Summary

-

Update to ETH Interest Rates

-

Update to USDT Interest Rates in Stablecoins Isolated Pool

-

VAI Initial Parameters (Stablecoins Isolated Pool)

Analysis

Update to ETH Interest Rates

After the Shapella upgrade, staked ETH yields have become the single most dominant factor in the cost of borrowing ETH across the whole ecosystem. Following the demand for ETH staking loops, we propose to adjust the interest rate curve for ETH by setting Multiplier (Slope 1) to 4.25% to achieve a rate of 3.6% at the Kink recommended below. This aligns with the current ETH staking APR of 3.3% and allows for a slight increase below the Kink. We recommend leaving the base rate at 0% to maximize the steepness of the interest rate slope, which is effective for optimizing utilization in interest rate-sensitive markets. Given the high efficiency of ETH markets, much because of the staked ETH APR, we also recommend increasing the kink to 85%.

Recommendations:

| Asset | Parameter | Current | Recommended |

|---|---|---|---|

| ETH | Multiplier | 9% | 4.25% |

| ETH | Kink | 75% | 85% |

Update to USDT Interest Rates in Stablecoins Isolated Pool

We recommend the alignment of the USDT interest rate curve parameters in Venus Stablecoins Isolated Pool with those of the USDT in Venus Core Pool. This will allow the stables pool to offer competitive rates in alignment with stablecoin interest rates across the crypto ecosystem, deepening the platform’s liquidity and bolstering its competitiveness in the DeFi landscape.

Recommendations:

| Asset | Parameter | Current | Recommended |

|---|---|---|---|

| USDT | Multiplier | 10% | 5% |

| USDT | Base | 2% | 0% |

Listing VAI on Venus Stablecoins Isolated Pool

Introducing VAI to the stablecoins Isolated pool will establish an additional market for the token and provide a venue for arbitrageurs to engage in trading activities. This will serve as an additional source of supply and demand for VAI, contributing to the maintenance of its peg.

This asset listing recommendation outlines the risk parameter suggestions for adding VAI to the Venus Stablecoins Isolated Pool. These parameters aim to ensure a secure and stable market for VAI within the Venus ecosystem. The launch parameters are set conservatively in light of the current low liquidity and market cap, with plans to reassess as they expand.

Recommendations

Based on the analysis provided below, we suggest the following initial parameter values for VAI within the Stablecoins Isolated Pool:

| Asset | VAI |

|---|---|

| Collateral Factor | 75% |

| Liquidation Threshold | 80% |

| Supply Cap | 130,000 |

| Borrow Cap | 0 |

| IR - Base | 0 |

| IR - Kink | 50% |

| IR - Multiplier | 15% |

| IR - Jump Multiplier | 300% |

| Reserve Factor | 10% |

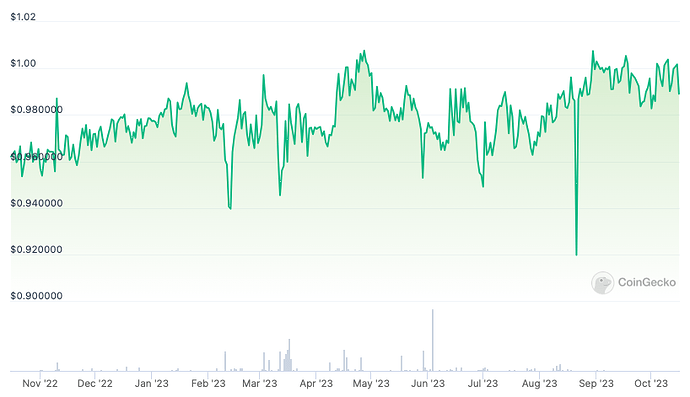

Peg Stability

Over the past year, VAI has demonstrated relative resilience in maintaining its peg to the US Dollar while keeping its trend to its intended target. While the peg may not always be steadfast, the community has demonstrated commitment and responsibility through recent endeavors and measures aimed at stabilizing the peg and mitigating price volatility.

Liquidity and Market Cap

When analyzing market cap and trading volumes of assets for listing, we look at data from the past 180 days. The average market cap of VAI over the past 180 days was ~$4.3M, and the average daily trading volume was ~$40K (CeFi & DeFi).

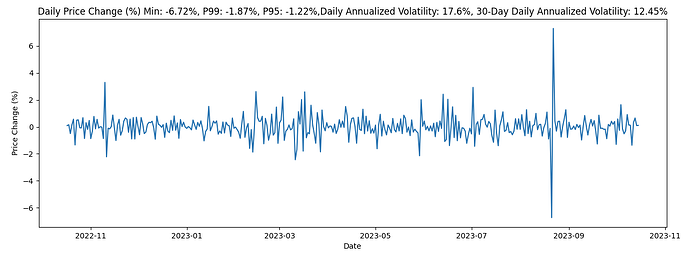

Volatility

Analyzing VAI price volatility over the past, we observed daily annualized volatility of 17.6% and 30-day annualized volatility of 12.45%. Considering this volatility, we recommend setting a Liquidation Threshold of 80%.

Supply Cap and Borrow Cap

Applying Chaos Labs’ approach to setting initial supply caps for new assets, we propose setting the supply cap at 2X the on-chain liquidity available under the Liquidation Incentive (configured to 10%) price impact.

Given the concentrated liquidity of VAI, we recommend a derived supply cap of 130,000 VAI.

Considering the relatively low daily trading volume, a prudent approach would be to list VAI with borrowing disabled, as this measure can serve as a safeguard against potential short attacks.

We will continue to monitor liquidity changes closely and adjust the parameters accordingly.

IR Curves

We recommend the following setting for the initial listing, which may be adjusted after analyzing the usage of the asset in the future.

-

Base - 0%

-

Kink - 50%

-

Multiplier - 15%

-

Jump Multiplier - 300%

-

Reserve factor - 10%