Summary

A proposal to:

- Increase WBTC’s supply and borrow cap on the ZKSync Core deployment.

All recommended increases are backed by Chaos Labs’ risk simulations, which consider the user behavior, on-chain liquidity, and price impact, ensuring that the higher cap does not introduce additional risk to the platform.

Motivation

WBTC (ZKSync)

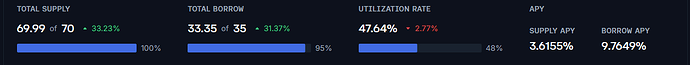

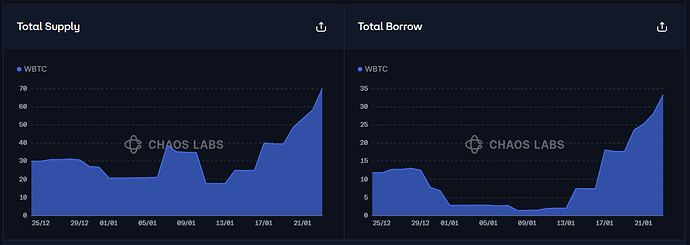

WBTC has reached 100% supply cap utilization and its borrow cap is 95% utilized. The growth in deposits and borrows is likely driven by looping activity caused by ZK Ignite incentives.

Supply Distribution

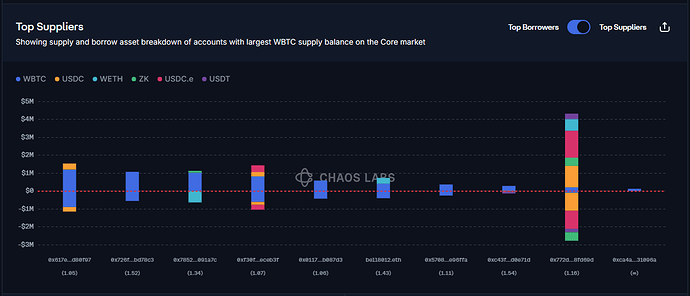

WBTC’s supply is fairly distributed among top holders, with the biggest user accounting for roughly 16% of the total supply. Most of the top WBTC suppliers use the asset as collateral to borrow WBTC, effectively looping over the same asset in order to farm ZK Ignite rewards. No position poses a significant liquidation risk.

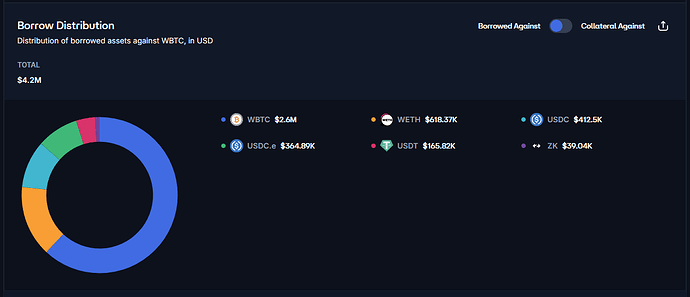

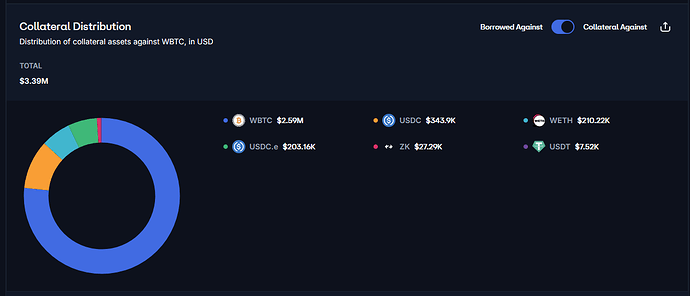

As a result of the top position, WBTC is the most popular debt asset against WBTC, representing 61.97% of the borrowing demand.

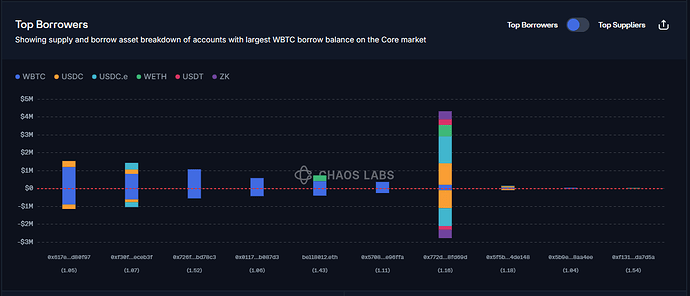

Borrow Distribution

Given the primary demand for WBTC borrow comes from looping positions, WBTC’s borrow distribution is similar to the previously covered supply’s distribution. No borrow position represents a significant liquidation risk.

As a result of the top position, WBTC is the most popular collateral against WBTC debt, representing 76% of the collateral value.

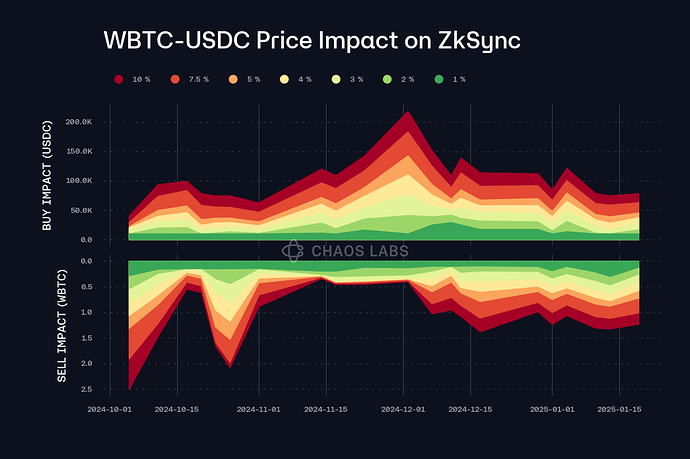

Liquidity

WBTC’s liquidity on ZKSync is somewhat poor, though our simulations indicate that, taking into account user behavior, this is sufficient to support a supply cap increase.

Recommendation

Given the aforementioned factors, we recommend increasing the supply cap to 90 WBTC and setting the borrow cap to 50%.

Specification

| Market | Asset | Current Supply Cap | Recommended Supply Cap | Current Borrow Cap | Recommended Borrow Cap |

|---|---|---|---|---|---|

| ZKSync | WBTC | 70 | 90 | 35 | 45 |

Disclaimer

Chaos Labs has not been compensated by any third party for publishing this recommendation.

Copyright

Copyright and related rights waived via CC0