Summary

- UNI

- Supply Cap - increase to 200,000

- Borrow cap - increase to 100,000

Analysis

UNI

Overview

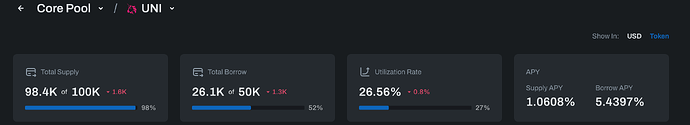

The supply cap for UNI on the Venus core pool is currently at 98% utilization.

Utilizing our supply cap methodology and considering the current usage on Venus and liquidity conditions, we recommend doubling the current supply and borrow caps of UNI to 200K UNI and 100K UNI, respectively.

Analysis

Positions Analysis

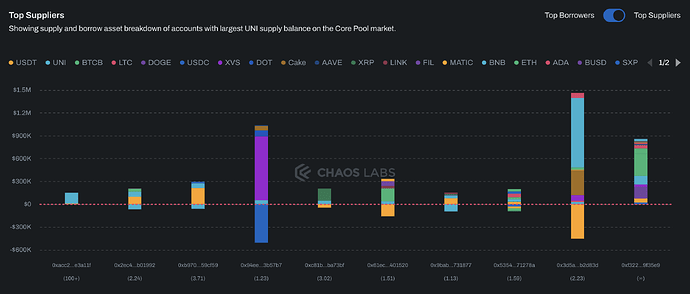

Examination of user positions shows that the suppliers are well versed, and in a healthy state with no prominent centralization risk. Given this usage, raising the caps does not introduce excessive risk to the protocol.

Liquidity

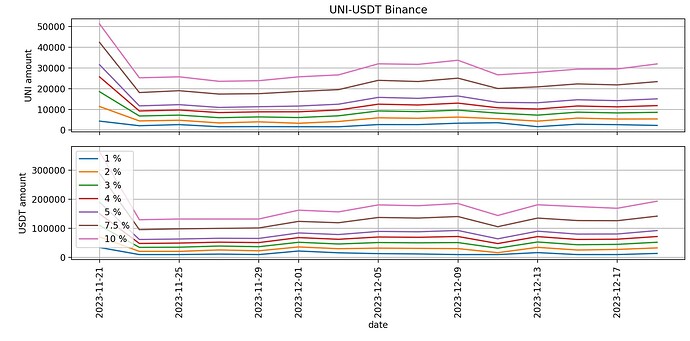

Liquidity vs USDT has been steady over the past month, with ~30K UNI subject to up to 10% price impact.

As we are in the process of integrating UNI into our stress test framework, we utilize our interim supply and borrow cap methodology in this analysis.

Interim Methodology

Supply Cap

Definitions:

-

CurrentSupplyCap- the current supply cap configured for the asset -

ExtremeLiquidationAmount- the amount eligible for liquidation given an extreme drop in the asset price using Chaos Labs’ Risk Explorer 1. We define the “extreme drop” for different market cap classes as follows:- Small Cap (<$2B) - 50% drop

- Medium Cap ($2B-$20B) - 35% drop

- Large Cap (>$20B) and Stables- 15% drop

-

MaxAmountLiquidated- the maximum amount that can be liquidated while keeping the slippage below the Liquidation Penalty

Framework:

- Evaluate the

ExtremeProfitableLiquidationRatio:

This ratio represents how many times the ExtremeLiquidationAmount can be profitably liquidated had it all been liquidated at once. Requiring 90% of an asset’s liquidated amount will be liquidated at once is a defensive approach and can be set differently given changing risk appetites.

- Set

R = min(ExtremeProfitableLiquidationRatio, 2) RecommendedSupplyCap = CurrentSupplyCap * R

Notes:

- The above assumes that additional supply and borrow amounts will be distributed similarly to the current supply and borrowing activity.

- To accommodate for unexpected borrower and market behavior, we provide an upper bound of

2*CurrentSupplyCapon the increase in supply caps. - To prevent over-concentration of a token’s on-chain liquidity on Venus, we cap the supply of each token at 50% of its total circulating supply on a given network.

- We recommend waiting at least two weeks between consecutive recommendations for a single asset to analyze suppliers’ and borrowers’ behavior.

- For simplicity, we will round the recommended numbers to the nearest round number.

Please note that while setting supply and borrow caps, we also take into account additional factors. These include the total on-chain supply of the asset, redemption process (where applicable), oracle setup, and the potential for price manipulation and long/short attacks, all of which could influence our recommendations.

Given the calculation below, our methodology allows for increasing the supply cap of PLANET to 2,000,000,000, doubling the current supply.

| Current Supply Cap | Extreme Liquidation Amount (UNI) | Max Amount Liquidated (UNI) | R | Recommended Supply Cap | |

|---|---|---|---|---|---|

| UNI | 100,000 | 991 | 25,000 | 2 | 200,000 |

Recommendation

| Current Supply Cap | Recommended Supply Cap | Current Borrow Cap | Recommended Borrow Cap | |

|---|---|---|---|---|

| UNI | 100,000 | 200,000 | 50,000 | 100,000 |