Summary

A proposal to:

- Increase xSolvBTC’s supply cap on Venus’s BNB Core deployment.

xSolvBTC (BNB Core Pool)

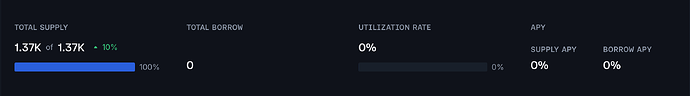

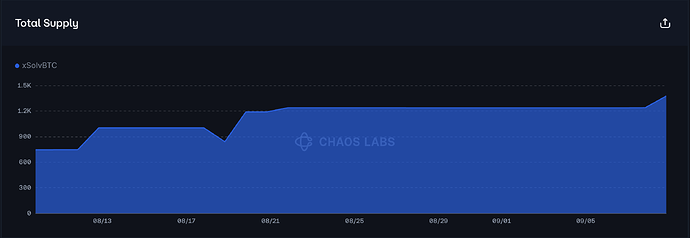

xSolvBTC’s supply cap utilization has reached 100%.

Supply Distribution

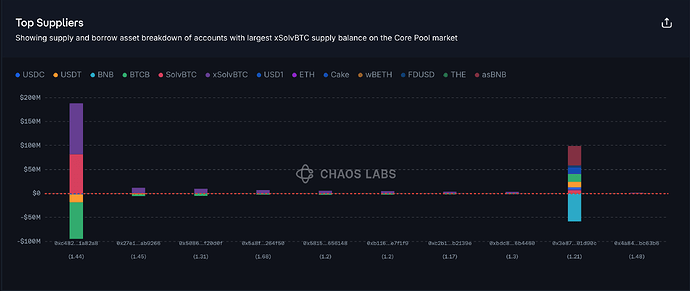

The supply distribution of xSolvBTC is concentrated, with the top supplier holding about 68% of the total. However, as this user is mainly borrowing BTCB and maintains a solid health score of 1.44, we do not view this as a material risk at present. The other top suppliers also maintain strong health scores, keeping liquidation risks under control.

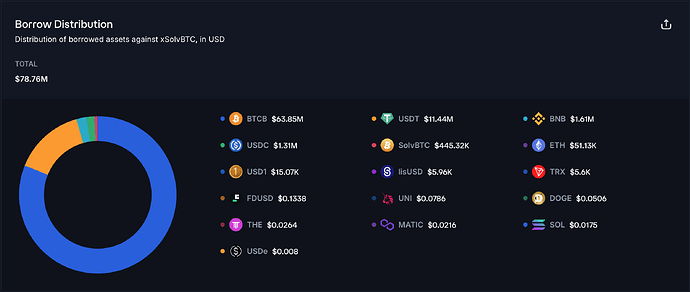

The largest asset borrowed against xSolvBTC is BTCB, accounting for 81% of the total distribution, which significantly reduces the likelihood of large-scale liquidations.

Liquidity

xSolvBTC’s liquidity has improved since our last review. At present, selling 50 xSolvBTC into USDT would incur less than 6% slippage, supporting a supply cap increase.

Recommendation

Given the user-behavior and on-chain liquidity, we recommend increasing xSolvBTC’s supply cap.

Specification

| Market | Asset | Current Supply Cap | Recommended Supply Cap | Current Borrow Cap | Recommended Borrow Cap |

|---|---|---|---|---|---|

| BNB Core | xSolvBTC | 1,375 | 2,000 | - | - |

Disclaimer

Chaos Labs has not been compensated by any third party for publishing this recommendation.