Summary

A proposal to:

- Increase SolvBTC’s supply cap on Venus’s BNB Core deployment.

Motivation

SolvBTC (BNB Core)

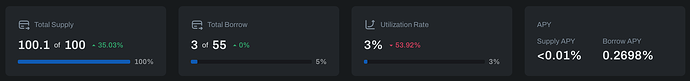

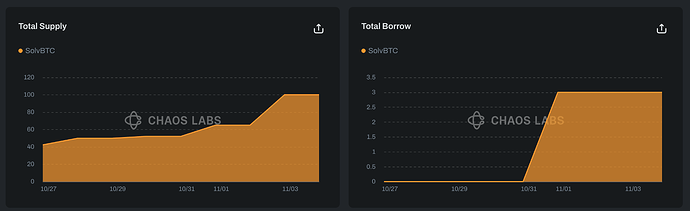

SolvBTC has reached 100% supply cap utilization and 5% borrow cap utilization following a surge of new supply.

Supply Distribution

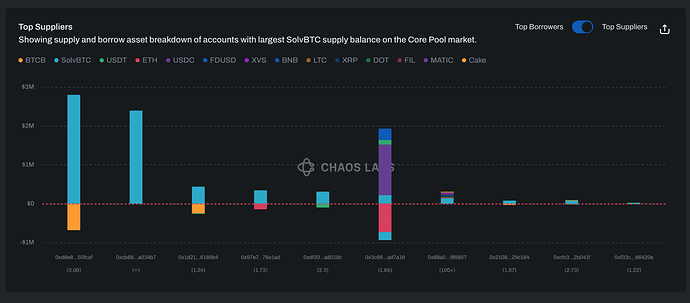

SolvBTC is used as collateral for various assets, with the largest position being used to borrow BTCB, thus significantly reducing the likelihood of liquidation. There is some concentration in this market, with the top two positions representing 41% and 35% of total supply, respectively.

However, these largest position has a strong health score of 3.08 and the second largest does not borrow against their SolvBTC.

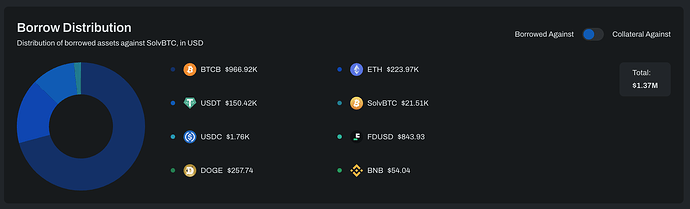

Overall, BTCB and ETH are the most popular assets borrowed against SolvBTC, representing 70% and 16% of the value borrowed, respectively.

Recommendation

Given the strong health of the largest SolvBTC suppliers, as well as on-chain liquidity, we recommend increasing its supply cap to 200. This increase is backed by Chaos Labs’ risk simulations, which consider the user’s behavior, on-chain liquidity, and price impact, ensuring that the higher cap does not introduce additional risk to the platform.

Specification

| Market | Asset | Current Supply Cap | Recommended Supply Cap | Current Borrow Cap | Recommended Borrow Cap |

|---|---|---|---|---|---|

| BNB Core Pool | SolvBTC | 100 | 200 | 55 | - |

Disclaimer

Chaos Labs has not been compensated by any third party for publishing this recommendation.