid the extreme market turbulence over the past 24 hours, Chaos Labs provides an update of the impact on Venus. Despite the heightened volatility and significant price declines across major crypto assets, Venus’s risk framework and liquidation mechanisms performed robustly, ensuring the protocol remained fully protected and free of new bad debt.

Observations and Analysis

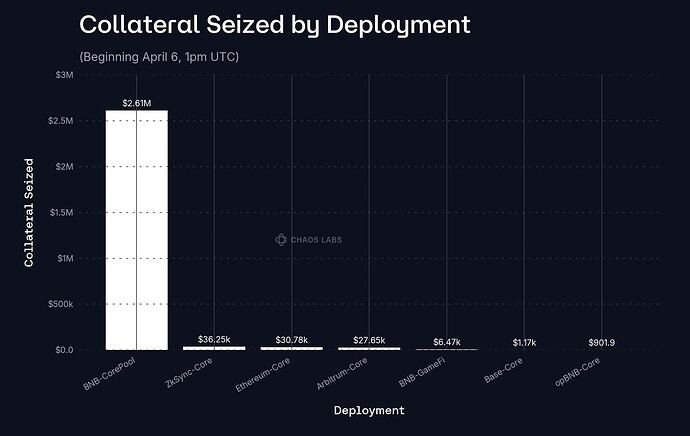

Over the past 24 hours, the crypto market experienced a sharp downturn, with BTC declining by 10% and ETH falling over 20%. This triggered widespread liquidations across both lending and perpetual markets, including $2.61M in collateral seized on Venus’s BNB Chain Core pool.

As shown above, this accounted for the vast majority of liquidations on the protocol, with ZkSync registering just $36K in collateral seized, followed by Ethereum at $30K.

Crucially, no bad debt was accrued, indicating that risk parameters have been set appropriately to account for severe market events.

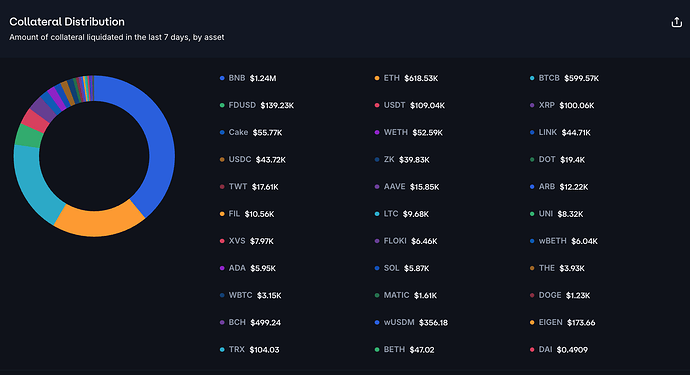

Overall, BNB, ETH, and BTCB accounted for the majority of liquidations on the protocol.

Conclusion

During this period of heightened market volatility, no bad debt was incurred, confirming that the liquidation mechanisms operated effectively. Chaos Labs’ risk monitoring infrastructure continues to operate in real-time and is fully prepared to intervene within the protocol if necessary.