Summary

A proposal to:

- Increase TWT’s supply cap on Venus’s BNB Core deployment.

- Increase asBNB’s supply cap on Venus’s BNB Core deployment.

TWT (BNB Core Pool)

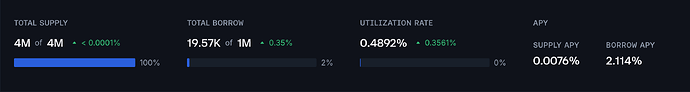

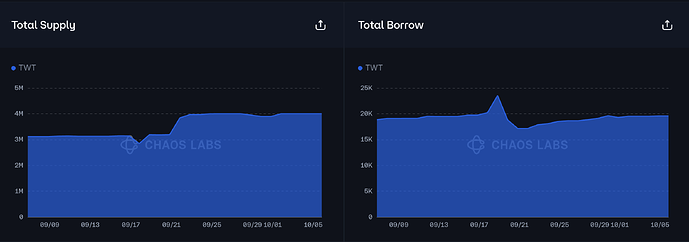

TWT’s supply cap utilization has reached 100%.

Supply Distribution

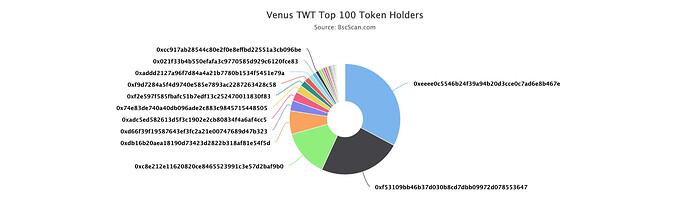

The supply distribution of TWT shows concentration risk, with the top three suppliers holding about 70% of total supply. The largest supplier accounts for 32%, the second for 24%, and the third for 13%. However, all three maintain solid health scores, 1.17, 1.66, and 2.83 respectively, significantly mitigating the risk of immediate liquidations.

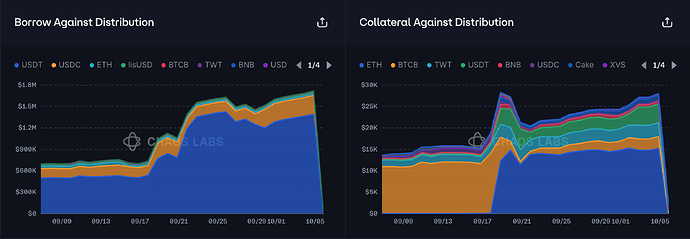

USDT is the largest borrowed asset against TWT, accounting for 80% of total borrows.

Liquidity

TWT’s liquidity currently allows selling up to 100K TWT into USDT with less than 5% slippage, supporting a supply cap increase.

Recommendation

Given the user-behavior and on-chain liquidity, we recommend increasing TWT’s supply cap.

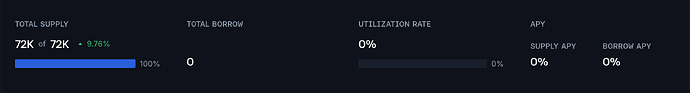

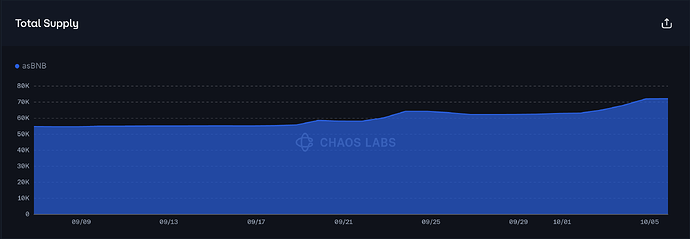

asBNB (BNB Core Pool)

asBNB has reached full supply cap utilization at 100%.

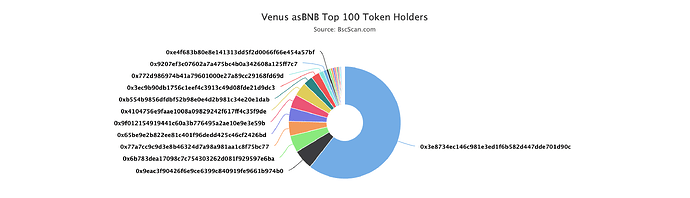

Supply Distribution

The supply distribution of asBNB shows concentration risk, with the top supplier accounting for 61% of total supply. However, this supplier does not currently pose a material risk, as their borrowings are in BNB, a highly correlated asset.

The remaining top suppliers either have no active borrowings or are also borrowing BNB, which significantly reduces immediate liquidation risk.

Liquidity

On-chain liquidity for asBNB remains limited, with a swap of 30 asBNB resulting in more than 4% slippage. However, as previously noted in the original listing and prior supply cap adjustments, asBNB can be atomically redeemed for slisBNB, which has substantially deeper liquidity. Currently, selling 4K slisBNB for BNB incurs less than 5% slippage, providing liquidators with a reliable path to unwind large positions and reducing the risk of bad debt.

Recommendation

Given the observed user behavior and current on-chain liquidity, we recommend increasing the supply cap for asBNB.

Specification

| Market | Asset | Current Supply Cap | Recommended Supply Cap | Current Borrow Cap | Recommended Borrow Cap |

|---|---|---|---|---|---|

| BNB Core | TWT | 4,000,000 | 8,000,000 | 1,000,000 | - |

| BNB Core | asBNB | 72,000 | 108,000 | - | - |

Disclaimer

Chaos Labs has not been compensated by any third party for publishing this recommendation.