Summary

- CAKE (Core Pool)

- Increase supply cap to 14M

- WBETH (Core Pool)

- Increase CF to 80%

Analysis

CAKE

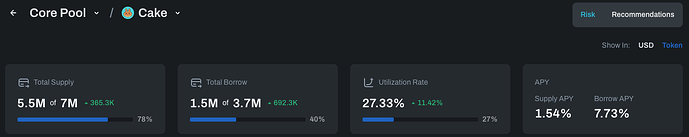

The supply cap for CAKE on Venus BNB Core Pool is currently at 78% utilization.

Utilizing our supply and borrow cap methodology, we do not observe additional risk when increasing the supply cap for CAKE on Venus BNB Core Pool. We recommend doubling the supply cap to 14M CAKE.

WBETH

Historical Volatility

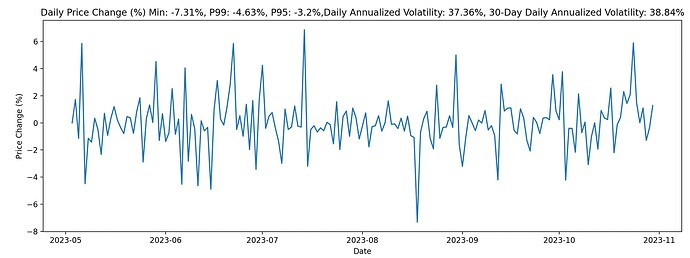

Analyzing WBETH price volatility over the past 180 days, we observe a daily annualized volatility of 37.36% and a 30-day annualized volatility of 38.84%.

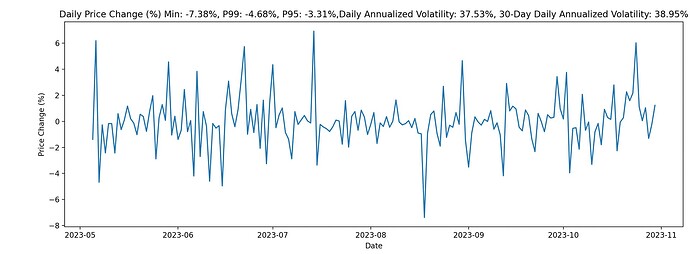

Compared to ETH daily annualized volatility of 37.53% and 30-day annualized volatility of 38.95%.

Positions Analysis

As of today, the total WBETH supplied as collateral on Venus is approx. 10.3K, amounting to ~$18.9M. The top 4 suppliers (detailed below) hold approximately 58% of the total WBETH supplies. They predominantly utilize their WBETH holdings as collateral to borrow USDT and BNB.

Additional data on all WBETH users can be found in Chaos Labs’ Risk Platform.

In our simulations, we observe minimal VaR attributed mainly to a single user, supplying 4.03k WBETH and borrowing ~5.84M USDT. The user actively manages the position and has been maintaining it in a healthy state.

Chaos continues to monitor the market and abnormal user behavior and will make additional recommendations as necessary.

Recommendation

As WBETH price is highly correlated with that of ETH, and given the current usage of WBETH on Venus, we recommend increasing the WBETH CF from 70% to 80%, aligning it with ETH parameters on Venus Core Pool.