Summary

A proposal to:

- Increase xSolvBTC’s supply cap on Venus’s BNB Core deployment.

- Increase SolvBTC’s supply cap on Venus’s BNB Core deployment.

All cap increases are backed by Chaos Labs’ risk simulations, which consider user behavior, on-chain liquidity, and price impact, ensuring that higher caps do not introduce additional risk to the platform.

Cap increases for the these assets had previously been paused due to identified potential issues with their accounting; we have since received confirmation from the Solv team that these issues will be resolved and are thus resuming recommended increases.

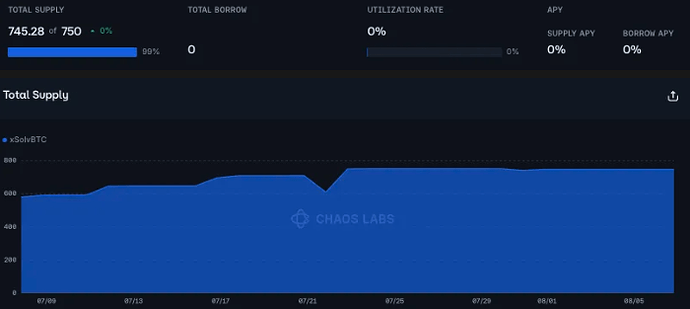

xSolvBTC (BNB Core Pool)

xSolvBTC’s supply cap utilization has reached 100%.

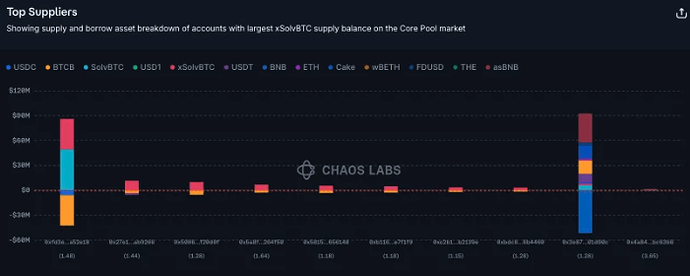

Supply Distribution

Supply is moderately concentrated: the largest supplier represents about 40% of all xSolvBTC deposited into Venus. However, this user is primarily borrowing BTCB, significantly reducing their likelihood of liquidation.

BTCB represents the vast majority of assets borrowed against xSolvBTC. Because the collateral and borrowed asset share the same underlying, liquidation and protocol risk is minimized.

Liquidity

On-chain liquidity has deteriorated somewhat, with a 30 xSolvBTC swap for USDT currently incurring about 5% price slippage.

Recommendation

Given the safe user behavior and on-chain liquidity, we recommend increasing xSolvBTC’s supply cap.

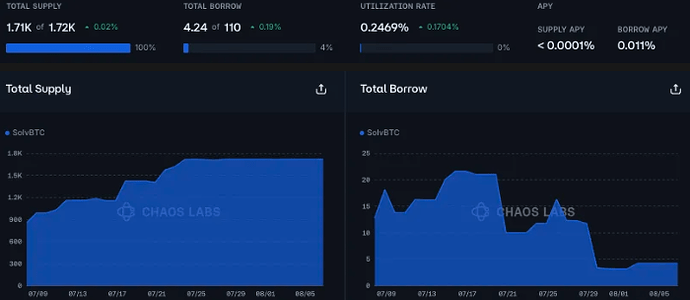

SolvBTC (BNB Core Pool)

SolvBTC has also reached 100% supply cap utilization, indicating strong demand for this newer market.

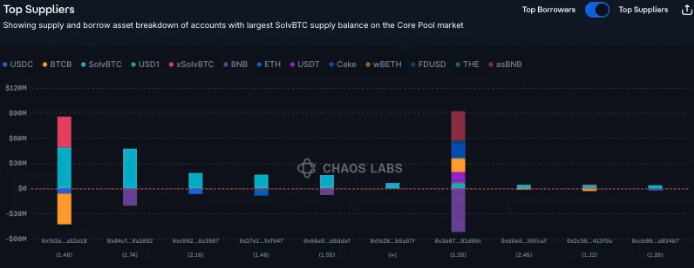

Supply Distribution

Supply is not highly concentrated; the largest supplier is the one discussed above with a relatively safe position. The second largest user, however is borrowing BNB against SolvBTC, presenting a somewhat higher risk of liquidation. Other top suppliers are borrowing USDC against their position.

The mixture of borrowed assets against SolvBTC is more varied than against xSolvBTC, with the largest asset being BNB, followed by BTCB, USDC, and ETH. The lack of correlation between most of these assets puts SolvBTC collateral at a higher risk of liquidation relative to xSolvBTC.

Liquidity

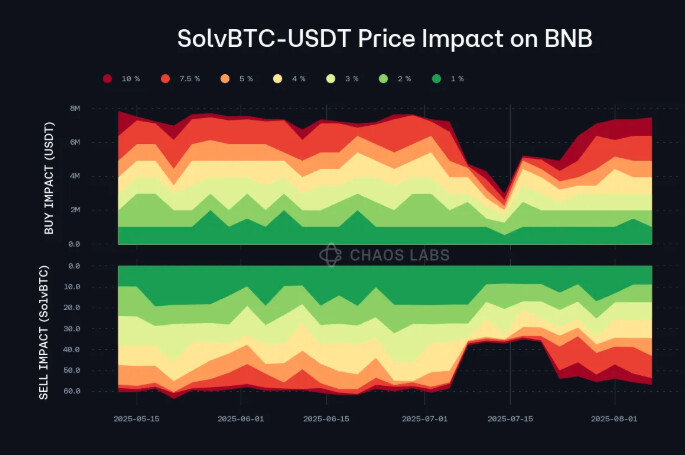

However, its on-chain liquidity is stronger than that of xSolvBTC, as selling 55 SolvBTC for USDT would incur roughly 5% slippage.

Recommendation

Given user behavior and on-chain liquidity, we recommend increasing SolvBTC’s supply cap.

Specification

| Market | Asset | Current Supply Cap | Recommended Supply Cap | Current Borrow Cap | Recommended Borrow Cap |

|---|---|---|---|---|---|

| BNB Core | xSolvBTC | 750 | 1,250 | - | - |

| BNB Core | SolvBTC | 1,720 | 2,000 | - | - |

Disclaimer

Chaos Labs has not been compensated by any third party for publishing this recommendation.