Summary

- BUSD

- Reduce CF to 0.72.

- MATIC (Core Pool)

- Supply Cap

- PLANET (DeFi Isolated Pool)

- Supply Cap

- Borrow Cap

Analysis

BUSD

Over the past months, the community has approved several proposals in its efforts to wind down the market, in light of Paxos stopping to support BUSD in February 2024. The efforts to date included:

- Freezing new supply and borrow by reducing supply and borrow caps to 0.

- Increasing BUSD Reserve Factor to 100%

- Pause MINT - complementary to setting supply caps to 0

- Pausing BORROW - complementary to setting borrow caps to 0

- Pausing ENTER_MARKET - will not allow users to start using BUSD as collateral. Users who have already enabled BUSD as collateral will not be affected by this update.

- Setting XVS rewards in the BUSD market to 0.

- Adjusting BUSD IR curves

- Implementing the “Forced Liquidation” mechanism which was designed to liquidate accounts holding BUSD borrow positions, thereby returning BUSD to the Venus Core Pool and allowing users to redeem their supplied BUSD.

- Repayment of BUSD insolvent accounts

In light of Binance’s announcement that it will cease to support BUSD and in our continued efforts of deprecating the market on Venus, we recommend gradually winding the Collateral Factor for BUSD to 0.

Our initial step involves reducing the Collateral Factor by 10% to 0.72. This approach aims to minimize the number of accounts subject to liquidation. Currently, this reduction would result in 45 accounts affected with a total liquidation value of approximately $28.2K.

We propose executing this change only after the completion of the final shortfall repayment, allowing users to redeem their BUSD supply. To avert potential liquidations, we advise those utilizing BUSD as collateral to repay their borrows and redeem BUSD holdings before the implementation of this proposal.

Following the initial CF reduction, we plan to recommend more aggressive CF reductions to expedite the market deprecation. We urge users to proactively wind down their BUSD collateralized positions ahead of time to avoid liquidations should the community decide to adopt this approach.

Note: As Collateral Factor reductions may lead to user accounts being eligible for liquidations upon their approval, we want to clarify the full implications to the community at each step. We will publicly communicate the planned amendments and list of affected accounts leading to the on-chain execution.

MATIC

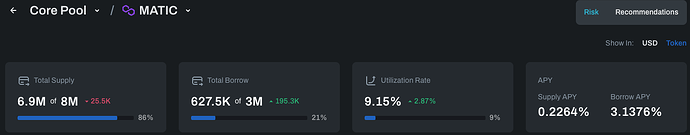

The supply cap for MATIC on Venus Core Pool is currently at 86% utilization.

Utilizing our supply and borrow cap methodology, we do not observe additional risk when increasing the supply cap for MATIC on the Venus BNB Core Pool. We recommend doubling the supply cap to 16M MATIC.

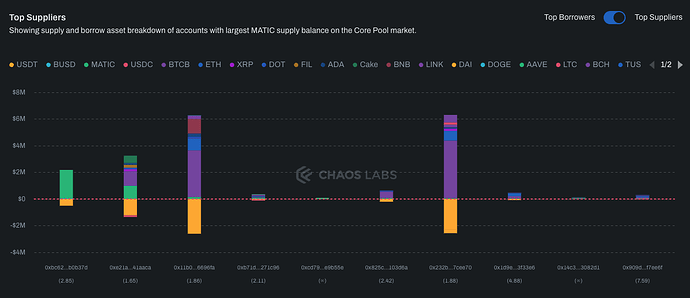

Positions

The examination of wallet distributions indicates no substantial risk and we have not identified any outsized positions that are actively affecting our recommendations.

On 03/12/23, there was an uptick in supply, primarily driven by this wallet, which supplied 2.7M MATIC to Venus.

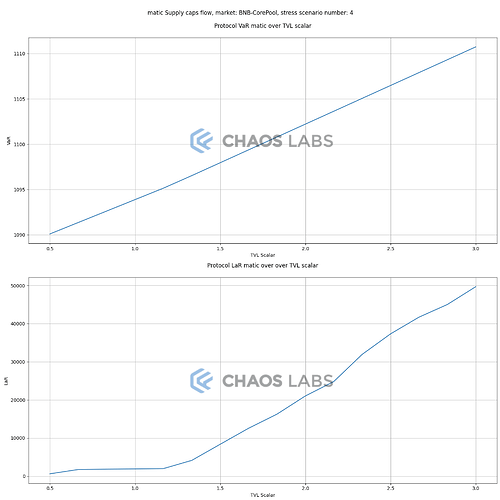

Simulations

Utilizing our simulations, we have identified that increasing the supply cap correlates with an incremental rise in VaR. However, this increase is notably minimal. Based on our analysis and methodology, we recommend doubling the supply cap.

Planet

Overview

The supply and borrow caps for PLANET as they have reached 100% and 73%, respectively.

As we are in the process of integrating PLANET into our stress test framework, we utilize our interim supply and borrow cap methodology in this analysis. Following the analysis below, we recommend doubling the current supply and borrow to 4B and 1.5B respectively.

Interim Methodology

Supply Cap

Definitions:

-

CurrentSupplyCap- the current supply cap configured for the asset -

ExtremeLiquidationAmount- the amount eligible for liquidation given an extreme drop in the asset price using Chaos Labs’ Risk Explorer. We define the “extreme drop” for different market cap classes as follows:- Small Cap (<$2B) - 50% drop

- Medium Cap ($2B-$20B) - 35% drop

- Large Cap (>$20B) and Stables- 15% drop

-

MaxAmountLiquidated- the maximum amount that can be liquidated while keeping the slippage below the Liquidation Penalty

Framework:

- Evaluate the

ExtremeProfitableLiquidationRatio:

This ratio represents how many times the ExtremeLiquidationAmount can be profitably liquidated had it all been liquidated at once. Requiring 90% of an asset’s liquidated amount will be liquidated at once is a defensive approach and can be set differently given changing risk appetites.

- Set

R = min(ExtremeProfitableLiquidationRatio, 2) RecommendedSupplyCap = CurrentSupplyCap * R

Notes:

- The above assumes that additional supply and borrow amounts will be distributed similarly to the current supply and borrowing activity.

- To accommodate for unexpected borrower and market behavior, we provide an upper bound of

2*CurrentSupplyCapon the increase in supply caps. - To prevent over-concentration of a token’s on-chain liquidity on Venus, we cap the supply of each token at 50% of its total circulating supply on a given network.

- We recommend waiting at least two weeks between consecutive recommendations for a single asset to analyze suppliers’ and borrowers’ behavior.

- For simplicity, we will round the recommended numbers to the nearest round number.

Please note that while setting supply and borrow caps, we also take into account additional factors. These include the total on-chain supply of the asset, redemption process (where applicable), oracle setup, and the potential for price manipulation and long/short attacks, all of which could influence our recommendations.

Given the calculation below, our methodology allows for increasing the supply cap of PLANET to 2,000,000,000, doubling the current supply.

| Current Supply Cap | Extreme Liquidation Amount (PLANET) | Max Amount Liquidated (PLANET) | R | Recommended Supply Cap | |

|---|---|---|---|---|---|

| PLANET | 2,000,000,000 | 0 | 500,000,000 | 2 | 4,000,000,000 |

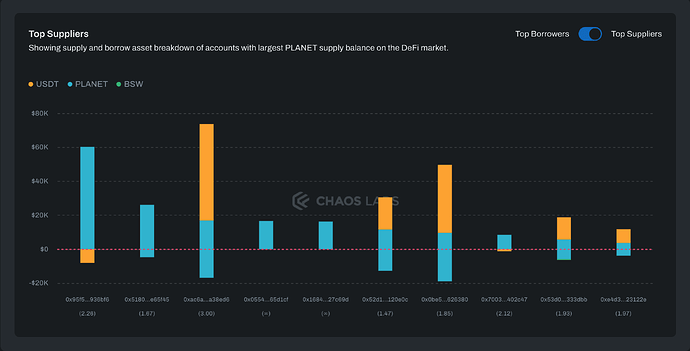

Positions Analysis

Examination of user positions shows that a predominant trend among users is to supply and simultaneously borrow the PLANET asset. This strategy is driven by the incentives offered for borrowing PLANET. Given this usage, raising the caps does not introduce excessive risk to the protocol.

Recommendation

| Current Supply Cap | Recommended Supply Cap | Current Borrow Cap | Recommended Borrow Cap | |

|---|---|---|---|---|

| PLANET | 2,000,000,000 | 4,000,000,000 | 1,000,000,000 | 1,500,000,000 |