Summary

Amid the high volatility of the last few days, Chaos Labs provides a recap of the impact of recent market activity on Venus. During recent market events, the protocol experienced significant liquidations, primarily on the BNB-Core involving BNB-denominated collateral. Thanks to the safe parameterization of the assets, all liquidations were executed efficiently, ensuring the protocol remained protected, and no bad debt occurred.

Liquidation Data, Beginning February 1

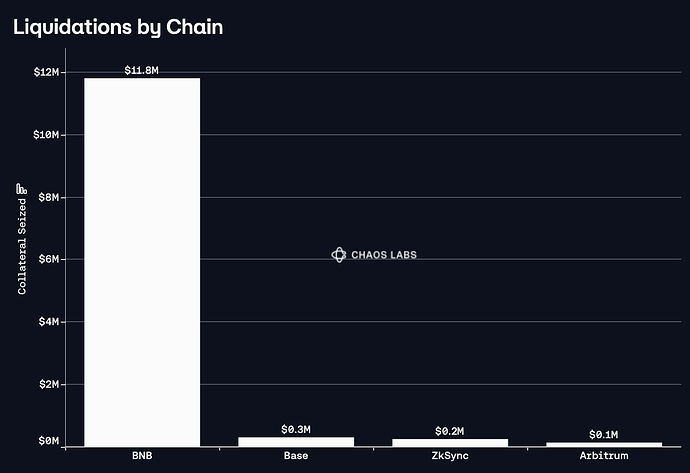

- Liquidation volume: $12.5M, BNB Chain represented 94.5% of this value.

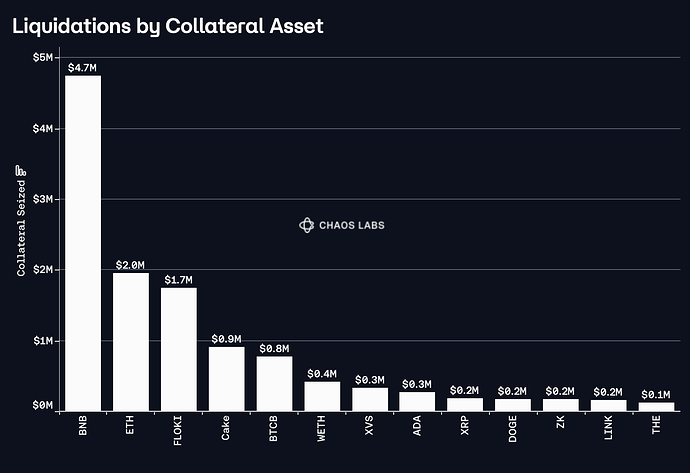

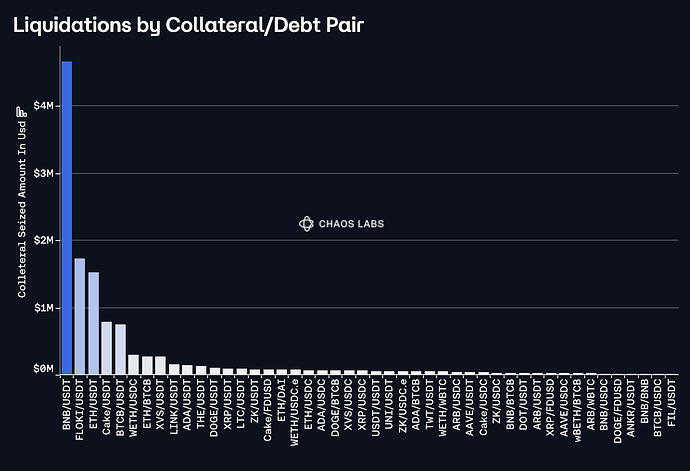

- Liquidation breakdown by collateral (excluding those with less than $100K collateral seized):

- Bad Debt Change: 7%

- The protocol did not incur new bad debt; instead, the value of existing bad debt decreased as prices fell.

Observations and Analysis

By far the most liquidated collateral/debt pair was BNB/USDT, followed by FLOKI/USDT and ETH/USDT. However, as expected, liquidations were processed efficiently for all of the heavily liquidated assets, as their supply caps are set according to available liquidity.

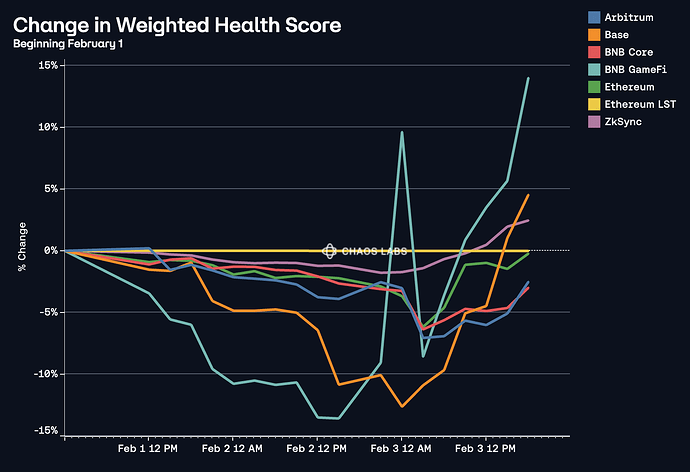

As of this writing, the weighted health score (the average health score for all users, weighted by amount borrowed) for major Venus pools has recovered, with BNB Core and Arbitrum the two exceptions, though they are down just 2.9% and 2.5%, respectively.

Liquidations cleared a significant amount of leverage, while price rebounds have improved health scores. The total Collateral at Risk slightly increased 12.77% from $47.03M to $53.04M, while the total Wallets at Risk dropped 19.28% from 1.46K to 1.18K. Below, we examine the two markets where health scores have not improved.

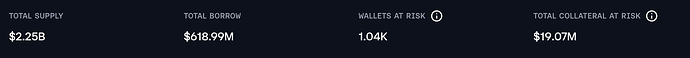

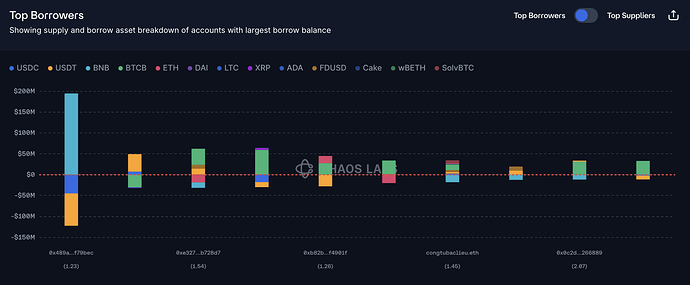

BNB Core

Despite a supply of $2.25B, just $19.07M collateral is at risk in BNB Core. Additionally, the top borrowers do not present a serious risk. The largest continues to be the BNB Bridge Exploiter, followed by a user using USDT to borrow BTCB, both highly liquid assets.

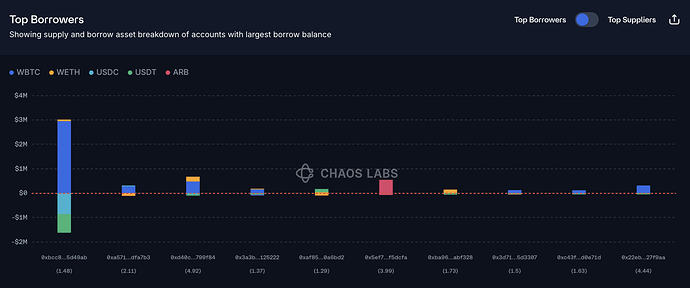

Arbitrum

The overall collateral at risk on Arbitrum is small, at just $31K. This market does not present a risk, even though it is relatively concentrated, with users borrowing stablecoins against WBTC.

Conclusion

Liquidations were efficiently processed on Venus, and in its current state, the protocol is not subject to significantly increased risks due to the market event. This indicates that parameters have been set appropriately.

Disclaimer

Chaos Labs has not been compensated by any third party for publishing this report.

Copyright

Copyright and related rights waived via CC0