Summary

A proposal to adjust WETH and ETH Interest Rate parameters across all Venus markets.

Motivation

Following observations of increase rate volatility, we recommend changes to ETH interest rate curves.

Interest Rate Analysis

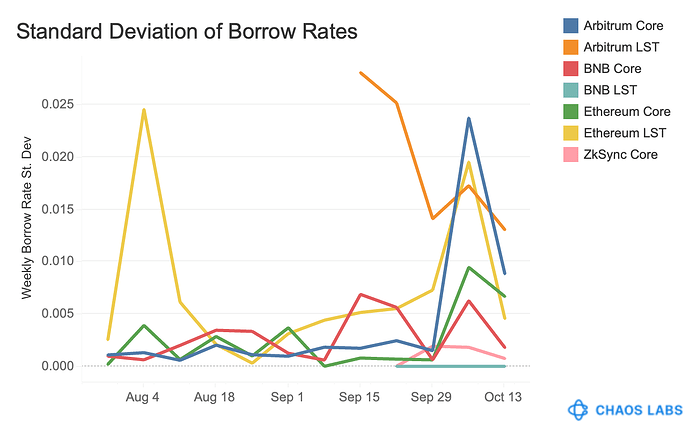

We have observed increased and persistent rate volatility for ETH markets across Venus, prompting us to review and recommend changes to all IR curves. The chart below shows the weekly standard deviation of ETH/WETH rates on all Venus markets. We can observe that rates have been especially volatile on Arbitrum-Liquid Staked ETH, though volatility has increased across the board since early September, with the overall standard deviation across all ETH markets rising from 1.36% to 2.27%.

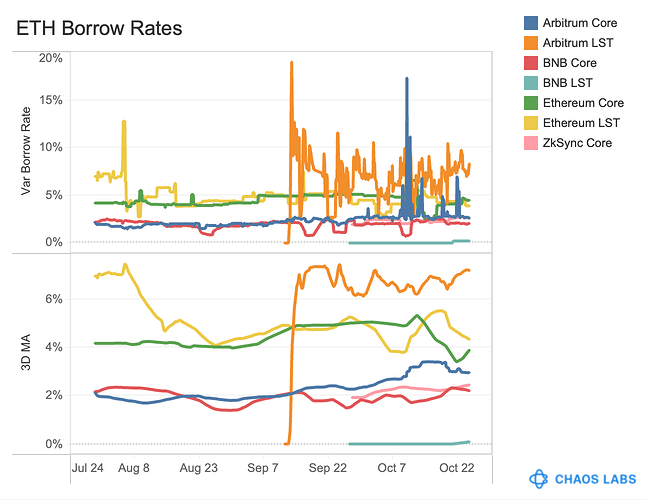

In the case of both Liquid Staked ETH pools, this has resulted from both markets being over-utilized.

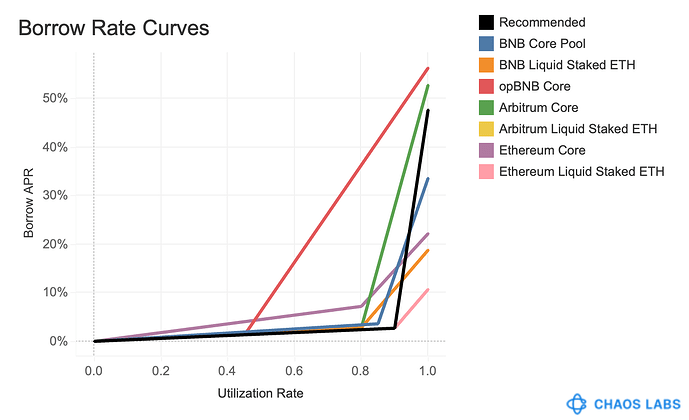

For all markets, we would like to target 2.7% at the Kink, the optimal rate for encouraging leveraged yield farming strategies. While the respective Liquid Staked ETH pools are intended to facilitate most leveraged yield farming, this 2.7% figure functions as the broader market rate for ETH borrows.

Additionally, we recommend aligning the Kink for all markets to 90%, finding that this does not meaningfully increase risk, as ETH’s liquidity is strong, while also increasing the capital efficiency of each market and improving the user experience.

This over-utilization calls for an increase in the JumpMultiplier, which will further increase borrow rates above the Kink, leading to new supply and/or repaying of debt. We recommend a JumpMultiplier of 4.5, which will lead to a borrow rate of 7.2% when utilization is at 91%. 7.2% is selected as the maximum because this is the maximum observed 3D MA borrow rate across ETH markets (on Arbitrum Liquid Staked ETH, as shown above). The increase is also necessary to compensate for the increased Kink, which reduces the area in which the JumpMultiplier is able to take effect. Below are charted the existing curves along with our recommended, aligned curve.

Specification:

| Asset | Market | Current Kink | Rec. Kink | Current Multiplier | Rec. Multiplier | Current JumpMultiplier | Rec. JumpMultiplier |

|---|---|---|---|---|---|---|---|

| ETH | BNB-CorePool | 85.0% | 90% | 0.0425 | 0.03 | 2.0 | 4.5 |

| ETH | BNB-Liquid_Staked_ETH | 80.0% | 90% | 0.035 | 0.03 | 0.8 | 4.5 |

| WETH | Ethereum-Core | 80.0% | 90% | 0.09 | 0.03 | 0.75 | 4.5 |

| WETH | Ethereum-Liquid_Staked_ETH | 90.0% | - | 0.03 | - | 0.8 | 4.5 |

| WETH | Arbitrum-Liquid_Staked_ETH | 80.0% | 90% | 0.035 | 0.03 | 0.8 | 4.5 |

| WETH | Arbitrum-Core | 80.0% | 90% | 0.035 | 0.03 | 2.5 | 4.5 |

| ETH | opBNB-Core | 45.0% | 90% | 0.03 | - | 1.0 | 4.5 |

Disclaimer

Chaos Labs has not been compensated by any third party for publishing this proposal.