Overview

Chaos Labs recommends increasing USD1’s collateral factor from 50% to 60%, despite limited improvement in onchain metrics, based on asset being stablecoin, limited usage as collateral, and the presence of conservative supply caps. These factors mitigate the potential risks associated with the adjustment.

Motivation

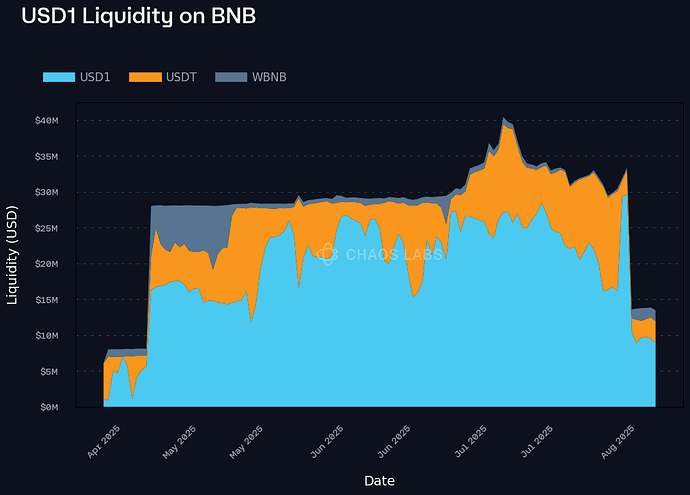

Since being enabled as collateral in late May, USD1 has experienced a contraction in onchain liquidity. Total liquidity has declined from around 30 million USD to approximately 15 million USD, rather than improving. A large share of this remaining liquidity consists of USD1 itself, which reduces buy side depth and may pose challenges during liquidations.

In addition, USD1’s peg behavior on BNB has shown frequent price deviations in the range of ±0.5%. These fluctuations are notable for a stablecoin and are likely a result of liquidity imbalances within the pools.

While these onchain indicators have not improved, USD1 is a stablecoin with limited current usage as collateral on Venus, and supply caps remain conservative. Given these mitigating factors, we assess that raising the collateral factor to 60% does not materially increase protocol risk at this stage.

Specifications

| Parameter | Value |

|---|---|

| Asset | USD1 |

| Chain | BNB |

| Pool | Core |

| CF | 60.00% |

Disclaimer

Chaos Labs has not been compensated by any third party for publishing this recommendation.