Summary

A proposal to:

- Increase asBNB’s supply cap on Venus’s BNB Core deployment.

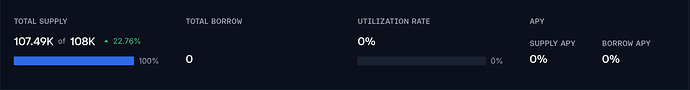

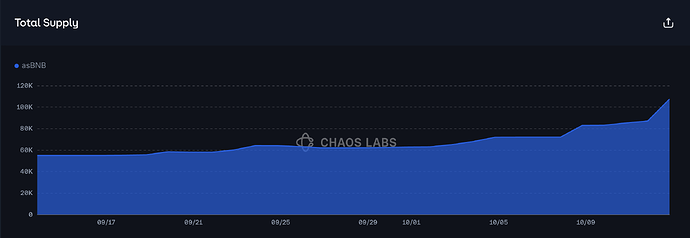

asBNB (BNB Core Pool)

asBNB has reached full supply cap utilization at 100%.

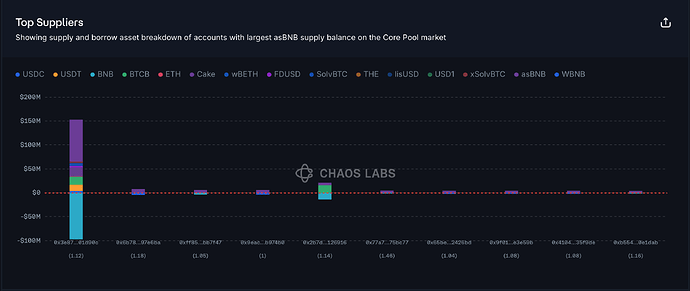

Supply Distribution

The supply of asBNB is concentrated, with the largest supplier holding 59% of total supply. However, this position does not currently present material risk, as the user is borrowing BNB, a highly correlated asset.

The remaining top suppliers are all borrowing either WBNB or BNB, which further reduces immediate liquidation risk.

Liquidity

As previously noted in the original listing and past supply cap adjustments, asBNB can be atomically redeemed for slisBNB, which has much deeper liquidity. Currently, selling 4.2K slisBNB for BNB incurs less than 5% slippage, providing liquidators with a reliable way to unwind large positions and reducing bad debt risk.

Recommendation

Given the observed user behavior and current on-chain liquidity, we recommend increasing the supply cap for asBNB.

Specification

| Market | Asset | Current Supply Cap | Recommended Supply Cap | Current Borrow Cap | Recommended Borrow Cap |

|---|---|---|---|---|---|

| BNB Core | asBNB | 108,000 | 216,000 | - | - |

Disclaimer

Chaos Labs has not been compensated by any third party for publishing this recommendation.