Summary

-

Stablecoin IR Curve Recommendations

- Multiplier Parameter Adjustment: Increase the multiplier parameter to reflect a 5.5% borrow rate at the 80% utilization kink point for USDT, USDC, DAI, and TUSD in the Core Pool and USDT in the Stablecoins Pool.

-

PLANET (DeFi Pool)

- Increase supply cap to 2,000,000,000

- Increase borrow cap to 1,000,000,000

-

TUSDOLD Borrow Rates

- Reduce borrow rate to 0

Analysis

Stablecoin IR Curve Recommendations

This recommendation aims to align Venus’ stablecoin interest rate models more closely with the broader market. We propose adjusting the multiplier parameter in Venus to attain a 5.5% borrow rate at the kink point of 80% utilization for all stablecoins.

Analysis

Stablecoin borrowing costs across DeFi have been increasing over the past several months, with rates trending upwards towards 5%. This trend echoes the broader market trend seen in traditional finance, where short-term t-bills are now yielding close to 5.5%. Consequently, with Venus’s stablecoin rates currently around 4%, a lower equilibrium compared to the market, we’re noticing significant volatility in the borrow APYs for stablecoins within the Venus core pool. This volatility is primarily due to utilization levels reaching near the kink point, leading to substantial APY fluctuations.

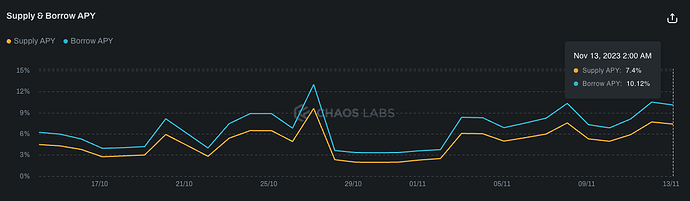

USDC supply and borrow rates on Venus Core Pool over the past 30 days

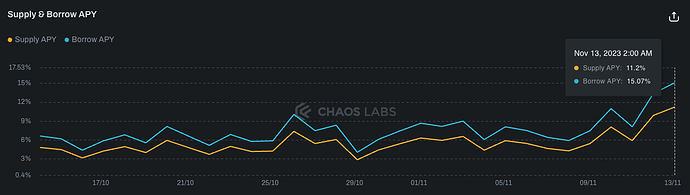

USDT supply and borrow rates on Venus Core Pool over the past 30 days

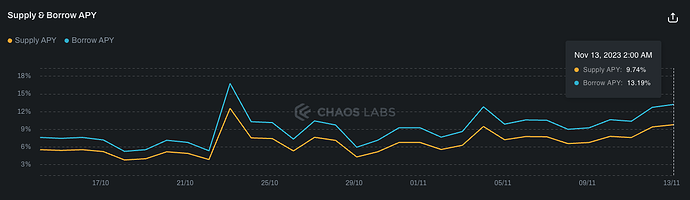

DAI supply and borrow rates on Venus Core Pool over the past 30 days

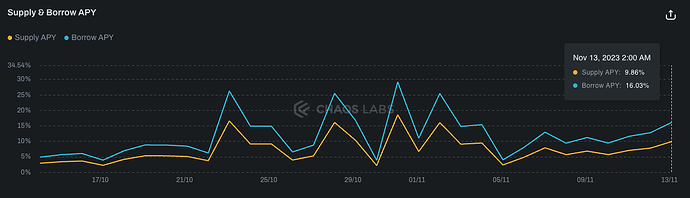

TUSD supply and borrow rates on Venus Core Pool over the past 30 days

To accommodate some flexibility, given that the exact equilibrium borrowing rate cannot be pinpointed down to a few basis points, we recommend setting the interest rate at the Kink slightly above the equilibrium market interest rate, at 5.5%

Reduced Rate Volatility

Adjusting the multiplier parameter upward has the potential to stabilize borrowing rates, thereby diminishing the likelihood of rates fluctuating beyond the optimal utilization threshold. Such a measure enhances user experience by providing more predictable cost expectations for borrowers and is anticipated to incentivize increased borrowing activity. By establishing a more stable and reliable borrowing environment, users can engage with the protocol with greater confidence, contributing to a more robust borrowing market. This stability is crucial for long-term user retention and the overall health of the platform, as it encourages consistent participation from both existing and prospective users.

Alignment with Broader Market

Elevated rates at the point of optimal utilization more accurately represent the proper balance point of market forces, synchronizing the interplay between lender supply and borrower demand. In an effort to harmonize these optimal utilization rates with the prevailing conditions in the wider DeFi landscape, we advocate for an adjustment. This recalibration would position the borrowing rates at the kink in line with or just below the rates established by comparable DeFi protocol

Specification

| Pool | Asset | Base | Kink | Multiplier | Jump Multiplier | Rec Borrow APY at Kink |

|---|---|---|---|---|---|---|

| Core Pool | USDT | 0% | 80% | 6.875% | 250% | 5.5% |

| Core Pool | USDC | 0% | 80% | 6.875% | 250% | 5.5% |

| Core Pool | DAI | 0% | 80% | 6.875% | 250% | 5.5% |

| Core Pool | TUSD | 0% | 80% | 6.875% | 250% | 5.5% |

| Stablecoins Isolated Pool | USDT | 0% | 80% | 6.875% | 250% | 5.5% |

Conclusion

Aligning the Venus protocol’s stablecoin interest rates with current market rates is crucial for maintaining its competitiveness and efficiency. The proposed adjustment to the multiplier parameter aims to optimize market function and user experience.

Given these considerations, we recommend setting the borrowing interest rates for USDT, USDC, DAI, and TUSD in the Core Pool and USDT in the Stablecoins Pool at 5.5%. Following this increase, we will continue monitoring the usage and equilibrium rate and make additional recommendations as necessary.

PLANET

Overview

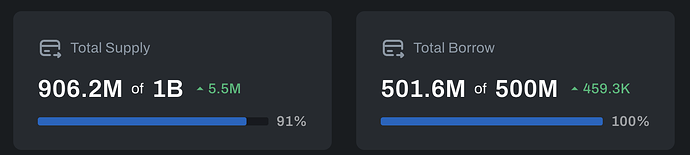

A proposal to increase the supply and borrow caps for PLANET as it has reached 91% and 100%, respectively.

Interim Methodology

Supply Cap

Definitions:

-

CurrentSupplyCap- the current supply cap configured for the asset -

ExtremeLiquidationAmount- the amount eligible for liquidation given an extreme drop in the asset price using Chaos Labs’ Risk Explorer. We define the “extreme drop” for different market cap classes as follows:- Small Cap (<$2B) - 50% drop

- Medium Cap ($2B-$20B) - 35% drop

- Large Cap (>$20B) and Stables- 15% drop

-

MaxAmountLiquidated- the maximum amount that can be liquidated while keeping the slippage below the Liquidation Penalty

Framework:

- Evaluate the

ExtremeProfitableLiquidationRatio:

This ratio represents how many times the ExtremeLiquidationAmount can be profitably liquidated had it all been liquidated at once. Requiring 90% of an asset’s liquidated amount will be liquidated at once is a defensive approach and can be set differently given changing risk appetites.

- Set

R = min(ExtremeProfitableLiquidationRatio, 2) RecommendedSupplyCap = CurrentSupplyCap * R

Notes:

- The above assumes that additional supply and borrow amounts will be distributed similarly to the current supply and borrowing activity.

- To accommodate for unexpected borrower and market behavior, we provide an upper bound of

2*CurrentSupplyCapon the increase in supply caps. - To prevent over-concentration of a token’s on-chain liquidity on Venus, we cap the supply of each token at 50% of its total circulating supply on a given network.

- We recommend waiting at least two weeks between consecutive recommendations for a single asset to analyze suppliers’ and borrowers’ behavior.

- For simplicity, we will round the recommended numbers to the nearest round number.

Please note that while setting supply and borrow caps, we also take into account additional factors. These include the total on-chain supply of the asset, redemption process (where applicable), oracle setup, and the potential for price manipulation and long/short attacks, all of which could influence our recommendations.

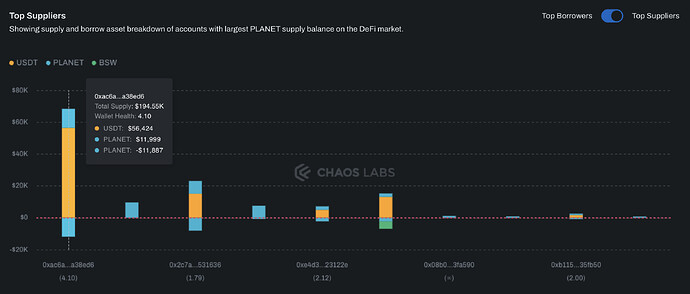

Positions Analysis

Examination of user positions shows that a predominant trend among users is to supply and simultaneously borrow the PLANET asset. This strategy is driven by the incentives offered for borrowing PLANET. Given this usage, raising the caps does not introduce excessive risk to the protocol.

Given the calculation below, our methodology allows for increasing the supply cap of PLANET to 2,000,000,000, doubling the current supply.

| Current Supply Cap | Extreme Liquidation Amount (PLANET) | Max Amount Liquidated (PLANET) | R | Recommended Supply Cap | |

|---|---|---|---|---|---|

| PLANET | 1,000,000,000 | 0 | 600,000,000 | 2 | 2,000,000,000 |

Borrow Cap

Utilizing our borrow cap methodology, We recommend doubling the borrow cap to 1,000,000,000 PLANET.

Recommendation

| Current Supply Cap | Recommended Supply Cap | Current Borrow Cap | Recommended Borrow Cap | |

|---|---|---|---|---|

| PLANET | 1,000,000,000 | 2,000,000,000 | 500,000,000 | 1,000,000,000 |

Reduce Borrow Rates for TUSDOLD

Over the months of executing the deprecation plan for TUSDOLD, IR parameters were updated in order to set aggressive borrow rates to incentivize the repayments of the borrowed assets.

At this time, the borrow APY for TUSDOLD is over 230% with borrow utilization at nearly 280% As borrowers are inelastic, we recommend reducing the borrowing rate to 0 to stop the additional debt incurred to underwater accounts that have TUSD borrow positions (for example, wallet 1, wallet 2, wallet).

Recommendation:

| Pool | Asset | Base | Multiplier | Jump Multiplier |

|---|---|---|---|---|

| Core Pool | TUSDOLD | 0% | 0% | 0% |