Summary

In light of the the MATIC to POL migration, Chaos Labs recommends reducing MATIC supply and borrow caps on Venus Core BNB Chain deployment to ensure the safety of the Venus protocol.

Technical Specifications

On September 4, 2024, the Polygon Foundation initiated a token migration from MATIC to POL. To migrate MATIC to POL, it’s possible to use the official migration portal as well as the officially deployed smart contracts on the following chains:

- Ethereum

- Polygon Network

- Polygon ZK

The token conversion is 1:1; no additional supply was minted at the migration date. POL additionally includes a 2% inflation rate distributed to validators and the Polygon treasury.

The MATIC to POL conversion can be reverted as the contracts allow transfers of POL to MATIC 1:1.

The MATIC token on the BNB Chain is a BEP-20 deployed by Binance through the BEP-20 Deployer. Polygon does not officially support this deployment, so it is also not supported by the migration contracts.

To migrate MATIC tokens on BNB Chains to POL, it is necessary to deposit them into Binance and perform the migration through the Binance conversion portal.

Given the complex nature of the migration, we expect that the market will be slow to adapt and that the usage of MATIC on the BNB Chain will continue in the following months.

Liquidity

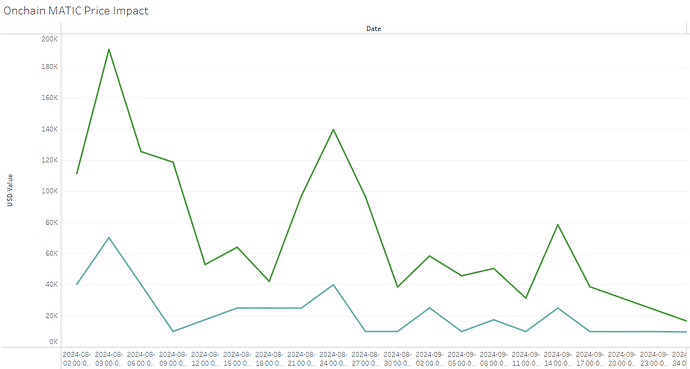

The DEX liquidity of MATIC on the BNB Chain has reduced since the migration event, and a sale of $45K worth of MATIC causes a 5% price impact.

USD Value at Price Impact

Green: 5% Price impact

Blue: 1% Price impact

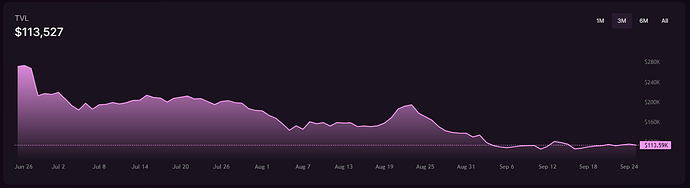

The DEX pool with the most liquidity is currently MATIC/WBNB on Thena with $113K of TVL.

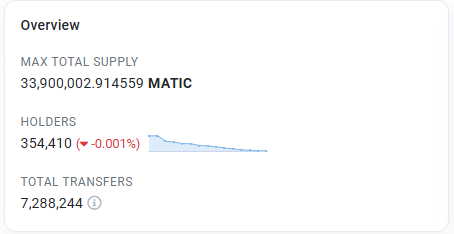

The current on-chain supply also recently dropped to 33.9M MATIC across 354K holders.

Usage

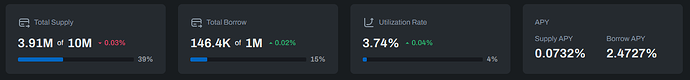

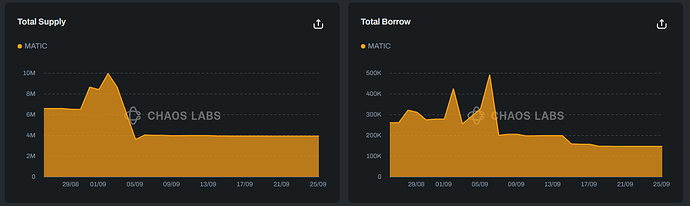

The supply cap of MATIC on Venus Core pool is currently at 39% utilization while its borrow cap reached 15%.

The demand for both MATIC collateral and MATIC borrows has fallen since the migration date.

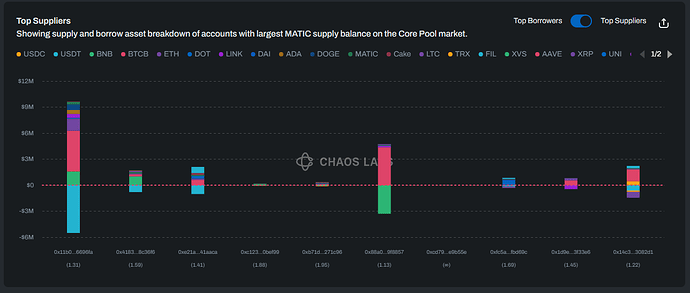

Supply Distribution

The major MATIC suppliers use it as collateral to borrow a diverse range of assets. None of the suppliers face significant liquidation risk, as their health scores remain secure. USDT is the most frequently borrowed asset backed by MATIC collateral.

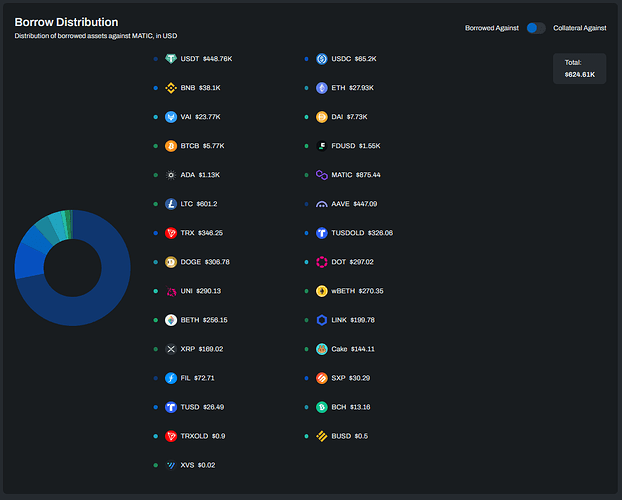

Overall USDT represents 71.7% of the assets borrowed against MATIC.

Borrow Distribution

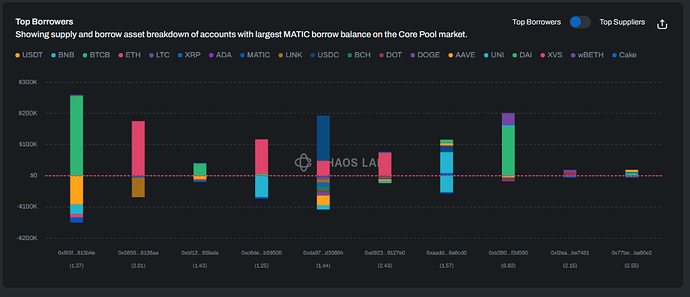

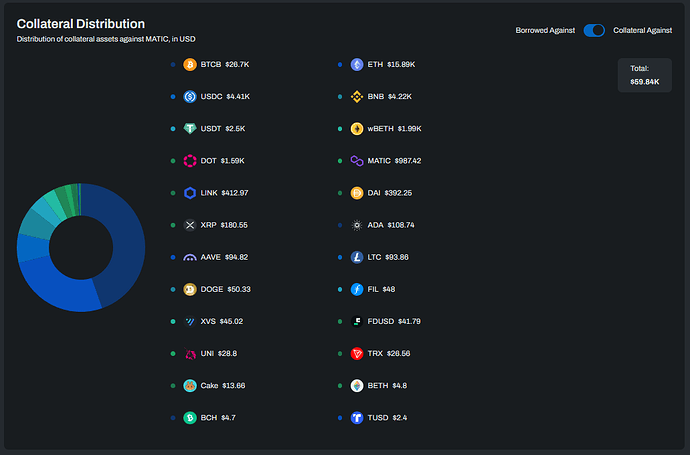

The largest MATIC borrowers also offer diverse collaterals, with BTCB and ETH being the most commonly used by top borrowers. None of the major positions present a significant liquidation risk.

Overall, BTCB represents 44.64% of the collateral used to borrow MATIC.

Recommendation

Given the reduced usage post-migration, user behavior, and reduced on-chain liquidity, we recommend reducing the supply cap to 5,500,000 MATIC and the borrow cap to 250,000 MATIC.

The recommended values target a cap utilization of 70% to allow new users to keep using the pool while not posing a risk of bad debt to the protocol. Additionally, we note that our simulations show no risk of bad debt at current supply levels. This is a proactive measure to protect the protocol if liquidity continues to decrease.

| Chain | Asset | Current Supply Cap | Recommended Supply Cap | Current Borrow Cap | Recommended Borrow Cap |

|---|---|---|---|---|---|

| BNB Core Pool | MATIC | 10,000,000 | 5,500,000 | 1,000,000 | 250,000 |