Summary

A proposal to:

- Increase xSolvBTC’s supply cap on Venus’s BNB Core deployment.

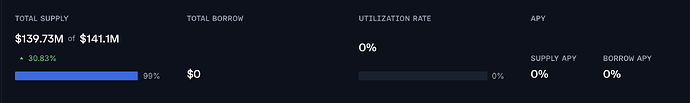

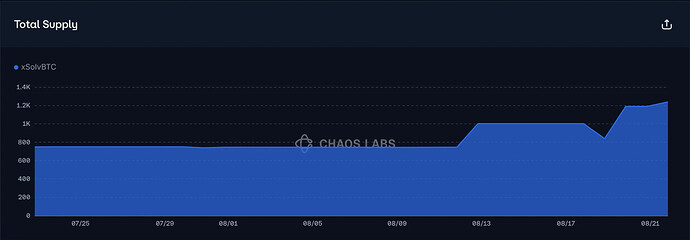

xSolvBTC (BNB Core Pool)

xSolvBTC’s supply cap utilization has reached 99%.

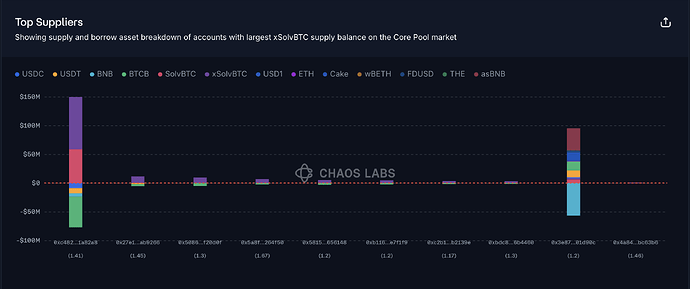

Supply Distribution

The supply distribution of xSolvBTC presents a concentration risk, with the top supplier accounting for around 65% of the total. However, since this user is primarily borrowing BTCB and maintaining a strong health score of 1.41, we do not believe this poses a material risk at the moment. The remaining top suppliers maintain adequate health scores, which help keep liquidation risks under control.

The largest asset borrowed against xSolvBTC is BTCB, accounting for 74% of the total distribution, which is consistent with the borrowing behavior of the top supplier noted above.

Liquidity

Currently, selling 30 xSolvBTC would incur less than 7% price slippage. While safe user behavior supports a cap increase, liquidity remains limited compared to the current supply cap. Therefore, we support a supply cap increase but recommend taking a conservative approach.

Recommendation

Given the user-behavior, we recommend increasing xSolvBTC’s supply cap.

Specification

| Market | Asset | Current Supply Cap | Recommended Supply Cap | Current Borrow Cap | Recommended Borrow Cap |

|---|---|---|---|---|---|

| BNB Core | xSolvBTC | 1,250 | 1,375 | - | - |

Disclaimer

Chaos Labs has not been compensated by any third party for publishing this recommendation.